Buyers often ignore short sale properties because the approval process takes too long and many deals fall through.

Irvine Home Address … 15 SAGE #41 Irvine, CA 92604

Resale Home Price …… $309,900

Sometimes, I get so tense

But I can't speed up the time

But you know, love,

there's one more thing to consider

Said woman take it slow

And things will be just fine

You and I just used a little patience

Guns N' Roses — Patience

Lenders, sellers, buyers, all are playing the patient waiting game. Lenders and sellers are waiting for prices to go up — which isn't going to happen as long as they need prices to go up because each needy sale prevents prices from appreciating. Buyers are also forced to be patient as lenders withhold product from the market they are afraid to sell because they know it would lower prices.

With everyone involved being forced to be patient, sales are near all-time lows, and the housing market languishes under the weight of distressed inventory.

Delays in Short Sales Frustrate Home Buyers

Short sales could accelerate the resolution of the housing crisis—if the process is streamlined by the big federal mortgage lenders

By Kathleen M. Howley

Charles Wright of Henderson, Nev., fell behind on his mortgage last year after a divorce squeezed his finances. He twice arranged to sell his house for less than its loan balance, a so-called short sale, only to see the buyers walk away because it took too long to get approval from the holder of the mortgage. “I couldn't even get a call back, never mind a yes or no,” says Wright, 30, whose loan was owned by Fannie Mae, the government-run mortgage-finance company. “Why make it so hard to sell when the alternative, foreclosure, means an even bigger loss for lenders?”

Good question. Thomas Popik, research director for Campbell Surveys in Washington, which conducts national monthly surveys of 3,000 real estate brokers, says more short sales could stem steep home-price declines. Although the home is sold for less than the mortgage in a short sale, it stays out of foreclosure, where the holder of the loan seizes the house and auctions it off at a steep discount to current value. “Any time a short sale can be substituted for a foreclosure, it's extremely good for the housing market,” says Popik.

Mr. Popik is wrong. Short sales do more damage to the housing market than foreclosures do. Let me explain.

Short sales are more damaging

I buy and sell foreclosures. The biggest market risk and uncertainty I face is the presence of short sales.

When I buy a foreclosure, the sale at auction is not considered by appraisers in the resale market. Since my auction purchase is all-cash, it is not considered indicative of resale market value. In short, foreclosures do not hurt resale market value unless and until they are resold on the MLS for less than current comps. Since most flippers are trying to maximize profits, they are trying to sell for the highest price they can get, so reductions from current comps are minimal. Short sales don't work the same way.

Short sales are a pain for buyers. They take forever to close, and there is no guarantee that the deal will close even after waiting months for the lenders to approve the sale. The only reason buyers go through the effort is because they either can't find other properties, or they expect a good deal for their patience. Short sales reset market values far more often than foreclosure resales do.

I deal with this market reality every day. Short sales are like ticking bombs waiting to take down the market comps when they close. It is common to Las Vegas to see short sales sell for 10% to 15% below recent comps. Two or three of these in a neighborhood, and appraisers cannot ignore the comparable resales, and the entire neighborhood is brought down. When lenders won't provide the loan, it doesn't matter if the buyer is willing, the sale isn't going to happen unless the buyer backs their willingness with cash. Short sales are comp killers.

And now back to the article:

There were 243,000 short sales in the first 11 months of last year, according to CoreLogic, a research firm in Santa Ana, Calif. That compares with 1.2 million notices of pending auctions in the same period. A lengthy consent process by loan holders deters potential buyers from agreeing to a short sale. In a normal home sale, people make an offer and get a decision from its owners within days, if not hours. For a short sale, the average time between a price bid and response is three and a half months, according to Campbell. The California Association of Realtors estimates that delays kill about half the short-sale deals in the state.

Who wants to wait around for a capricious lender?

The biggest mortgage holders, Fannie Mae and Freddie Mac, completed 7,768 short sales in January, down from 9,373 in the prior month. “I get the sense that Freddie and Fannie have been trying harder to make things work, say, over the last 8 or 10 months, but it still is a fight to get these deals through,” says Ron Wilczek, owner of Metro Phoenix Homes, a real estate agency in Tempe, Ariz.

Fannie Mae approved a short sale for Wright, the Nevada homeowner, after he found a third buyer. A deal went through on Feb. 15, two weeks before the house's scheduled foreclosure auction. The price was $265,000, 37 percent less than what Wright paid in 2007 and about $125,000 short of what he owed Fannie Mae.

