Today we review current conditions to verify that we are not at the bottom of the housing market, and examine the property of a grade D HELOC abuser.

Irvine Home Address … 17 SUNRISE Irvine, CA 92603

Resale Home Price …… $1,528,000

{book1}

I don't wanna close my eyes

I don't wanna fall asleep

'Cause I'd miss you, babe

And I don't wanna miss a thing

'Cause even when I dream of you

The sweetest dream will never do

I'd still miss you, babe

And I don't wanna miss a thing

Aerosmith – I Don't Wanna Miss A Thing

Their gullets awash with kool aid and eyes ablaze with imagined riches, fanatical bulls prematurely celebrate the bottom of the housing market.

Relax. You haven't missed a thing; we are not at a bottom, and although I have stated I will not call a bottom, I do not believe conditions exist for a bottom to form — unless perhaps kool aid intoxication is so strong that bulls can make it happen through force of will. Anything is possible.

The obsession with a market bottom comes mostly from bulls hoping to make a fortune and to restart the housing ATM and to live the bubble lifestyle — a foolish mindset discordant with our future reality of (1) flat home prices, (2) rising interest rates, (3) less borrowing, (4) increased saving and (5) less spending. Timing Does Matter, and nobody wants to overpay for real estate, but once prices fall below rental parity, timing the bottom becomes less important, and drop duration takes on new importance because it determines how long buyers will be trapped in the homes they purchase.

Today I want to look at where prices are, where they are going, and how long it will take them to get there.

Good News

On the positive side, many of the IHB Property Valuation Reports we prepare show properties as positive cashflow, a prerequisite for a durable market bottom. As long as it is less expensive to own than to rent, buyers intent on long-term ownership of a particular property are making a rational decision, and the collective action of these buyers (coupled with the irrational ones) forms a market bottom.

Bulls want to end the discussion with acheiving rental parity and assume other problems — like rising interest rates, falling rents and foreclosures — will not impact pricing, so when prices do go down, they claim the obvious forces working against prices were a surprise — it is only surprising to those who bury their heads.

Bad News

I wrote a post early last month titled House Prices Will Decline in 2010. I mentioned the 3 primary factors working against the market; (1) prices are too high, (2) mortgage interest rates will go up, and (3) foreclosures will increase.

Prices are too High

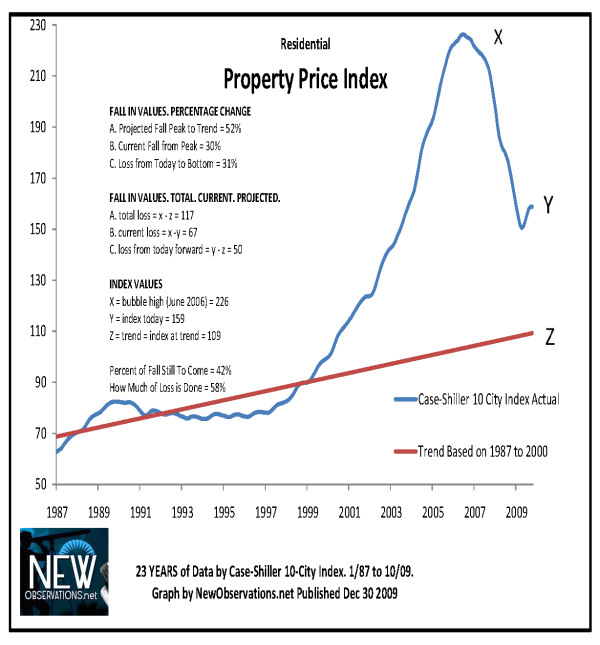

The basic argument as to why prices will fall is not complex; prices are still too high by historic measures.

Calculated Risk put it this way: "House prices are not cheap nationally. This is apparent in the price-to-income, price-to-rent, and also using real prices.

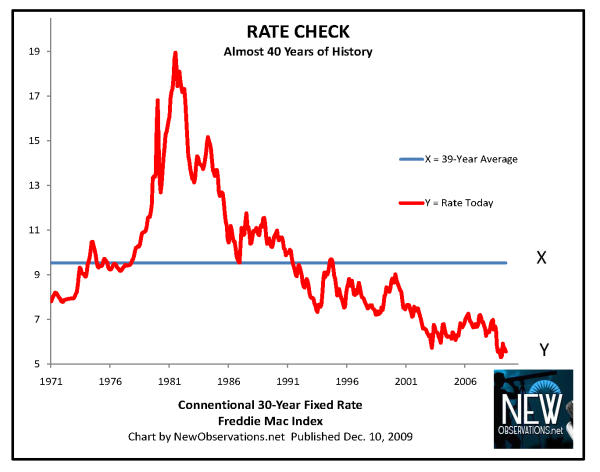

Mortgage Interest Rates will go up

This is also a simple argument; interest rates are nearly zero, and based on the long-term chart, it looks like rates must move higher.

Perhaps the best evidence for concluding interest rates have bottomed and will soon move higher comes from Ben Bernanke, Chairman of the Federal Reserve, who recently refinanced his ARM to a fixed-rate mortgage.

Foreclosures will Increase

CNN Money recently published an article titled, 3 reasons home prices are heading lower, where the authors cited (1) foreclosures, (2) rising interest rates, and (3) the end of the tax credit. Rising interest rates was mentioned above, and tax credit props made my list of caveats as to why people may not want to buy now. Foreclosures and Shadow Inventory made my list of 2009 Residential Real Estate Stories in Review, and it is the biggest unknown facing the market — it isn't unknown as to whether or not this inventory exists; it does, what is unknown is when this inventory will hit the market.

Nothing has changed, but for further support, I want to enlist economists Dean Baker and Christopher Thornberg.

Dean Baker: We’re Still In a Housing Bubble

Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, speaks frequently about the relationship between the cost of ownership and the cost of rental — rental parity as we call it — as an important measure of house prices. Obviously, I agree with him. His latest writing, Dean Baker: We’re Still In a Housing Bubble, is a cogent presentation of the current housing market situation.

