I'm not making this up. The CAr really said this.

Irvine Home Address … 16 CREEKWOOD 67 Irvine, CA 92604

Resale Home Price …… $549,900

The time has come

To say fair's fair

To pay the rent

To pay our share

The time has come

A fact's a fact

It belongs to them

Let's give it back

Midnight Oil — Beds are Burning

I wrote about the home mortgage interest deduction in detail back in January of 2009 in Tax Policy and Housing:

Debt Subsidies

Debt subsidies, in particular the home mortgage interest deduction, are seen as a great benefit to home ownership. The benefit is widely overestimated and misunderstood.

First, people fail to understand that to obtain a debt subsidy, you must have debt. You must be making an interest payment on this debt in order to qualify, and you get to reduce your tax burden by a small percentage of the interest amount. In short, you are paying a dollar to save a quarter. There are people who actually seek to maximize their interest payments in order to increase this subsidy. This is really, really foolish. Anyone out there who believes it is a good idea to spend $1 to receive $0.25 in return, please send me as much money as you wish, and I promise to send back 25% of it.

Realtors try to con people with the "throwing your money away on rent" argument. Homeowners buy into the fallacy. Interest is the rent on money. You throw away money on interest just like you throw it away on rent. In fact, people who overpay for housing throw away more money on interest than renters do to obtain the same property, even after the tax subsidy. The only argument one can make for paying extra interest is if you are receiving a return on that investment through property appreciation. We all see how that is turning out.

The main reason the benefits of the home mortgage interest deduction are overestimated is because people forget they must give up the standard deduction in order to obtain it. This is one area where tax policy can have hidden and indirect impact on housing. Changes in the standard deduction greatly impact the benefit of the home mortgage interest deduction. As the standard deduction is increased, the positive impact of the HMID is decreased. In fact, if the standard deduction were doubled, the average American holding a $150,000 mortgage probably would not bother itemizing to obtain the HMID because it would be of no tax benefit at all. This would certainly simplify people's tax returns. A higher standard deduction is also a boon to renters who do not have the option of obtaining the HMID.

When we set up the RentVsOwnulator, we put in a 25% tax benefit from the HMID. Some people have commented that this is too small a number. It is not. Several people have run the calculations both with and without the HMID, and the net difference is only 25% even at the highest tax brackets. Basically, if you want to figure out your real tax benefit, take your highest marginal tax rate and subtract 10%. That will be a much closer estimate to reality. This reduction is caused by losing the standard deduction.

Another facet to the HMID is the cap level. Currently mortgages up to $1,000,000 are eligible for the deduction. Does anyone think this is right? Do you realize you as a taxpayer are subsidizing $1,000,000 mortgages? When the GSEs were set up, they established a conforming loan limit. The reason they did this is because they are mandated to subsidize mid and low income housing. Why is the limit on the HMID any higher than the conforming loan limit from the GSEs? Why are we subsidizing high income borrowers?

If we were to reduce the HMID cap level to $500,000 and adjust it by the CPI going forward, we are still subsidizing relatively high income borrowers ($500,000 is still almost triple the median home price in the US). A reduction in this cap would have the same impact as the lower GSE conforming limit is having: it would lower prices at the high end by eliminating the subsidies.

IMO, the government has no place in subsidizing house prices that are well above the median. One can argue that the government should not be subsidizing anything in housing, but the low and middle income subsidies are here to stay. If we raise the standard deduction and lower the HMID caps, we can greatly reduce the impact of the HMID and the cost we pay for it as taxpayers. This would have the effect of lowering prices on more expensive homes, but it would help stabilize the lower end of the market. That is what the market needs right now.

I wonder if anyone on the Obama commission is an IHB reader?

Obama commission considers limits to mortgage interest tax deductions

by JON PRIOR — Wednesday, November 10th, 2010, 4:37 pm

The National Commission on Fiscal Responsibility and Reform, proposed limiting the mortgage interest rate deduction on taxes, one of the primary incentives for owning a home.

Silly me, I thought providing shelter was a primary incentive for owning a home.

President Obama created the bipartisan commission in February to provide options on overhauling the tax system and reducing the national deficit. According to a November report, one option excludes citizens from deducting interest payments on second residences, home equity loans or mortgages over $500,000.