If Wright's property had ended up in foreclosure and got sold at the local auction venue—a parking lot near the casinos and wedding chapels of the Las Vegas Strip—Fannie Mae's loss might have been greater. Foreclosed properties typically sell at a 28 percent discount to current market value, according to RealtyTrac, a real estate data company in Irvine, Calif. At least Wright, in his short sale, sold his house for close to its current value.

Did the lender really obtain a greater recovery at short sale? If they had foreclosed in a timely manner months ago when the borrower first went delinquent, prices were higher, and the recovery would have been greater. Plus, the real estate commissions and other sales costs not paid at auction eat into recovery amounts. Further when you factor in the portfolio cost of lowering neighborhood values, and short sales aren't the magic elixir they are made out to be.

Did the lender really obtain a greater recovery at short sale? If they had foreclosed in a timely manner months ago when the borrower first went delinquent, prices were higher, and the recovery would have been greater. Plus, the real estate commissions and other sales costs not paid at auction eat into recovery amounts. Further when you factor in the portfolio cost of lowering neighborhood values, and short sales aren't the magic elixir they are made out to be.

When it comes to approving short-sale offers, what seems like dawdling to buyers and sellers may be lightning speed to the mortgage industry, says Faith Schwartz, executive director for the HOPE NOW Alliance in Washington, a group of home-loan investors, lenders, and mortgage servicers including Bank of America and Wells Fargo. Before a short-sale offer can be approved, the holder of the home loan must agree to the price, she says. Other parties may have to assent as well. About half of troubled mortgages involve homes that have so-called second liens such as home equity loans, according to the Treasury Dept. Mortgage insurers may get involved, too.

“All those pieces have to fall together, and that takes time,” says Schwartz. Fannie Mae has set up a program that lets real estate agents talk directly with Fannie when they run into roadblocks during a short sale, says Marcel Bryar, a vice-president at the mortgage financier.

Remember, a short sale is an extended negotiation between the borrower and the subordinate mortgage holders. It isn't usually the first mortgage holder who objects to the sale. Since the second mortgage is generally a complete loss and most borrowers are insolvent, this negotiation can easily get bogged down.

The Federal Housing Finance Agency, which regulates Fannie and Freddie, wants short sales to be “consummated efficiently,” says Corinne Russell, a spokeswoman. Short sales can prevent neighborhood decay by limiting the number of vacant homes and can “ultimately help save taxpayer dollars,” she said in an e-mailed statement.

That's just stupid. Absentee owners generally don't bother with short sales. Most short sales are delinquent owners occupants squatting in the property. They have no incentive to move out until the short sale is completed because they will have to start paying for housing once they leave. Plus, what possible incentive does an short-sale occupant have to maintain the property? Any money they spend is not going to come back to them as equity.

Marie McDonnell, owner of Truth in Lending Auditing & Recovery Services in Orleans, Mass., says loan servicers may be responsible for the delays in short sales. Servicers earn fees by sending the monthly bills and collecting mortgage payments, though they typically don't own the mortgage. They also are in charge of communicating with the mortgage holder when the homeowner wants a short sale. That power gives the servicers the motivation to drag their feet as they rack up additional late fees. In Wright's case, Fannie Mae says it acted in a timely manner once it was told by the servicer of Wright's request.

Banks are in no hurry to recognize the losses on their second loan portfolio. With billions in bad debts on their books, the major banks — who are also major loan servicers — are not foreclosing on those homes where they hold the second mortgage. Those borrowers blessed with those circumstances will be allowed to squat indefinitely.

Chris Killian, a vice-president at the Securities Industry and Financial Markets Assn. in New York, says servicers dealing with an avalanche of defaulted mortgages generally don't have an interest in keeping loans in limbo. Says Wright: “Everyone could save a lot of headaches if the process could be speeded up.”

The bottom line: Short sales could accelerate the resolution of the housing crisis—if the process is streamlined by the big federal mortgage lenders.

The bottom line: short sales make the housing crisis worse by lowering neighborhood comparables. Until we stop messing around with short sales are begin expediting foreclosures, prices will continue to grind lower as each new short sale resets the comps to lower values.

When do we get our next HELOC?

The owner's of today's featured property have been bouncing along with the same maxed-out mortgage balance for the last 5 years. They must have gotten tired of waiting for the next HELOC cash infusion, and instead they are selling the property short. They don't want to hang around and pay off any debts. The house is supposed to do that.

- Today's featured property was purchased on 4/4/2000 for $160,000. The owners used a $127,920 first mortgage, a $23,985 second mortgage, and a $8,095 down payment. They waited two years before going Ponzi.

- On 4/30/2002 they refinanced with a $201,562 first mortgage and obtained a $21,500 HELOC.