"Home prices have posted six months of gains, according to the Case-Shiller home price index, released this morning. But some housing bears say that the fundamentals don’t support those price gains and that, even once the market finds a bottom, home prices aren’t likely to show significant appreciation for many years to come.

Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, laid out his case [PDF warning] at a risk conference last week for why we still have a housing bubble. Adjusted for inflation, home prices are still 15-20% higher than they were in the mid-1990s. “There’s no plausible fundamental explanation for that,” he says."

Remember Christopher Thornberg's Beacon Economics 2010 Orange County Forecast? He had the same observation:

![]()

Back to the article:

Why? Simple, he says: Economic fundamentals are all going in the other direction. Rental apartment vacancies are reaching record highs. [also see Rents Fall to 3 1/2 Year Low in Orange County] Many segments of the housing market are still oversupplied. And the core demographic in the country—the baby boomers—are reaching the age where they’re more likely to downsize, buying less house in the years to come.

Far from some rosy estimates that housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation, Mr. Baker argues that home prices are far more likely to increase annually at the rate of inflation, at best.

“If anything, I expect housing to be weaker than normal rather than stronger over the next decade,” he says. “People who say this is a temporary story, there’s no real reason to believe anything like that.”

The recent burst of good housing news has been fueled by government stimulus, including the tax credit, low mortgage rates and easy financing from the Federal Housing Administration. Mr. Baker, who had been a skeptic of the tax credit, concedes that it has worked. So, too, he says, has the FHA effectively supplied credit to goose sales.”

Yes, we replaced subprime with FHA (and the GSEs), and we put thousands of people into homes with 3.5% down FHA loans, money renters likely to fall 10% or more underwater. If they walk, you and I pay the bills.

Housing Bubble Deflation Progress by Market Segment

The Great Housing Bubble deflates unevenly across market segments with the low-end falling most and the high-end falling least — so far anyway. The differential rates of decline has created a gap between top and bottom that has never been so stretched. The bottom of the market collapsed first as toxic financing is most lethal to those with least sophistication, resources and experience: subprime. Borrowers further up the property ladder are falling flat like subprime but they are allowed to dance with lenders in amend, extend, pretend — a charade seemingly with no end.

Many people believe the high end will suffer the least while the low end suffers the most because history recorded same over the last 3 years. I contend the various market strata are like Shoemaker Levy comet fragments marking different points along the same trajectory destined to meet with the same fate. Only time will tell if I am right or wrong.

I have a difficult time visualizing how prices at the high end can stay so high. The high end and the low end went up together, and the low end has since fallen; either the low end must go back up a great deal, or the high end must come down — unless you believe the gap between the rich and the poor is destined to widen forever.

Bulls would have us believe that Irvine and Orange County are so desirable that wealth will concentrate here in abundance saving our housing market and making it different than the rest; it is a compelling narrative with a small kernel of truth; however, the narrative ignores the size and interrelationship of all housing markets and the consequences of the substitution effect on housing values.

Roaring Back?

What about the idea that "housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation?" It is the prevailing (and incorrect) belief in the market today. Dissenting views exist: Housing recovery could take a decade, say optimists, and House values won't regain bubble heights for AT LEAST a decade. That doesn't sound good.

The first story has a great opening:

"Even as the housing market shows signs of improvement, including in new data released Tuesday, economists warn that it could take up to a decade for many homeowners to regain equity in their homes, while some people in the hardest-hit regions of the country may not see a recovery during their lifetime."

During their lifetime? Yikes! Certainly not giving any false hopes here.

The second story is interesting because it is either extremely bearish or condescending of bears, and I can't determine which:

"A New Jersey financial publishing house assumes conservative rates of growth in its formulas but acknowledges that its conclusions take a 'real leap of faith.'"

It is a leap of faith because (bearish) house prices will not bottom as quickly and prices will not rise as fast as projected? Or, is the leap required because (bullish) prices are obviously going to rise much faster than this guy projects, so he is way too conservative? Enlighten me in the astute observations.

"According to the Standard & Poor's/Case-Shiller index, which tracks changes in the value of residential real estate in 20 metropolitan regions, prices have fallen 32.6%, peak to trough, between 2006 and the third quarter of 2009.

HSH is predicting a flat real estate market with no increase in value through June 2010. Then, from July 2010 through August 2011, a period of 14 months, prices are projected to increase at a rate of about 2.5% a year. And from then on out, the company is figuring on a yearly gain of 3%.

With these percentages in mind, let's look at what would happen to the value of a $200,000 house purchased at the top of the market in July 2006.

By the time the market hit bottom — at least the bottom according to Case-Shiller's 32.6% figure — that property was worth $134,800. Using HSH's assumptions, the value of the imaginary house won't get back to the $200,000 paid for it until July 2022 — 12 1/2 years from now."

As you may have surmised, I also projected recovery times in The Great Housing Bubble, Future House Prices – Part 1:

Irvine, CA, Projections from Historic Appreciation Rates, 1984-2026

Perhaps we will round out the bottom a bit with 5% interest rates, but we do eventually need to get back on line of rational appreciation instead of the line of irrational exuberance. What many consider normal appreciation is in fact a parabolic blowoff of a speculative mania.

Don't worry, it is different here.

What happens in Vegas, stays in Vegas, right?…

Fortunately, we are much closer to the bottom than to the top for most market segments. In fact, I am very bullish on Las Vegas, if for no other reason than I see where we are in the chart above. Here in Orange County and Irvine in particular, we have not progressed far enough along the journey to reach bottom.

It is what it is. Stay tuned.