The current cap on the HMID is $1,000,000 for first mortgages, and $100,000 for HELOCs. Basically, the commissions proposal would most effect cities like Irvine where high wage earners borrowing between $500,000 and $1,000,000 get to take advantage of this tax break.

The current cap on the HMID is $1,000,000 for first mortgages, and $100,000 for HELOCs. Basically, the commissions proposal would most effect cities like Irvine where high wage earners borrowing between $500,000 and $1,000,000 get to take advantage of this tax break.

Every Irvine home owner should contact their congressman and demand they resist this option. This tax increase is aimed squarely at the upper middle class wage earners in places like Irvine. It will take both your income and your property values.

Of course, don't expect us lowly renters to give you much support.

Other options would be to tax dividends and capital gains at the ordinary rates. The commission said its extensive plan would reduce the deficit by nearly $4 trillion through 2020. Cutting mortgage interest rates was, expectedly, met with resistence from the housing industry.

Michael Berman, chairman of the Mortgage Bankers Association, warned that now is not the time to be cutting back incentives.

"The mortgage interest deduction is one of the pillars of our national housing policy, and limiting its use will have negative repercussions for consumers and home values up and down the housing chain," Berman said.

Lawrence Yun, chief economist for the National Association of Realtors even told the Wall Street Journal that limiting the mortgage interest deduction would bring on another recession.

"We share the widespread concern over the growing national debt and want to help identify reasonable solutions," Berman said, "but we cannot support proposals that would chip away at the foundations of the real estate market."

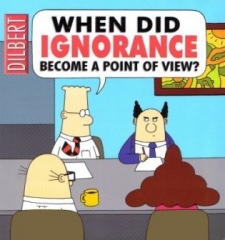

Apparently, the California Association of realtors didn't think Lawrence Yun went far enough in his use of ridiculous scare tactics.

The CAr is pulling out the heavy artillery….

California Realtors say cutting mortgage interest tax deduction will devastate nation

by JON PRIOR — Thursday, November 11th, 2010, 5:03 pm

Santa Clara County Realtors Association President Karl Lee warned that limitations to the mortgage interest deductions a presidential commission is considering would devastate the national economy.

Home prices in the affluent California county increased roughly 6% to $699,174 in October, according to the association. It's up 11% from a year ago. The National Commission on Fiscal Responsibility and Reform, proposed two options in their efforts to overhaul the tax system. One was to reduce how much homeowners could deduct by 20%, and the other was to exclude second residences, home equity loans or mortgages over $500,000.

Each of those ideas are good ones. The impact would be to make debt more expensive and thereby less desireable. Another thing I would add is that they should raise the standard deduction so fewer people would gain advantage from itemizing and taking the HMID.

"This policy will immediately and unnecessarily reduce the net worth of many American households," Lee said.

Reducing the home mortgage interest deduction would certainly take much of the air out of the bubble. It would reduce loan balances, and thereby lower offers of new buyers. This will lower prices for homes in areas where loans exceed $500,000. It would immediately reduce the net worth of homeowners in those areas. However, this policy would not impact anyone else. New buyers would be taking on less debt — which is a good thing. Renters would no longer be subsidizing the debts of homeowners through tax incentives — which is a good thing. And tax revenues would increase — which is why the commission is considering it.

Reducing the home mortgage interest deduction would certainly take much of the air out of the bubble. It would reduce loan balances, and thereby lower offers of new buyers. This will lower prices for homes in areas where loans exceed $500,000. It would immediately reduce the net worth of homeowners in those areas. However, this policy would not impact anyone else. New buyers would be taking on less debt — which is a good thing. Renters would no longer be subsidizing the debts of homeowners through tax incentives — which is a good thing. And tax revenues would increase — which is why the commission is considering it.

Isn't this objection really an admission that our current system of home values is a debt-dependant Ponzi scheme?

"Limiting mortgage interest deductions will also result in domestic job losses in many core American industries that are directly or indirectly impacted by housing."