- On 5/28/2003 they refinanced with a $206,000 first mortgage.

- On 12/2/2003 they refinanced with a $244,000 first mortgage.

- On 1/8/2004 they obtained a $30,000 HELOC.

- On 11/4/2004 they obtained a $100,000 HELOC.

- On 6/20/2006, right at the peak, they refinanced with a $378,000 first mortgage.

- On 3/28/2007 they refinanced with a $378,000 first mortgage.

- On 9/10/2007 they refinanced with a $377,000 first mortgage. They actually paid it down!

- On 6/19/2008 they refinanced with a $382,000 first mortgage.

- Total mortgage equity withdrawal is $230,095.

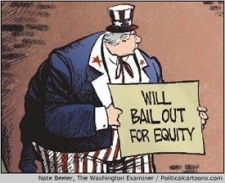

This property is being offered as a short sale. Perhaps the California Housing Finance Agency will provide them mortgage assistance. These borrowers seem worthy of a bailout, right?

Irvine House Address … 15 SAGE #41 Irvine, CA 92604 ![]()

Resale House Price …… $309,900

House Purchase Price … $160,000

House Purchase Date …. 4/4/2000

Net Gain (Loss) ………. $131,306

Percent Change ………. 82.1%

Annual Appreciation … 5.9%

Cost of House Ownership

————————————————-

$309,900 ………. Asking Price

$10,847 ………. 3.5% Down FHA Financing

4.87% …………… Mortgage Interest Rate

$299,054 ………. 30-Year Mortgage

$67,787 ………. Income Requirement

$1,582 ………. Monthly Mortgage Payment

$269 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$65 ………. Homeowners Insurance (@ 0.25%)

$344 ………. Private Mortgage Insurance

$377 ………. Homeowners Association Fees

============================================

$2,636 ………. Monthly Cash Outlays

-$148 ………. Tax Savings (% of Interest and Property Tax)

-$368 ………. Equity Hidden in Payment (Amortization)

$20 ………. Lost Income to Down Payment (net of taxes)

$59 ………. Maintenance and Replacement Reserves

============================================

$2,199 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,099 ………. Furnishing and Move In @1%

$3,099 ………. Closing Costs @1%

$2,991 ………… Interest Points @1% of Loan

$10,847 ………. Down Payment

============================================

$20,035 ………. Total Cash Costs

$33,700 ………… Emergency Cash Reserves

============================================

$53,735 ………. Total Savings Needed

Property Details for 15 SAGE #41 Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1022

$303/SF

Property Type: Residential, Condominium

Style: Two Level, Traditional

View: Park/Green Belt

Year Built: 1976

Community: Woodbridge

County: Orange

MLS#: S654957

Source: SoCalMLS

Status: Active

——————————————————————————

Stylish and so sharp – 2-story END UNIT in Woodbridge located across from a large park with peaceful views. A sunny & bright remodeled kitchen has custom French doors leading out to your own large private patio with storage area and fountain. Offering 2 spacious bedrooms, 2 tastefully remodeled bathrooms, whirlpool tub, attractive wrought iron on staircase, 2 ceiling fans, inside laundry and cozy living room with crown molding. One of the best locations in the complex with all the amenities Woodbridge Village has to offer, including pools, tennis courts, lakes, parks and much more. Please visit www. wva. org for additional community photos and details. IMMACULATE HOME AND IN MOVE-IN CONDITION!

Thank god there aren’t any short sales in Irvine. If there were the market would be dragged down 10-15% !!!!! What a relief. Las Vegas sure is different.

Wow the inventory Tsunami is really devastating Irvine this spring. It sure is a good thing that inventory isn’t seasonal. Anyone seen a 4 bed 3 bath SFR in Irvine? Why are they becoming extinct with this massive spring inventory uptick?

Hey PR, I thought you were going to take exception with Irvine Renter’s spurious claim that auction prices do not reflect resale prices after yesterday when you used the 2007 550K auction price as a 2007 resale price in your astute observation that implied 2011 prices on par with 2007 prices in Irvine. Please put Irvine Renter in his place – don’t let him get away with that kind of stuff.

I see 125+ 4bd/3ba SFRs in Irvine over 2000 sf, under $1M… Were you asking a different question?

You’re funny … let’s compare LV to Irvine in 18 months.

Hello All –

I know this blog is supposed to only be about Irvine RE. But, we have seen lots of activity and posts about other communities in CA and elsewhere.

The big question is do we think that macro and micro issues which affect IR RE is getting better or worse?