Irvine Home Address … 17 SUNRISE Irvine, CA 92603

Resale Home Price … $1,528,000

Income Requirement ……. $321,086

Downpayment Needed … $305,600

20% Down Conventional

Home Purchase Price … $675,000

Home Purchase Date …. 4/9/1999

Net Gain (Loss) ………. $761,320

Percent Change ………. 126.4%

Annual Appreciation … 7.7%

Mortgage Interest Rate ………. 5.13%

Monthly Mortgage Payment … $6,660

Monthly Cash Outlays ………… $8,340

Monthly Cost of Ownership … $6,150

Property Details for 17 SUNRISE Irvine, CA 92603

Beds 5

Baths 3 full 1 part baths

Home Size 3,500 sq ft

($437 / sq ft)

Lot Size 5,800 sq ft

Year Built 1980

Days on Market 424

Listing Updated 11/13/2009

MLS Number U8005368

Property Type Single Family, Residential

Community Turtle Rock

Tract Rg

Rarely on the market. Location, location. Thousands spent in upgrades. Home has been remodeled and updated. Beautiful backyard, light and bright, open floor plan. Hardwood flooring throughout, Huge family room/den area. Office area. Master suite with private sitting area attached. Entertainers backyard with BBQ area, Private jacuzzi and sitting area. Awnings, outdoor fireplace. Three indoor fireplaces enhance the living areas. Kitchen nook, large den with wine room attached. Skylights bring more sun to already bright home. Low association fees. No Melo-Roos. Walking distance to Bonita Canyon and Turtle Rock schools, University High School. Next to Turtle Rock Community Park, Tennis, Pools and Association. Beautifully kept and maintained. Thank you

I have to admit, when I look into the details of some of these HELOC abuse cases, I try to imagine the borrower's life and the feeling of power of having hundreds of thousands of dollars given to you by the market to spend as you will. Borrowers get to enjoy a carefree (and careless) attitude toward money where they simply spend whatever it takes to get whatever they want; what a great reality to live in. It's unfortunate that reality isn't Reality.

Some assume I must be jealous to even ponder such things, but I assure you it isn't jealousy. There are some things in life you have to see for what they are, and the seduction of kool aid intoxication and reckless spending is just as potent as any vice known to man. As a society, we succumbed to the Siren's Song in large numbers and inflated the largest and most destructive housing bubble in US history. I hope we can see clear not to do it again.

Option ARMs Surpass Subprime Mortgages in Loss Severity

Friday, January 29th, 2010, 11:52 am

The slipping performance was pronounced in pay-option adjustable-rate mortgages (option ARMs), pushing revised loan loss severities in this sector higher than that of subprime.

The growing pain in option ARM performance is the cover of a HousingWire magazine issue out now, which studies the effect of $134bn of option ARMs expected to recast into higher monthly payments over the next two years.

During the weak performance seen in 2009, Moody’s took rating actions on nearly 45,000 (residential mortgage-backed securities) RMBS transactions related to the 2000 to 2009 vintages. As delinquencies rise and home values decline, Moody’s continues to revise its loss projections in the RMBS.

Moody’s does not expect a bottoming of house prices before Q310, with another 11% national decline likely before the worst is over. These price declines, taken with rising unemployment, housing inventory oversupply and weak demand, are pressuring performance.

On the heels of longer foreclosure and liquidation time lines “exacerbated by unsuccessful modification efforts” in 2009, loan loss severities worsened across all sectors, according to Moody’s.

Option ARMs have surpassed subprime as the sector with the steepest loss projections for securities issued from 2005 to 2007, according to Moody’s. The rating agency now expects a 20% cumulative loss on ‘05 option ARM RMBS, 41% on ‘06 securitizations and 51% on ‘07 securitizations.

Delinquencies of 60 or more days, assets in foreclosure or held-for-sale rose “markedly” since the last Moody’s revision to option ARM RMBS projections in Q109. Serious delinquencies rose to 40.4% from 33.3% for ‘05 securities, to 47.3% from 38.6% for ‘06 securities and to 41.3% from 30.4% for ‘07 securities.

“unless you believe the gap between the rich and the poor is destined to widen forever.”

Do you expect our brand of fascist-capitalism to change this century?

Actually, yes, I do. If you look back at the end of the 19th century, we had similar conditions here in America with a huge gap between rich and poor. The beginning of the 20th century saw trust-busting, income tax, creation of inflation with the Federal Reserve and other wealth-eroding populist policies. I believe we will see a similar trend over the next several years. The concentration of wealth reached its zenith under George W. Bush’s Ownership Society.

Examining the OC in a microcosm the median price to median income ratio has increased every decade, 1970s to the 80s, to the 90s, to the 00s to now.

You could be right, we may be headed towards socialism. In a best case scenario I give that 50 years, we probably won’t be around for it. The exponential wealth destruction of the middle class has huge momentum with global forces in play and will likely require a war to quell.

Certainly you don’t think this change will happen this decade do you, or in the next 5 years?

I don’t see war as a requirement, but I do expect to see an increasing crime rate.

Do you remember the move ‘Back To The Future II’? Remember the part where he returns to 1985 and the neighborhoods have been transformed into ghettos and there is the enormous tower in the middle of the city with all the homeless people outside?

This is the direction we are moving in.

I think we are continuing down the classic haves and haves-not path. Obama’s supposed platform of change has only accelerated the GWB fascist-capitalistic policies. Obama operates under the guise of wealth redistribution bit all we see is more of the same. There is only one fascist capitalism party.

In the future, most areas will turn into ghettos, but the wealthy will live together in there guarded ivory towers. Think the classic movie Metropolis.

The reason I think it will take over a century is because it is very easy to control the fascist-capitalistic masses. Give them their smart phones and 3d TVs and they are happy to live in their box of a life.

Take the book ‘1984’ where 85% of the population belongs to a group called The Proles that are basically just a bunch of uneducated obedient workers but told that they are ‘Free’.

Look at the similarities that we can draw between this and modern society where we have a very large ignorant mass that is more concerned about Football, Stocks, American Idol than the loss of their liberties and wage slave manipulation – all while being told how ‘free’ they are.

This is where it is all going – keep the masses engaged in consumerism, chasing stuff while slowly accepting a crappier and crappier standard of living; slaving away to do the bidding and services for the elite at the top.

We are already there!

the thing that Orwell best nailed was the role of the lottery in keeping the underclass from becoming desparate and diconnected. I see that all the time today.