Nonsense. Homebuilders can adjust to whatever price levels the market will offer. If you drive around Las Vegas, you see signs for new home developments with houses selling for less than $90/SF. They built and sold the same houses for $250/SF four years ago. The people most impacted by this price change would be owners of raw land who would see their depressed values remain low for a very long time. As long as the resale price of the home exceeds the cost of production, homebuilding — and all its associated employment — will do fine.

Santa Clara County is seeing some improvement in the market. In October, more than 1,000 home sales closed, a 4.5% decrease from September, but it was the lowest monthly decrease in five months. The inventory of homes on the market dropped nearly 7% in October.

The lowest decrease in five months is an improvement? That is really spinning.

"Removing a significant homeownership incentive is a short-sided answer to our larger national debt problem, a solution that in reality will drive the country into a deeper economic crisis," Lee said. "Every American, regardless of income status or geography, should oppose limiting mortgage interest deduction."

The fear in the comments of the realtors is obvious. The self-serving nature of those comments is equally obvious.

Typical Irvine Ponzi Investor

When people invest in real estate in Irvine, they expect the property to appreciate in value, and they further expect this appreciation to be convertible to cash by a stupid bank complicit in the Ponzi scheme. When house prices rally, this works out well. The investor gets much more money from the property than rents generate, and the bank gets an increasing loan balance, more interest payments, and higher profits. If it weren't for the fact that it is a Ponzi scheme guaranteed to blow up, it is a great arrangement for both parties.

- This property was purchased on 4/7/2003 for $383,000. The owner used a $306,400 first mortgage, a $57,450 second mortgage, and a $19,150 down payment.

-

On 7/15/2004 the owner refinanced with a $412,500 first mortgage.

- On 8/29/2007 he refinanced again with a $437,500 first mortgage.

- He defaulted about a year later, and squatted off and on for about three years.

Foreclosure Record

Recording Date: 06/30/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 03/29/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 04/27/2009

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 12/10/2008

Document Type: Notice of Default

This loan was finally put out of its misery on 8/6/2010 when the property was purchased by a flipper for $426,500. Condos in this zip code are currently selling for $311/SF which would put the price of this property at $511,906. They have already lowered their wishing price once, but they still appear to be about $40,000 over market.

What do you think this will sell for?

Irvine Home Address … 16 CREEKWOOD 67 Irvine, CA 92604 ![]()

Resale Home Price … $549,900

Home Purchase Price … $426,500

Home Purchase Date …. 8/6/2010

Net Gain (Loss) ………. $90,406

Percent Change ………. 21.2%

Annual Appreciation … 106.1%

Cost of Ownership

————————————————-

$549,900 ………. Asking Price

$109,980 ………. 20% Down Conventional

4.21% …………… Mortgage Interest Rate

$439,920 ………. 30-Year Mortgage

$103,846 ………. Income Requirement

$2,154 ………. Monthly Mortgage Payment

$477 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$46 ………. Homeowners Insurance

$335 ………. Homeowners Association Fees

============================================

$3,011 ………. Monthly Cash Outlays

-$353 ………. Tax Savings (% of Interest and Property Tax)

-$610 ………. Equity Hidden in Payment

$166 ………. Lost Income to Down Payment (net of taxes)

$69 ………. Maintenance and Replacement Reserves

============================================

$2,282 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,499 ………. Furnishing and Move In @1%

$5,499 ………. Closing Costs @1%

$4,399 ………… Interest Points @1% of Loan

$109,980 ………. Down Payment

============================================

$125,377 ………. Total Cash Costs

$34,900 ………… Emergency Cash Reserves

============================================

$160,277 ………. Total Savings Needed

Property Details for 16 CREEKWOOD 67 Irvine, CA 92604

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 1,646 sq ft

($334 / sq ft)

Lot Size: n/a

Year Built: 1977

Days on Market: 15

Listing Updated: 40485

MLS Number: S636494

Property Type: Condominium, Residential

Community: Woodbridge

Tract: Th

——————————————————————————

UPGRADES GALORE!!! This gorgeous 3 bedroom townhome is located in Woodbridge, one of Irvine s premier neighborhoods. This spacious and open layout has Dual Master Suites, with a possible 3rd bedroom downstairs. The home is turnkey and ready to be lived in. There is a long list of recent upgrades which include brand new stainless steel appliances, granite countertops, distressed hardwood floors, designer paint, crown moldings and baseboards, new fixtures and much more. There is a private backyard patio, an enjoyable indoor fireplace, and an attached 2-car garage.

