In my first post, I said I was financially conservative. What does that mean with respect to financing a home purchase? It occurred to me that exotic financing terms are not exotic anymore. Interest-only, adjustable rates, and negative amortization have become so ubiquitous that nobody seems to remember why 30-year fixed-rate mortgages are used (or were used, they aren’t common in OC anymore). That is the focus of this post.

In my first post, I said I was financially conservative. What does that mean with respect to financing a home purchase? It occurred to me that exotic financing terms are not exotic anymore. Interest-only, adjustable rates, and negative amortization have become so ubiquitous that nobody seems to remember why 30-year fixed-rate mortgages are used (or were used, they aren’t common in OC anymore). That is the focus of this post.

To be financially conservative is to be risk adverse. A fixed-rate conventionally-amortized mortgage is the least risky kind of mortgage obligation. If you can make the payment – a payment that will not change over time – you get to keep your home. A 30-year term is most common, but if you make bi-weekly payments (makes two extra per year), you can pay the loan off in 22 years. If you can afford a larger payment in the future, you can increase your payment and amortize over 15 years and pay off your mortgage quickly. The best insurance you can have to deal with unemployment or disability is a house that is paid off. As you can see, stabilizing or eliminating your mortgage payment reduces your risk of losing your house or facing bankruptcy. Unfortunately, payments on fixed-rate mortgages are higher than other forms of financing.

The interest-only, adjustable-rate mortgage (IO ARM) became popular early in this bubble when fixed-rate mortgage payments were too large for buyers to afford. In the bubble of the late 80’s, these mortgages did not become common, and the bubble did not inflate beyond people ability to make fixed-rate conventional mortgage payments. This is also why prices were slow to correct in the deflation of the early 90’s because most sellers didn’t need to sell, so they just waited out the market. It was a market correction characterized of large inventories, but this inventory was mostly not the “bad” inventory of must-sell homes. The few must-sell homes that came on the market in the early 90’s drove prices lower, but not catastrophically because the rally in prices did not get too far out of control; however, this bubble is different.

IO ARMs are risky because they increase the likelihood of losing your home. IO ARMs generally have a fixed payment for a short period followed by a rate and payment adjustment. This adjustment is almost always higher, and sometimes, it is much higher. At the time of reset, if you are unable to make the new payment (your salary does not increase), or if you are unable refinance the loan (home declines in value), you will lose your home. It’s that simple. These risks are real, as many homeowners are about to find out. People try to minimize this risk by extending the time to reset to 7 or even 10 years, but the risk is still present. If you had bought in 1990 with 100% financing on an interest-only loan and had to refinance in 1999, your house was probably worth less than you paid, and you would not be given the new loan. Even a 10 year term is not long enough if you buy at the wrong time. As the term of fixed payments gets shorter, the risk of losing your home becomes even greater.

The advantage of IO ARMs is their lower payments. Or put another way, the same payment can finance a larger loan. This is how IO ARMs were used to drive up prices once the limit of conventional loans was reached (somewhere in 2003 in OC). A bubble similar to the last bubble would have reached its zenith in 2003/2004 if IO ARMs had not entered the picture. In any bubble, the system is pushed to its breaking point, and it either implodes, or some new stimulus pushes it higher. Enter the negative amortization (Neg Am) mortgage (aka – option ARM).

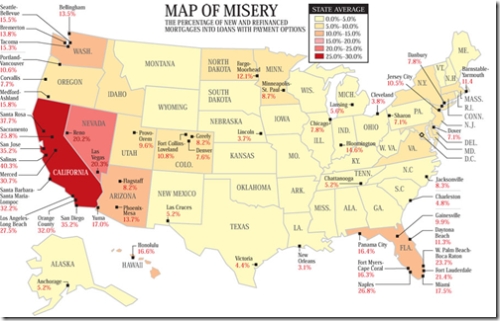

The Neg Am / option ARM loan is the riskiest possible loan imaginable. It has all the risks of an IO ARM but with the added risk of an increasing loan balance. Using this loan, not only do you have the risk of not being able to make the payment at reset, but you are much more at risk of being denied for refinancing because your loan balance can easily exceed your house value. In either case, you lose the home. (According to Businessweek’s Map of Misery, 32% of new and refinanced mortgages in Orange County were of this type. See article Nightmare Mortgages)

The risk management measure not related to the mortgage terms is the downpayment. Most people don’t think of downpayments as a way of managing risk, but banks do. Downpayments reduce your risk in two ways: first, they lower your monthly payment, and second, they give you a cushion ensuring you can refinance (if necessary) should your house value decline. The problem with downpayments is obvious: few people save enough money to have one.

Eliminating downpayments through the use of 80/20 combo loans was another massive stimulus to the housing market. Lenders used to require downpayments because it required a borrower to demonstrate the ability to save. At one time, saving was considered a reliable indicator as to a borrower’s ability to make timely mortgage payments. Once downpayments became optional, a whole group of potential buyers who used to be excluded from the market suddenly had access to money to buy homes. Home ownership rates increased about 5% nationally due in part to the elimination of the downpayment barrier.