“Certainly you don’t think this change will happen this decade do you, or in the next 5 years?”

I do not believe a purported populist President with a left-leaning Congress is going to institute tax policies nor encourage monetary policies that encourage further concentration of wealth. I believe we will see the rich get less rich because taxes will go up, a lot, and inflation will eat away at the value of stored money. It won’t be a revolution or anything that dramatic; we will see a long-term shift away from concentration of wealth to dispersion of income. The Socialist ideas of the Left will be tested out, I’m afraid.

It’s definitely going to get interesting. My bet is that a third party candidate is going to show up and spoil the party for the Republicans next election and we are going to be stuck with more Obama’s Spend-Our-Way-To-Prosperity Tail Wag The Dog economics.

The GOP is going to gain traction by beating their Socialism Straw Dog and split the voters. We will then have a Ross Perot type come in and ‘steal’ away enough voters that Obama will squeak by.

Since nobody seems interested in electing an independent candidate….

No, the Republicans will spoil the party all by themselves. They will nominate Palin or some similar idiot who will be destined to lose. Best case scenerio (from the Republican point of view) will be a Bush-Kerry repeat (with Obama being Bush in this analogy), where everybody hates both canidates but the incumbent squeaks out a win due to the power of incumbency alone.

Worst case scenerio (for the Republican point of view again) is Reagan-Mondale, with Obama playing the part of Reagan. Remember, at this point in the Reagan presidency, his job approval ratings were lower than Obama’s are now, so this is quite possible.

The most likely scenerio is Clinton-Dole, between the two extremes above. This also factors in a likely drubbing for the Democrats in Congress in 2010 (like in 1994).

There’s basically no chance Obama loses in 2012, without a major scandal (Watergate II) or a seriously charasmatic opponent (that is, the next Reagan, Clinton, or Obama himself)-which probably wouldn’t even work since Obama is also charasmatic.

Very good analysis. I suspect the dynamic will be somewhere between the Reagan/Mondale and the Clinton/Dole elections. Either way, I don’t see how Republicans gain much in 2012, particularly the White House.

Another good analogy would be FDRs victory in 1936.

My $5 says that the candidate will be Scott Brown. A pro-choice Massachusettes Republican has the shortest path to the middle.

If there is an opening at all don’t be surprised by a major bid for the Democratic nomination from Hillary. She is playing the opportunist, keeping her name off the unpopular legislation, staying away from collateral damage. Don’t be surprised if she presents herself as the antidote to all the buyer’s remorse among moderate Whites who swung to Obama as self absolution for racism guilt. She has the power to split the party.

I couldn’t believe the hubris of the Obama insiders when they mused last January about what Obama would accomplish in his “first term”. Even then I thought that their arrogance would be their downfall. We shall see.

Once we get the widespread poverty going – I guarantee you that hungry people will have no moral problem with forming ‘foraging’ parties and taking what they need. If it means stealing from people living in nice areas then that’s what they will do.

Nice areas like Irvine would be a nice target for people looking to steal stuff. Do you think that ‘guard’ at the front gate is really going to protect anything?

Just look at the L.A riots in the 90’s – when you get a large mass of pissed off people together; the police can’t do a whole lot.

“Just look at the L.A riots in the 90’s – when you get a large mass of pissed off people together; the police can’t do a whole lot.”

Yes, but this is very neighborhood based. Don’t remember much looting in Irvine. I lived in Newport Beach at the time, watched it all on the news.

In many of the places where the rioting was widespread, to this day the police are sometime afraid to patrol.

So, will these undeserved areas get bigger and bigger and the upscale areas get smaller and more isolated?

David-

You don’t get to watch our local Channel 39 (ITV).

The Irvine PD has a lot of money and has invested heavily in heavier weaponry, attack systems and militarized vehicles. All that stuff gets proudly displayed on Channel 39.

We (wife and I) were puzzled why the IPD would need such stuff. I mean, are they gonna call the SWAT Team into Broadcom’s cafeteria because some engineer took too many napkins? Our viewpoint is that the money would be better spent on the schools.

However, in light of your observations, it makes sense that the IPD beef up it’s heavy weapons systems.

We can easily roadblock the city at the 55, 73, San Diego and Santa Ana freeways. We can control traffic in from Newport and Costa Mesa as well. Indeed we should be able to count Newport Coast and Corona del Mar as our allies since they can also be well defended at key entry point.

Unfortunately all those tracts East of the Santa Ana Fwy will have to be surrendered since they can not be properly isolated from the undersible elements moving east from Moreno Valley and Riverside.

Hell yea, I love your mentality for the police force getting military weapons and equipment. You know what? A TERRORIST could get a dirty nuclear bomb, we should equip the Irvine P.D. with nuclear capabilities!!!

What a load. If the system goes down, the rich will have defenses, but you cannot defend against random violence or snipers. Maybe we can pre-kill the ones we *think* are going to do that!! Yea…that’s another good idea.

Enjoy your ever-growing police state and the debt associated with it. You will be safe, but you won’t have an economy. Personal responsibility flies out the door with most citizens nowadays.

pre-kill…

I’ve been pulled over THREE times by the IPD becyase the office “thought” I had broken the law.. mind you, never saw me.

Indeed, I never had. I had a witness twice, the other time, the office was older enough to realize the error in his ways.

It’s called “preventive ticketing”.

It’s also called Fascism. I think the Gestapo and the KGB engaged in that kind of shenanigans, huh?

I still think that if someone gets an appraisal for a heloc & gets the heloc, they should have their tax value reset to that value. (1) They are agreeing to the value, and (2) are financially benefitting from the increased value. You could possibly cap at the total debt on the property, as you wouldn’t want to completely smash the guy who paid 50k for a property in the 60’s and wants to increase his mortgage to say $300k, but the home appraises for > $1M (numbers are bad guesses, but the principle holds).

This would discourage heloc abuse, increase tax revenue, and be consistent with the spirit of prop-whatever that limits property tax increases.

This is one of the best ideas out there. Well expressed by you.