The neighborhood has many amenities such as beach clubs, lagoons, kayaks, sailboats, tennis courts, swimming pools/spas, banquet rooms, and many recreational parks (including children's areas) within the four square miles making Woodbridge a community of interest to anyone who enjoys outdoors and luxury. The surrounding schools are wonderful and right at your doorstop. This home is a MUST SEE!

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

When people talk about HMID being helpful to middle-income Americans, it becomes hard to argue with lowering the cap to $500k.

However, renters have the ability to see the benefit of deducting interest. Landlords can deduct mortgage interest, and it would violate actually agreed upon economic principles to say that the deduction did not somehow make its way to renters.

But think about how the newest HMID repeal is being pitched. You get rid of HMID to lower top tax rates? Actually, they aren’t talking about getting rid of it, at least in option-2, but lowering the cap, which is a lot more palatable than complete elimination.

They seem fixated on reducing the number of brackets. Does anyone who does their own taxes (or other people’s taxes) think that the number of brackets is what drives tax complexity?

Landlords don’t take the HMID, they take the deduction as a business expense on a Schedule E.

I don’t see how they will be affected by this, and thus renters will not lose the trickle down benefit.

What trickle-down benefit? Landlords charge what the market will bear, not the minimum required to clear their monthly nut.

This increases a landlords tax liability. The net effect is lower prices due to decreased demand in rental property ownership due to decreased profitability.

Renters see no benefit.

As a society, we need to phase out debt incentivization in general and lessen the burden on savers/producers.

In general that is true, but not always. I lived in on the beach in Newport for 10 years and had the rent raised one time, $100. If the landlord had his expenses going up, my rent would have gone up a lot more. He like me and expenses were not going up, so as far as I am concerned, I benefitted from the trickle down.

As a renter, to be perfectly frank, my Irvine landlords have raised my rent incessantly, sometimes as much as $200/month, but the usual was $100/month increase.

The mortgage interest deduction, or any other deduction apparently never factored into their rent income numbers.

This whole idea that we renters somehow benefit from these tax write-offs is a myth.

~Misstrial

winstongator: “However, renters have the ability to see the benefit of deducting interest. Landlords can deduct mortgage interest, and it would violate actually agreed upon economic principles to say that the deduction did not somehow make its way to renters.”

Your statement is flat-out wrong. As Walter pointed out below, landlords deduct mortgage interest as a business expense on the Schedule E, and they will continue to be able to do so, regardless of what happens to the HOME Mortgage Interest Deduction. The HMID is a way to extend this business expense for landlords over to private residences. It speaks volumes as to how American loanowners view their houses as business investments rather than merely homes to live in.

-Darth

My point is a counter to the idea that the HMID is a subsidy from renters to homeowners. By that logic, the deductibility of interest on rental properties is a subsidy from homeowners to renters.

“In 2005, a special Presidential panel on tax reform actually proposed eliminating the business-interest deduction and severely restricting mortgage-interest tax breaks. Those proposals, predictably, went nowhere.”

The number of brackets is the least complex part of taxes. The complex items are the deductions and who gets what and how much. Most are spelled out as to who gets what. But many others aren’t and that is where things get complicated.

http://www.cfapubs.org/doi/pdfplus/10.2469/faj.v65.n6.8

Basically, the commissions proposal would most effect cities like Irvine where high wage earners borrowing between $500,000 and $1,000,000 get to take advantage of this tax break

That is what is so perverted about the “incentive” in the first place. The more you indebt yourself, the more “benefit” you get.

I really really really like the idea of limiting the benefit to the national average of mortgage debt. If the average mortgage of the country is 200K and your mortgage is 500K then the maximum deduction you get to claim is the same as if you had a 200K mortgage. It’s only fair since this is a national program – all that bull about “local markets” has no place in the discussion. Why is tax money paid by folks in Arkansas being diverted to house debtors in Irvine California? How does an over-extended Irvine house debtor claiming big deductions help the Arkansas taxpayer? It doesn’t.