The combination of IO ARMs, Neg Am / option ARMs, and 80/20 combo loans took what would have been a bubble like the 90’s and turned it into an uberbubble (look at it as a bubble built on top of a bubble). In the early 90’s in California the median home price dropped from around $200K to $175K, about a 12.5% decline. The current bubble is about three times as large. Does that mean a 37.5% decline is coming? Only time will tell.

When I say I am financially conservative, I am saying I will only finance a home with a fixed-rate conventionally-amortized mortgage and a sizable downpayment. The reason for this is simple stress management: I don’t want to spend the next several years worried about my loan reset or house value or future salary raises. I will buy someday, not because I want to make a fortune in Southern California real estate, but because I want to have a stable housing payment, and a stress-free life.

.

.

P.S. For all of you who see this entire post as common sense (which it is), check this out: Don’t Buy Stuff You Can’t Afford

Great analysis.

Keep up the good work.

—–

Thanks for the insight. I’m hoping to purchase myself, hopefully what youre saying is true. We’ll just wait it out and see.

Great post IrvineRenter!

Excellent insight and analysis

Enjoy your posts and comments, very applicable to my situation.

32% negam loans in OC? Is that correct? Was this for 2006?

I knew there were negam loans going on. But I had no idea it was 32%!!

I finally found out the answer that exist abstractly in my mind, which was why i will do 30-fixed loan.

Thank you.

From above Prices and Rents chart, around 1990, the home prices about 30% higher than rents and around 1996 these two lines intersect.

I am guessing it might take another 6 years to make these two lines intersect again, which means year 2013 is the bottom. And avg. Los Angeles home prices just around $300K.

IrvineRenter,

>> In the bubble of the late 80’s, these mortgages did not become common

Were you in Souther Cal during the late 80’s and early 90’s ?

If so, can you describe how prices went up in late 80’s and how prices went down in 90’s ? The more details the better.

Thanks.

Can you explain how an 80/20 combo loan works (out of curiosity, I am not trying to figure out how to buy with no down payment!). Thank you for your post. It is very interesting and informative.

gn,

I did not live in Southern California during the previous bubble. From the people I have spoken to and the research I have done, I believe I am on solid ground when I state exotic mortgage products were not widely used during the price rally, certainly not to the degree they are today. The market psychology with the fear of being priced out was prevalent during the boom times. Bubbles deflate because of buyer fatigue (all who want to buy do so until there are no buyers left). The early 90’s bubble was no different.

Rich Toscano on Piggington’s site goes into detail about the previous bubble.

http://piggington.com/

And there is a good synopsis of the chronology of the last bubble here:

http://marinrealestatebubble.blogspot.com/2005/09/of-bubbles-past-chronological-listing.html

Melissa,

A lender creates a primary mortgage for 80% of the purchase price to avoid private mortgage insurance (PMI). Then the lender piggy-backs a loan for the other 20% to complete the purchase. The 20% loan is less secure and carries a higher interest rate.

Jerry,

You analysis is exactly how I see it as well. A distant bottom way down from today’s prices. It is hard to argue with history or that graph.

IrvineRenter – One argument I have heard (feel free to call it a positive spin) is price in early 80s was depressed because of extremely high mortgage rate. I think people back then were using the exotic loan as well. I wasn’t around so I don’t know for sure.

And the price in the early 90s was depressed because of recession and massive layoffs.

So if you normalized the graph to 1990 price instead of using 1982 price , the graph wont be so bearish against current housing price.

Personally I certainly agree that part of the recent housing rally was due to credit bubble. But I also think there are some fundamental behind it.

Thus I am not as certain that a catastrophic bust must follow especially if rents keep on rising and mortage rate stays relatively low.

But if there is recession in near future then I think harder landing is very likely.

red,

During the late 80’s interest rates were around 11% – 13%. By 1994, interest rates were around 9%. This served as a “cushion” during the downturn of the early 90’s. Without this “cushion”, prices would have been a lot lower.

This time around, interest rates are already very low. So, there will be no “cushion”.

First this is a great post by irvinerenter and says exactly what I have been telling my friends who want to buy a house. Usually it makes their head spin but for the most part they get it. Thanks irvinerenter for a great post!

Red and gn,

During the 80’s you had inflation running rampant with interest rates as high as 18% with jumps in between. The fed rate from that time looks like an ekg of someone having a heart attack. In other words house prices were up just above inflation for that time period which is normal for OC. Also back then people bought houses to live in and when they had to move well the they had to move. So to help with the crazy rates sellers or builders would buy down the rates for people so that the house would sell.

Now for the 90’s Red is somewhat correct that job losses excerbated the price drops but it is not what caused them. The 90’s run up was caused by the heard mentality of get in now or be priced out forever. Yes arms were used during that time but no where near the level they were today. What happened is no one could afford to live here and affordabilty became the issue and rates historically were low in the 8% range. Sales slowed down drastically (sound familar?) and prices were in the single digits and then down. Then we had the manufacturing job losses and the savings and loan debacle. Builders built more condos because profit margins were good and people were buying them and then they starting sinking. In 1993 rates were down in the 6% range and that cushion didn’t help because prices continued to go down until 1996. J.M. Peters and The Lusk Co. were major builders in the area and they both went BK.