Good luck with repealing Prop 13, which is what you are proposing. Ain’t gonna happen.

I agree, not gonna happen, but I still think it is a good idea.

Shouldn’t it be possible to amend prop13, not reapealing it. No refi, no revaluation.

CA politics seems even more toxic than politics in general, so I wouldn’t expect it. Many in CA (and some near my relatives in FL) don’t believe there was a housing bubble, and it is the decline that is the deviation from ‘normal’.

With the massive wave of refinancing, now is the only time you could do it. You pitch to most people who have their sub 6% loans, that it would only be if they increased the outstanding loan that they’d see an increase…

If you can’t convince people of something sensible, and mildly painful, how are you going to get them to do something hard?

I’m not in CA, so it’s not really my fight, just an idea.

That is an excellent idea!!! However, all those people that worked so hard to make that house go from $27,000 to $750,000 would cry and bellyache about how they cannot afford the taxes, which just means the next guy down the block buying new, has to pay even MORE taxes to make-up for it.

Welcome to the new entitlement generation. Prop 13 is a failure, but the people who benefit from it will fight tooth and nail to protect their interests. I hope it is repealed.

Honestly, I hope the whole system caves in on mortgages and housing drops another 30-40% in IRVINE, BUT, that won’t happen. I’d love to see the breakdown on nationality of homes sold in Irvine.

Crime has actually went DOWN since the economy tanked. Do you see police forces laying off officers? Of course not, let’s make cannabis a FELONY and we can have union jobs forever that pay 3% at 50. We could think of more things to put people behind bars to increase the prison population…do it for the children!!

I do not see things changing anytime soon. The american people are sheep. They keep voting banana republicans in or defacrats, and they wonder why the whole system sucks. Then a talking head like Hannity or Rush get on the air and convince people to vote banana republican because defacrats screwed it up!!!

Insanity is doing the same actions expecting a different result. Maybe the american people are insane and not just willfully ignorant (i.e. a stupid dumb-ass)

Swiller –

Why do you think they are throwing unlimited money at unemployment benefits? It’s not because they are Philanthropists…

The number of officers employed would be irrelevant in the face of a major crisis (think L.A Riots).

You notice that the mainstream media never has a real interest in promoting independent candidates; they only show up to Democrat/Republican party get-togethers. It indirectly tells the masses that there are only 2 viable candidates to vote for.

So what we get from the MSM media is essentially just a mouthpiece for one party like Fox News selling the GOP line in exchange for money to run Viagra ads against those viewers.

No money to be made in catering to independents when the majority think it’s all fine and dandy the way it is.

Wow the astute observers are downbeat today. Whenever I see this level of negativity towards the ‘state’ of our society, I wonder to what utopian years we are comparing our current condition. These are actually comparably good times and we have avoided some potential disasters that would have reset everyone’s perception. To be downbeat today I think you have to be taking an awful lot of good things for granted.

Politically speaking don’t underestimate the independents – the so-called “swing voters” who are not bought and sold by party politics. Take heart when the ranks of independents are growing faster than the ranks of either party. Independents step in when an administration overreaches (see healthcare, attempted nationalization of). Look for independents to drive a course change in 2010 as incumbents on both sides realize that independents are going to decide their home district election.

Woodbury Renter –

How can the government be going on a spending spree when it has no money?

Obama and Bernanke are in the back room printing Dollars – we are all going to be paying for this in short order.

The best analogy I have seen so far is the patient feeling better after a shot of morphine.

When the morphine wears off – then what? Not much has changed that got us in to trouble….. Eventually this is going to have to be addressed.

Dave, I’m just talking about keeping perspective. There have been much harder times in this country, basically in every decade. We got a bit of a pass in the 90’s while terrorism was strengthening overseas out-of-sight/out-of-mind. This peace is not permanent. There will be war that actually affects more than the military families, there will be a succesful terrorist attack, there will be new disease mutations that kill millions, there will be a major natural disaster, maybe on the San Andreas. This is human history, it is immutable. We should enjoy this relative peace and tranquility. Granted this type of tranquil epoch drives people to their frivolous pursuits of iPods and iPads, Mercedes, Led TV’s etc, however this a symptom of relatively good times.

I agree, WR. This level of pessimism is out of touch with reality. Times are hard, but they aren’t THAT hard. And as you pointed out, our system is very well designed to readjust itself when politicians overreach.

-Darth

Don’t forget before Perot, the Presidential Debate was controlled by the Women League of Voters….AFTER Perot, our lovely government officials took that control away and handed it to one defacrap, and one banana republican. There is your reason why Ron Paul was REFUSED a spot on the debates. REFUSED!! And you ask me why I think our nation is in a state of bullsh1t?

Don’t get me started on the WARS…poverty. drugs, middle eastern nations…..I’m pessimistic?

I am DONE with this. The only reason I do right things is because I have to account to my Creator, my God, not the state, nor to appease my increasingly fascist neighbors in Irvine, Lake Forest….etc.

If the country gets super bad, you can bet I’d target Newport Coast and the nicer neighborhoods. The bonus is, most of those people are LIBERALS and they have freely given up their right to bear arms.

Ron Paul was in most of the Republican debates; he got only 1.6% of the delegates and won no state (he was in second or third in 27 states). He did not run as a third party candidate in the general election.

His failure was not due to any big conspiracy; it was due to people not voting for him. To win an election you don’t just have to be “right”-you also have to be popular. Ron Paul was not popular.

Really? When was Ron Paul on TV during the debates? You are not telling the truth. I had to WRITE IN Ron Paul on California’s voting booth. I shouldn’t be surprised, people who think the two party system is working are still in denial. People are like the banks, just say no. Extend and pretend, vote for the person who can keep your mind busy from frivolous thing to frivolous thing.

Extend more terms to defacraps and banana’s. Pretend the political system is working. Sound familiar?

Expect a huge economic implosion and prices correcting themselves, or inflation that will make Jimmy Carter look like a GREAT president.