Limiting the deduction to the national average is the first step. Getting rid of it completely would be even better, but it will take some time to convince the sheeple that it really isn’t helping the average person all that much.

Homebuilders can adjust to whatever price levels the market will offer. If you drive around Las Vegas, you see signs for new home developments with houses selling for less than $90/SF. They built and sold the same houses for $250/SF four years ago.

Exactly. If the builders can get the land for 50% off what it would have cost during the bubble then they can sell the same house for at least 50% less. Of course, the “r”ealtors don’t like to acknowledge that.

More profitable to fear-monger. Oh no, we don’t want to lose some jobs! We need to keep the market running inefficiently so some housing middle men do not lose their share of the profits.

FU{K you, CA”r”.

We just completed building a home, and our lot price was about 15% of the total cost. So, even if we got the lot for free, we’d still only be down 15%. During the process, I read that the lot price should be limited to 20% of the total cost.

Were Vegas builders just rolling in money, or have their building costs come down 64%, or were lot costs >> 20% of total?

That doesn’t seem right to me. In California the value of the land is usually well over half the total value of the property.

Agree.

And factor in building permits, environmental impact reports, the cost of legal representation at planning commission hearings, inspection fees, architectural design costs due to earthquake structural materials requirements, utility permits, meter installation costs (and possibly a fire hydrant, depending)and last but not least, The Williamson Act….

There’s no way someone can build on a similar parcel of raw land here in Cali as opposed to another state, such as AZ or NV. Not the same.

As home prices went up, the cost of construction was fixed, so the extra went into land value and profits to landowners.

The old rule of 20% of the cost is the lot is true in most of the United States. In fact, if you study real estate economics, that is the standard textbooks use. In areas where land is scarce, the cost of the land becomes much greater as a percentage of total project cost. For instance, in Hong Kong, it is not uncommon for the land to be 80% of the cost of a project.

During the housing bubble, the builders who bought and developed their own land made huge amounts of money. In Las Vegas at the peak, land costs were well over 50% of the cost of the house. Now they have written these values down to near zero.

The small group of people most interested in keeping house prices elevated in California are large landholders and developers.

I had seen that in the Redfin info for Irvine, and somewhat in SoFla. Really, what many people were doing during the bubble was speculating on the value of land, which had gone up even faster than home prices. Consider a house now tax-valued at 400k, 100k for land. Was valued at 700k 3yrs ago, which would have worked to 400k land. So the land value 4x’d, not just the home price near doubling.

I heard the ‘they’re not making anymore land’ mantra in FL, but when you fly into FLL or MIA, you see tons of it, especially north of PB County.

So land costs could be 80% of total even if you’re building a massive apartment/condo tower in HK? Prob the same in nyc too.

What I find interesting is that construction costs have decreased in this cycle, unlike previous cycles. Labor costs have decreased, even if materials have not.

The people who say that there can not be cost inflation without wage inflation do so in the face of reality.

I agree. Interest deductions of any kind encourage consumer debt, and that’s not healthy for most household management. Correspondingly, taxing earned interest penalizes savings. These are two pretty odd incentives built into the tax code, at whatever income level, if you consider the tax code as a system for influencing economic behavior.

“There is a long list of recent upgrades which include brand new stainless steel appliances, granite countertops, distressed hardwood floors”

http://www.crackthecode.us/images/DistressedHardwoodFloor.jpg

LOL! If you don’t mind, I will use that image for the blog.

If you don’t mind

Not at all.

This is my favorite one yet!

Hilarious

TFA!

totally f’n awesome!

My concern is that they will keep the deduction in place and make a hard-to-navigate system for future home purchasers that will severely hurt this future first-time home buyer.

Unless we see a radical tax code re-alignment for all taxpayers, I know this future buyer is going to end up on the short end of the stick.

WAAAH WAAAH I’m rich and I’m losing my loopholes to get out of paying my fair share of taxes WAAAAAH!

Get rid of this subsidy, get the government out of housing. $100 million dollar homes get quite a tax write-off compared to $20,000 homes. The amount you overpay for your home pales in comparison to the “tax benefit”.