The point is the same though affordability. Between 1980 to 1990 home prices went up by 34% over inflation and 1996 to 2006 by over 58%. This simply put is not sustainable and has to come down. Hopefully there will not be the job losses like the 90’s because the drop will be ugly. A drop of 10% to 12% over the next three years in nominal terms will return OC back to the normal rate of appreciation. Hopefully I can do post on this topic soon too. I just need to refine some of the numbers.

“A drop of 10% to 12% over the next three years in nominal terms will return OC back to the normal rate of appreciation.”

How are these number to be reconciled with with the results of Home Prices and Rents Table ?

Had an interesting conversation with my cousin, the lender, today.

It seems as though the market is responding very aggressively to the problems with BBB and Alt-A mortgages. For example, she told me that a good many lenders are now requiring FICO scores in the 700-720 range for an 80/20 loan. It seems as though at least moderately conservative home financing is already being forced upon the system.

I have to wonder just what percentage of people in OC have scores of 700+. Anyone have a source for this data?

Countrywide’s rate sheet shows 100% LTV stated down to 640 and 100% LTV full-doc down to 620.

However, the borrower must be 0x30 on his house, no NOD’s within the last 36 months, and no BK with the last 24. This alone swipes the punch bowl away from many an FB.

https://www.cwbc.com/PdfFiles/WLDBC%20CA.pdf

Peter – If the drop in nominal terms were 10%-12% the lines won’t cross. That was taking the theory that OC home prices would return to the average appreciation rate of about 3.25% more than inflation using 2000 as a base year. We are so beyond average appreciation that a 10% drop in a few years could return us to normal. If there is another economic set back such as irvinerenter’s theory that the loose lending that has been going on colapses then they will meet again. Will that happen? It is just beginning to unravel and so far it doesn’t look good. OC home prices tend to do better than inflation which is a good thing but it can’t last forever and if something hurts OC’s economy the drop will get worse. I hope that clears it up.

Great post!! Very informative for those of us who are anxiously waiting to be 1st time buyers and don’t want to make the mistakes of others. I have found it to be VERY easy to get lured into one of these types of loans, especially if you have no idea of the risks involved. If it wasn’t for articles like these, and the sense to actually do my research before spending my hard earned money, I might have been in that 32%!! Keep up the good work!

Pet gripe (marring an otherwise excellent post).

Graphs covering 25 years really should have a logarithmic y-axis.

Irvine renter,

Just wanted to thank you for some good posts. It’s probably alot of work putting that all together….but I certainly appreciate it.

Keep it up…..We are listening.

Kevin

OK, the punch bowl is getting drained as we speak… The link to the Countrywide rate sheet above is still good but it now points to an updated sheet that goes into effect Mar 5th.

STATED 100% IS GONE!

They’ll do 95% stated down to 620 FICO but 2 mos reserves are needed along with no mortgage lates allowed and >36mos since any NOD’s.

The rate premium for 100% LTV versus 80% is shocking.

Great post Irvine Renter! I was living in Valencia in the 90s – layoffs and the earthquake in 94 had much to do with huge supply – I had a mortgage for around 8%, 30 year fixed rate. I bought a $300K home that previously had been selling for 450K only two years earlier. My down payment was 10%. A version of the HELOC was around, but you had to “prove” that you were going to use it for property improvements. Many folks were either walking away from properties due to lost equity, or short-selling to banks who had no clue what was going on in CA at the time. Another interesting idea that emerged at the time (and I would like anyone’s thoughts on this) was the “cram down”. Basically, instead of short-selling, the owner offered the bank a lower refinanced price (in line with the current market) – the benefit to the bank was continued payments (albeit lower), and avoiding the cost of foreclosure.

SOMEBODY PLEASE BEAT THIS WOMAN. . Seriously…read at least the last paragraph….goes like this…

“She advises, “For first-time buyers, I strongly recommend doing whatever it takes to get a home now, and not waiting for home prices to decrease. Take a serious look at your personal finances, and if your job is stable, or your income is expected to increase in the future, it may be a good idea to stretch your financial qualifying ability by choosing one of the adjustable rate mortgages. You can get a lower interest rate by taking a 3-year or 5-year ARM, which will keep your payments lower during that time period.”

Heres the link…

http://realtytimes.com/rtcpages/20050222_orangeco.htm

Come on now, no one really wants to beat anyone.

With that said, this article did prompte me to start a list, with these two yokels from the article as my first two entries, of realtors I don’t consider credible enough to ever buy a home from. Ultimately, when I do go buy a house if someone on the list is the agent, I’ll simply tell the seller that I can’t purchase out of credibilty/ethics concerns related to the agent.

That’s more effective than a beating and will save you 3 to 5 in jail.

“There is very little land left to develop, and the processing of plans, obtaining approval for permits, and all the infrastructure fees are both costly and take a long time. The new home builders have not been able to keep up with demand, so there is no excess inventory, and prices of new homes are increasing with each new release.”

Oh really…. she is a so-called “expert”? She wrote a book about how to make money in any market? Sure, for the herself selling books and agents selling homes….

Hi

G’night