Hope for Change. Extend and pretend. What’s next? “One more try!!! We’ll get it right!!!” 2012

This is your brain (shit ain’t working)….this is your brain on DENIAL (vote defacrap, vote banana republican)

When will we learn!? I just got this email today from a lender. What exactly are we doing to make things better or make sure this does not happen again?

“Cal Chaffa…..Half Percent Down…Marginal Credit OK …Not limited to 1st Time Buyers

Good Morning

Thanks to those of you who’ve e mailed asking me if still publishing.

It was long holiday season for all us and with the El Nino rains….it was ez to put off writing again.

Good news to start of the 2010 spring selling season.

Cal Chaffa has over 4 billion dollars in unspent funds and has opened up the program to those buyers currently owning a home, with BAD credit and with virtually no down payment.

Thats right….1/2% DOWN ….NO FICO SCORE…AND MOVE UP BUYERS WELCOME.

Here are the fundamentals of the loan program.

Current home owners and 1st Time buyers are eligible

Primary Residence Only

Up to $729,250 loan amounts

No Minimum FICO score

½ % down payment..yes that’s “half percent down”…(no kidding)

Gifts from family members OK

Seller (or agents) can pay all closing costs including “pre paids” (up to 6% of sales price).

No “Recapture Tax” if home is sold later

High Debt Ratios (up to 47% back end ratio)

Call me for more information…..I’ll e-mail your borrower a loan package loan application have them underritten written and approved within 48 hours.”

unbelievable.

almost seems like a joke but I don’t think it is.

Obamanomics: continue the transfer of debt to the poor and gold to the wealthy.

All that matters is temporary improvement of life style, or a delay in the decline in life style.

Sorry, that is not Obama. Smells exactly like the Republican program we had when they had the Presidency, both houses of Congress and the Supreme Court. But go ahead and vote for Palin as soon as you get the chance.

That exactly is Obama. What do you think happens when banks get free money to stay in business and speculate profits? The poor and middle class get crushed by the unnecessarily created inflation. And then they vote to self perpetuate the vicious circle. This is a transfer of wealth.

I don’t buy the Robin Hood BS.

The only way to raise everyones’ standard of living is allowing capitalism (not our current mixed economy of gov’t subsidy) to run free. Let the foolish fail, let the prudent prosper. Having faith in the gov/t to fix things is a pipe dream.

So are we closer to the bottom in Irvine than the top?

Because if we are, that scares me.

The pricing of the new SFRs in the Woodbury/WBE Grand Opening are $100k too high to me, and if the bottom is 2011, will they get that much lower?

The Irvine Company creates and lives in their own reality. They will sell for whatever they believe they can get. The churning in the resale market will be more telling.

Is TIC really that far off?

Compared to Irvine resales, it doesn’t look like inventory is that much lower priced if you use BK’s Rule of 10-15% for that “New House Smell” premium. And in some cases, the seller’s outrageous asking prices are inline with Wooddbury/WBE pricing.

2010 doesn’t seem much lower from 2005/06 for certain SFR products… so isn’t Irvine different? Or do we blame on the FCBs and the 3CWGs?

TIC is not far off now. In fact, they have been below resale on a $/SF basis. They may be far off the bottom, but they are not far off the current market.

For that price it better have 180 degree ocean views…it aint 06 anymore!

IR,

I noticed you don’t list the specific dates and amount of HELOC withdrawal anymore. Was there any privacy/legal issue.

I kinda miss that.

No, not at all. Sometimes it just seemed to belabor the point, but perhaps the details are the point after all. As I recall, this owner took out a Option ARM for about a million bucks, and now it is blowing up. This owner more than doubled the mortgage debt.

Excuse me? Did I read that right?

And option ARM refi for a million bucks?

A million bucks refi?

I’ve driven through the area, it’s near me.

A million bucks refi?

I think I better write a $1000 check to the IPD fund for heavy weapons protection from the unwashed masses in 2012.

I usually agree with most of what is written in this blog and much of what shows up in the Astute Obs, but when I start seeing talk of “fascist-capitalism” economic systems, comparisons between the Housing Bubble and Orwell’s “1984”, the fantasy notion of something called GWB’s “Ownership Society”, predictions of the poor forming “foraging parties”, and likening our society’s VERY modest rich-poor divide to that of the 19th century and 3rd-world countries, my only conclusion is that YOU HAVE GONE FREAKING CRAZY!!! At the very least, IR, AZDavid, and PlanetReality have earned that description through their ridiculous non-Astute Obs. What the hell are you guys smoking?!?!

The large middle class and the still relatively small rich-poor divide in this country are NOTHING at all like 19th century America or any of today’s banana republics in Central/South America or any of the rest of the 3rd world. Those comparisons are patently ridiculous sensationalism. Yes, times are hard. No, they are nowhere near THAT hard.

-Darth

I only made the statement that our modern concentration of wealth has peaked with theOwnership Society, which I think is true. I drew parallels to other rich versus poor populist movements because the dynamics are the same. We are not a banana republic, but we will see a populist movement toward Government Robin Hood.

Do you believe we will see continued concentrations of wealth? And will this cause wealthy housing markets to continue appreciating while poor ones decline?

I don’t think that it has peaked at all, IR. If anything, the gap is widening as a result of the bursting of the bubble. Do you really think that the gap has narrowed over the past 3 years?! Seriously?! As the poor and the middle class have been crushed by unemployment, falling wages, and disappearing benefits? It wasn’t only bankers and stock brokers and realtors that were living fat during the bubble.

The poor are poor. That will never change. They don’t know how to be anything but poor. Either through bad luck (disease, handicap, etc.) or bad choices (addiction, laziness, etc.), they will be poor the rest of their lives, no matter how much help they get. These are the people that win the lottery and are dead broke (or just plain dead!) a couple years later.

The rich are rich. That isn’t gonna change. They have figured out how the game is played, and they have the abilities, determination, and the resources to play it. Some faces change in both the rich and the poor groups, but not on a statistical level, and that’s what we’re talking about here. We’re talking about the statistical composition of our society.