Mortgage deduction for homes was not put in place to help us, it was put in place to make it appealing for the sheeple to buy a home (Why rent? when you buy you get a tax write-off while you pay your balance down, don’t be stupid and rent get in debt now!!!) This creates artificial demand and artificial pressure (buy before you get priced out and stuck with higher taxes!!)

Fear is a wonderful tool. If I accept Jesus I won’t burn in hell forever and ever? Pass the Jesus juice.

“$100 million dollar homes get quite a tax write-off…”

Can you explain how when HMID limits deduction for first mortgage at $1 million?

Only $1 million dollars? That is such a LOW amount, I’m sure there are thousands of readers to this blog that have mortgages at or above $1 million dollars correct?

Yes I exaggerate to prove a point. The real point is mortgage interest deduction from taxes is bullshit. We get to avoid paying taxes in order to pay banksters? So the taxes we would have paid that are supposed to go back into social infrastructure and welfare of the people are instead sent to the bankster families.

Stop drinking the Kool-Aid, the mortgage deduction is nothing more than a hoax to make the banksters more wealthy, NOT to protect your hard earned wages. Homes have been made into commodities and it’s ripping the nation apart.

When the subsidies stop, the wealth transfer slows…GOOD. I hope homes come back to realistic terms so everyone including David and myself for that matter, can afford to buy a home they will use for years. Until then, housing is the greatest Ponzi scheme ever developed. just ask al the Boomers who have cashed in over the last 30 years….

Only $1 million dollars? That is such a LOW amount, I’m sure there are thousands of readers to this blog that have mortgages at or above $1 million dollars correct?

Yes I exaggerate to prove a point.

Your “point” didn’t prove anything. You completely missed what Chris was trying to tell you, and apparently didn’t read IR’s article. The HMID is capped at mortgages at or below $1M. Incorrect is not the same as exaggeration.

Fear is a wonderful tool. If I accept Jesus I won’t burn in hell forever and ever? Pass the Jesus juice.

And was it really necessary to berate other people’s religious views in order to “prove” your “point”? What exactly is your point? Are you pressing for abolishing religion at the same time as the HMID? Do you have a point?

This blog needs an Ignore button…

-Darth

Lord, please save me from your followers.

“I’m sure there are thousands of readers to this blog that have mortgages at or above $1 million dollars correct?”

I don’t think there are that many IHB readers that **are dumb enough** to have this type of mortgage ;-).

The government likes being in housing. Government decided that communities of home owners are safer and cheaper than communities of renters. Stability over change. So they subsidize the lifestyle that they would prefer.

People with children get more subsidy because they are more ideal. Less likely to move, more likely to contribute to society etc…

you can say this with a straight face? do you see any instability caused by families getting into mortgage debt that they can’t sustain?

In no way have I said that the government has been right.

Mortgage Interest Deduction whoppeee…

If they really want to lower the federal deficit, how about eliminating the ability to deduct your state property taxes from your federal return. (alright, we already have that, it’s called the alternative minimum tax)…

If you think people are going nuclear now…

Why should we be taxed twice on the same income? Unless you were being facetious, this idea shows a fundamental misunderstanding of tax policy. The HMID issue is completely unrelated to the double-taxation issue. The HMID doesn’t give you a deduction on taxes already paid. It gives you a deduction on money paid to the banksters.

-Darth

The Commission’s proposal eliminates the deduction for state income taxes, I believe.

The repeal of HMID will pass at around the same time Congress declares National Flag Burning Day or commissions a Hitler Memorial on the Mall.

Heard idiots on NPR this morning, saying “Why would they wanna repeal that? It’s the best thing the government does for homeowners.”

I weep for my country.

Or Cali reworks Prop 13.

We can talk all day, but good luck getting any of this passed.

The future crops with Moonbeam on the top will have the best chance to do this. Else, it’s business as usual (whaddya expect?).

Agreed, HC. As much as the HMID repeal is needed and right, it is NEVER going to happen. Too many voters have too much money at stake. Renters have a lot of money to lose, too, but it’s much more indirect and harder to identify (national debt down the road, higher overall tax rates, etc.). And besides, we renters are much less reliable voters and political donors. Sad, but true.

-Darth

And current renters are always being sold on the virtures of future HMID.

