Address: 25 Golden Eagle, Irvine, CA 92603 (Shady Canyon)

Plan: ?? sq ft – 4/4.5

MLS: S452978 DOM: 62

Sale History: 1/6/2006: $4,030,000

Price Reduced: 09/28/06 — $4,480,000 to $4,280,000

Current Price: $4,280,000

For those that might not know, Shady Canyon is one the most prestigious and exclusive communities in Orange County. This village in Irvine consists mostly of custom homes although there are a few ‘tract’ homes as well. Prices currently range from $3,495,000 – $17,900,000.

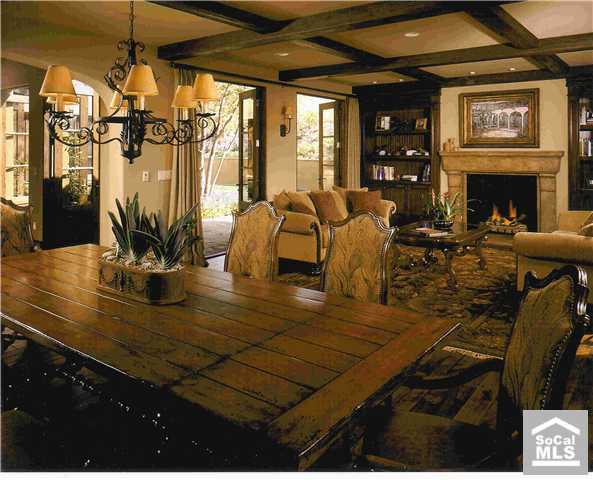

While scouring MLS looking for flips, I came across 25 Golden Eagle. You’ll want to look it up in ZipRealty to check out the rest of the pictures. A gorgeous home in a beautiful setting but you need mucho dinero to play in this part of Irvine.

This home was custom built in 2003 and it appears the original owner listed the home in November 2005 and sold it in January 2006. The new owner is a RE broker and put the home back on the market in August 2006 looking to make $450,000. The price was lowered a couple weeks ago reducing the potential profit to about $250,000. The broker is offering 3% for someone to bring a buyer and that will decrease his profit to about $122,000. I’ve been unable to find any loan information so if someone else is able to dig that up, please post. Imagine what the carrying costs on something like this would be. This one may take a while to sell but I’ll keep checking.

UPDATE #1 – November 16, 2006

This listing fell off the market on November 2nd. If it gets relisted I’ll update the post. In the meanwhile, check out another $4+ Million Flip at OC Renter’s blog.

UPDATE #2 – December 15, 2006

And now it’s BACK on the market at a price of $4,295,000. It’s also now listed with Uber realtor John McMonigle. I’d bump up the selling costs to be about 6% now which would give the seller a profit of about $7,000. Nice 😉