The middle class, otoh, drifts between these groups. They rise when labor conditions are tight, and they fall when employment falls. These are the guys that don’t know how to get rich, but they aren’t screwed up or unlucky enough to remain poor. They don’t understand cashflow, and they don’t have the discipline to choose investing over spending, but they have also chosen to avoid the major vices that trap the chronically poor. The middle class earns a wage, and they spend it. They watch TV and drink Diet Coke, blissfully unaware of how the world and our economy works. When jobs are plentiful and the economy is humming, workers get raises, increased benefits, and better treatment.

What about all those construction workers that were riding high during the bubble? Do you think that their fall has narrowed the gap between rich and poor?

Also, from a historical perspective, we are nowhere near the conditions that this country saw in the pre-WW2 period. We are also nowhere near the conditions that the 3rd world sees today. I know an old guy that had a job making toilet seats in a factory in the 30’s. He earned 25 cents an hour with no extra benefits. Those kinds of jobs were the norm in our nation’s cities until the 1940’s and ’50’s, and they are still the norm in most of the world today. Simply being born in 20th or 21st century America is STILL winning the biggest genetic lottery ticket in all of human history.

Yes, times are harder in America today, but they aren’t THAT hard.

-Darth

IR,

Robin Hood stole from the government (ruling class) not necessary from the individual rich person. The extremely rich is this country are socialist — When they make bad investments, they expect and get the govt. (middle class) to bail them out. When they make good investment (at least short-term), they want to keep it and pay as little tax as possible.

I do beleive you’re correct in the concentration of the wealth in the US. Most so-called third world countries are seeing more middle class, but the US has seen a decrease in the middle class, especially for the only HS education trades people. The HS education mortgage people pay skyrocketed for a while. But overall the US people are well fed or over fed, so the likely hood of massive riots are slim, at least for now.

It only takes a little bit to go from ordered to mob rule, especially when moral restraint and shame have been removed. Order is kept in the US by moral restraint. Moral restaint has been eroded, so large police forces are needed in most major cities. Even small cities have excessive number of police and SWAT, paramilatary units, now for just incase. And there’s the national guard and army.

Remember, the army with tanks was called out to get rid of the unsightly bonus protesters, who were only asking what was promised to them.

Remember, the good neighborhoods in L.A. received full police protection during the riots.

I’m afraid that 1984 is pretty close to what our polity is doing.

As a matter of fact, I was talking to my teenage son about this yesterday.

The rich are indeed getting richer at the expense o the middle class because long ago they bought out the political machines and the mainstream media.

The poor are bought off by giveaways from the Gov.

There still is a semblance of freedom but by and by it’s controlled by the “Democrats vs. the GOP” and “CNN vs. Fox”… meaning there really is NO freedom.

The masses are indeed being bought with stuff: big screen TVs, big SUVs, big McMansions, Entertainment Tonight, free porno on the Internet, and so on.

Even drug legalization is finally being allowed to be considered because it will serve as a placebo when people have to live in small apartments and drive small cars once our Chinese Masters decide not to invest in our Ponzi scheme.

Not to worry though, I think the big 3D LCD panels with good quality drugs will keep the masses happy. Imagine the NFL on 3D.. The cheerleaders will look great!

However, it is impossible to hold an intelligent social debate. At least it is impossible to create enough coordination to implement change because the American Ruling Class controls the means of discussion.

And, most people would rather get stoned watching TV than “think” about what’s going on.

It’s only a matter of time before those TVs get little webcams that can be monitored by Big Brother… Heck, the next batch of TVs will be IP based.

The Ministry of Truth will eventually take over the NAR, huh?

tonye: “I’m afraid that 1984 is pretty close to what our polity is doing.”

Read it again. You’re delusional.

And stop believing all those movies that give the impression that the Gov’t and the CIA and all those agencies are all-powerful. The CIA wishes that they could do a tenth of what Hollywood says they can do.

-Darth

> The masses are indeed being bought with stuff:

> big screen TVs, big SUVs, big McMansions,

> Entertainment Tonight, free porno on the

> Internet, and so on.

Okay….so we “free” the masses to do what they want and it would be…watching big TVs, driving big SUVS, etc.

Wait. I mean, we “spread the wealth” to the masses so they get a bigger piece of the pie. And they will…buy bigger TVs, bigger SUVs, etc.

It’s really funny I mean I read above about how things are HORRIBLE here for the middle or lower class. The “poor” here have cellphones, TVs, running water. The average “poor” person here is obese and the rate of obesity for the poor in the U.S. is rising faster in than any other class. Read that sentence again carefully and think about the poor during our 10,000 years of human civilization.

Now go to a slum in Manilla. Wander over the China countryside. Take a trip to India. The “expanding middle class” in those countries pine for the lifestyle of the American poor.

The U.S. represents a fraction of the population of the planet, and our poor live better than 99% of billions of others, but several commenters above believe we have a broken, corrupt system that is seriously flawed because everyone here isn’t a millionaire.

So they conclude our poor are going to riot any day now! They are being denied their yachts and they’re going to take the barricades!

To quote Devo:

Freedom of choice is what you got.

Freedom from choice is what you want.

First, I doubt interest rates will go up until serious inflation occurs, which I don’t think will happen any time soon. The Fed will keep them low as long as a poor economy is more likely than high inflation.

Second, there definitely seems to be a “flight to quality”. People who used to only be able to afford Riverside can now afford Corona; people who used to only be able to afford Corona can now afford Anaheim; people who used to only be able to afford Anaheim can now afford Irvine-plus people who used to be able to afford Irvine can also afford Irvine. This pushes demand upwards.

Third, all the numbers show basically all areas have flattened and most are on the increase. Now, maybe that’s artificial due to governmental meddling and there will be a double dip, but that certainly isn’t guaranteed. I don’t see prices dropping much below last year’s bottom. (I don’t see them going up significantly either.)