They said the same thing about healthcare…

The deduction levels the playing field that landlords can take the interest deductions on Sch E. I would rather give the money to the govt than give it to the banksters to bribe the govt.

What the Realtors Say: “Qualified Homebuyers Should Have Access to Credit.”

I know buyers at work who qualified in a very short time. 3 at 3.5% down and 2 others at 20% down in Irvine. The leaders asked and received W2, current check stubs, copies of 1040 for income verification. That too much to qualify for the Realtors. Why can it be that you just have to be able to be alive to qualify — no income verification needed.

American don’t need basic math skills because they have computers.

Slightly off topic for today’s post, but very relevant to this blog in general: Check this out:

http://www.ocregister.com/articles/homes-275622-irvine-young.html

Short summary: new Irvine Co new homes received a far stronger demand than expected (granted this from the Irvine Co, so take that with a grain of salt.) Still, so much for weak demand for homes in Irvine.

All of the recent TIC sales have been very strong, because they have been pricing them BELOW THE MARKET! The article that you posted talked about 1,000-1,400 sq. ft. townhomes in the low $300’s. Suppose that the 1,000-sq. ft. models are selling for $310K. That’s $310/sf for a BRAND-NEW home. Meanwhile, many 1970’s and 80’s townhomes elsewhere in Irvine are still listing for $330/sf and up. (Listing, not necessarily selling.) So, yes, of course demand is going to be strong when they price their brand-new homes BELOW the existing-home market.

It’s what IR has been saying for years: the only way to create true demand is to lower prices.

-Darth

If that’s the case, shouldn’t we/ blog acknowledge those who bought below market as making a smart move?

Not if you’re chasing a market that’s moving downward. Of course Irvine isn’t quite like that and many people have differing opinions about where things are going in Irvine.

If it turns out that pricing holds about $300/SF in Irvine, then buying below market was a brilliant move. The verdict is still out as to whether or not that price level will hold.

Yes for houses it’s the same. TIC is smart. 20% down required, so cut down on the squatters.

Won’t happen!

The USA is a democratic country that cares more about the voters than about the country itself. The voters don’t approve higher taxes but easily approve “free” and enjoyable things.

China, for example, is under communist dictators who care about the prosperity of their country. They won’t hesitate to approve a polluting and noisy airport in the backyard if it generates billions of cash.

Compare the national debt, China has almost no debt, while the UK or the USA…

What about Ireland, the debt per capita is $515,671?

http://en.wikipedia.org/wiki/List_of_countries_by_external_debt

See, Irvine is rich because it has/had rich companies like The Ford Motor Company not because it has parks.

Used to be we hated authoritarian communists in this country. Now I see praise of the Chinese model all over the place.

Ugh.

You have to love that Hydro. You also have to love capitalists that don’t believe education should be socliazed and free through college. Education is KEY. In fact in a 1999 report done by both democrats and republicans (Gary Hart/Newt Gingrich and others) it listed the failure of our social education system as more of a direct threat to national security than terrorism.

Since 1999 have we poured trillions into educating our country, or bombing and killing other countries? The greatest threat always lies within.

Another far-Left socialist college prof. Lovely. Can’t say I’m suprised, though. Probably an Agran voter.

-Darth

I’m not old enough to remember but I was told that the gov did away with credit card interest deductions and car interest deductions long time ago. Thats to bad.

This will have a bigger impact that that and I agree this is a terrible thing to do. How about cutting spending instead of raising my taxes.

We would certainly accelerate paying down our mortgage debt if the mtg int deduction were limited to $500k of debt.

Yet another lovely garage with attached house!

Doggone, just saw your post today, after I spent twenty minutes writing up the same CAR nonsense.

Another briliant thought provoking blog, but I would have thought you spent 5 minutes.

MID does nothing to make homes affordable because most buy homes with mortgages, so most are bidding against others in the same situation. MID benefits banks only because it raises the amounts borrowed.

Buyers worried about further price drops

http://lansner.ocregister.com/2010/11/12/buyers-worried-about-price-drops/86534/

This is some great information. I like how it gives several points of view on the mortgage interest tax deduction issue. If this goes through I can see it benefiting some and hurting others. Unfortunately it would probably hurt people in my market area.