“Bulls would have us believe that Irvine and Orange County are so desirable that wealth will concentrate here in abundance saving our housing market and making it different than the rest; it is a compelling narrative with a small kernel of truth;”

It happens. The Hamptons used to be a haven for middle class families working in NYC. The idea that the Hamptons is now affordable to anyone who is now remotely middle class is laughable – it is an exclusive enclave for the NY power brokers.

Still, as it went through this transformation in the 1950s, 60s 70s and 80s, there were certainly those who said, “he Hamptons arent different, prices must become affordable (relative to the rest of the NYC housing stock) once again” 60 years later, I think its fair to say those people truly were “priced out forever”.

The perma bears would have you think Obama is going to kick all of the power brokers out of the Hamptons and replace them with Jefferson style projects — DYNOMITE !!!

Time for reality: you want to know when the hamptons will be afordable? Answer: after a nuclear terror attack.

Wow, delusion from BOTH sides today! And here I thought that it was only the bears that were overdosing on pessimism today.

So let me get this straight, AJ, you’re saying that Irvine and OC are to…uhh, Newport Coast??? West L.A.??? themselves??? …as the Hampton’s are to NYC? Wow, that’s reaching! The dynamics are completely different. First, NYC’s real estate dynamic is created largely because IT’S AN ISLAND!!! We don’t have anything like that out here. Even if we did have someplace that rivaled NYC in importance (we don’t!), we still wouldn’t have their geographical dynamic.

Irvine is nice, but to call it an exclusive enclave of some other place’s power brokers is delusional in the extreme.

Did someone mess with the water supply overnight? Where’s all this nuttiness coming from today? Come back to reality, folks.

-Darth

I’m with you Darth. Homes in Irvine are overpriced, inflation is penting up, there will be political fireworks in 2010 and 2012 etc.

But we have not reached novelistic dystopia. Not by a long shot. Let’s all get a grip and enjoy our lives. Most of us only get about 70 spins around the sun, no point being despondent through most of them.

I don’t know about WR and Darth but I’m looking forward to the Beverly Hills 90210 remake; the Asian Irvine edition. Maybe Jacky Chan can be the corny dad.

I don’t get the comments ragging on Irvine’s Asian population. I’m a German-Irish white guy mutt, but the Asian population in Irvine doesn’t bother me. (By Asian, I’m assuming East Asian: Chinese, Korean, etc.) The Persian population, Indians, and several other ethnicities don’t bother me either. I just moved into an SFR, but when I was in a condo complex a month ago, if I stood in my front door and counted left to right, my nearest neighbors were Persian, white, white, black/Zimbabwean, Chinese, Filipino/Hispanic, Hispanic/white, French, Italian/Korean, white, and white (the whites and blacks having roots in other countries but born and raised in the US and not 1st-gen Americans). Multi-ethnicity is a GOOD thing! I like multi-ethnicity.

What bothers me are places like Santa Ana (except for Floral Park), Gardena, and Watts. Those places are not multi-ethnic. They are mono-ethnic. Mono-ethnicity is bad.

-Darth

better than multi-ethnic is not caring about it at all and not making an issue of a place being too little or too much of a certain ethnicity or race

I agree, Chris, but to people like Planet Reality, color-blind is beyond their reach. They will always see a person’s color first, even as they imagine that they are not racist.

I don’t have a problem with acknowledging people’s ethnicity, as long as it’s not the FIRST thing that people notice.

-Darth

How about the neighborhood around the 99 market by the Santa Fwy?

Ever seen the parents at Uni? I swear some of those kids must be bussed from East of 405 to Uni… (As a matter of fact, I have several times followed vans of kids going east from Uni after school. Usually as going only as far as the shopping centers on Alton, but those vans kept going up Culver and Jeffrey). If it had been only once or twice, but I have seen this many times. I don’t know how they manage but Uni is no longer evenly polyethnic, it’s saturated by East Asians.

Hi IR

Long time reader here with a quick question for you.

I have read you say that you predict the high end of Irvine will fall 10%-20% in price, but what about the other categories of Irvine properties?

Could you define “high end”, “low end” and whatever other strata in terms of dollar intervals, i.e. high end is 750k to 1M as well as your prediction for their price behavior in the coming years?

Thanks

We are all guessing if you want to put exact percentages on up or down over the next few years. The market will probably be volatile as foreclosures and changes in financing terms dominate prices. It is difficult to predict where the market will go when so much effort to manipulate its course exists in Washington.

Realistically, anything below the median is within 10% of its bottom, stuff between $500K and $850K is still 10% or more above, and the over $850K market is quite inflated.

I see a slow erosion of prices as interest rates go up and inventory is washed through the system over the next 2-3 years followed by slow appreciation.

Thanks IR

You provide a great service by the education that you put out there. This blog is much more than a forecasting service.

How did you arrive at those #s?

Also, where do you get all your data, for example the Case Shiller data since 1987? I cannot find it on the web

Case-Shiller can be found here: S&P Case-Shiller

I arrived at the off-the-cuff numbers above by guessing at how fast interest rates will go up and how much inventory will push prices down. Going strictly by the math, house prices should go down much more than 10% from here, but the art of forecasting is to make a guess as to why numbers will not perform as mathematical models suggest.

thanks for the link. saw this page before, but i guess i should have taken the time to sign up for this data

regarding your historical price and trendline chart, although trendlines are not reliable, have you considered charting the case shiller index on a logarithmic chart and showing the trendline on that chart to account for the delta percentage?

IR, would you recommend getting that $8000 on low-end properties in Irvine? since your predication they’d go down 10 more percent anyway… I don’t know whether its a good idea

IR,

Thanks for another great post! I did have a question about your comment on Las Vegas. I understand that the trajectory of the rise and fall of house prices in LV strongly suggests that a bottom has been found, but I believe you’re working under the assumption of a normal market, with normal population growth, housing starts, etc. Of course I can’t predict the future, but I think conditions are conducive to a significant downside overshot in LV, as that market is incredibly oversupplied.

Let me put it this way: Imagine that there was no housing bubble, and the blue line indicating housing prices was perfectly straight up to today. What would happen to prices if you could magically add many tens of thousands of housing units?