In my opinion irvine has just more cash reserves to weather the storm. Prices will remain higher and more resistant to the storm than others principely becuse people dont want to pay for private schools.

Irvine is clearly not nearly as nice as many south county communities in landscape or affordability. It is flat and boring. No night life and basically corporate.

Basically what you are paying a huge premium for is the schools and a history of price stability. The thing is I would much rather live in MV for a 30% plus discount with ‘nearly as good schools’. I would gladly pay for the additional tutoring of my child.

The opportunity now for savy buyers is to go away from Irvine and get a fantastic new home with a pool etc. for a 25+% discount to Irvine with actual land.

Your kids will do fine. Only stupid FCBs that have little understanding of the way things work pay these stupid Irvine prices. And they do bc they believe this is the only way to capture the American Dream! So let them waste their money… who cares.

You don’t have to worry. Your child already speaks English. Live in Coto and have 2 times the house .. leave this hopeful overpriced destination to the fools that are willing to pay for it….

If you are a foreigner reading this… than you should PAY BIG TIME for Irvine RE. Your child needs the education just to get even in America.

Not racists at all.. just a true to life comment.

BD

Not true. I’ve lived in OC, and worked in Irvine since 1986. I have had two children go through the Saddleback School system. You are either in complete denial, or are just plain jealous of Irvine. The Irvine schools FAR outshine those of south OC.

Irvine is a good place to live, it;s not my flavor, but then again, I love freedom. Too many rules, too many police, too many non-english speaking citizens, too much foreign owners, “the Rectum”, the list of things I do not enjoy is longer than that which I do. However, people coming from a communist or very controlled system will love Irvine. It is good to be a comrade in Irvine.

Now remember, never write anything down with the number “4” as it may offend you chinese neighbor! Hoag Hospital made sure to leave out the 4th floor at the new hospital for “average” citizen of Irvine.

I see 32 of them: http://www.redfin.com/homes-for-sale#!lat=33.687038259926666&long=-117.77426605930864&market=socal&max_num_beds=4&max_price=1000000&num_baths=3.0&num_beds=4®ion_id=9361®ion_type=6&sf=1,2,3,4&uipt=1&v=6&zoomLevel=10

I don’t really track Irvine so I do not know if 32 is high or low.

oops, sorry, just to be clear that search is between 0 and 1000000 dollars. (not too interested in anything over that…. can barely afford half that!)

That’s right, and then how many sell per month?

don’t know, do u?

PR, why don’t you log into your MLS account get the details for us? You are still paying your dues aren’t you?

It’s funny how PR just ignores anyone who proves him wrong. Yes PR, we notice when that happens. lol

Irvine Renter –

Why do you sarcastically suggest that these apartment debtors might receive mortgage assistance – or no, I will use your vocabulary: “bailout” ? They were just being good little monkeys doing everything that the powers that be wanted them to do. Furthermore, evidence suggests that they were just doing what was in their family’s ( especially their children‘s ) best interest. Why punish the children?

How do you know that this was not all the result of yearly medical bills? Perhaps even a sick child. I do not know about you, but I would do whatever it takes to make my children well. Look at the cost of healthcare. Can you really blame them? I know I can’t.

We all agree now that doing just about anything in the name of personal best interest is perfectly fair so as it does not violate laws. Is it a crime to HELOC the living Shi[t] out of one’s apartment? I think not. It was all within the bounds of the contract between the lender and the borrower. Therefore they did nothing wrong. Why should we not open the public treasury and help them all?

I think that you just need to look at this more objectively and not let emotional devices such as “fairness” cloud your judgement and try to foster more of a giving spirit. Remember: “It is more blessed to give than to receive”.

Has anyone else noticed a manic quality to PR’s denial and market cheerleading lately? I wonder if the denial is getting harder to maintain?

This is how you respond to facts? And with an incorrect irvine inventory number on your page no less. What a shame. The factual reality will set you free.

Not particularly more so than in the past.

but he and AZ should be on your payroll for driving traffic to your blog. I actually come to read their posts more than the actual blog (no offense) because it is so entertaining.

To me personally, it seems that PR posts things to “stir $h!T up” regardless of what he actually believes or doesn’t.

As for AZ, not sure what he believes for real other than insulting people personally who disagree with him. I guess you can call him really passionate or maybe just his “online” personality.

but either way, the banter of the posters is the real entertainment of the blog IMO.

Thanks. Also I hope you enjoy factual discourse based on reality.

Factual Masterbation sounds more appropriate, PR. Keep stroking.

and like clock work…lol

wait till IHO gets a wind of this.

PR knows the “real” inventory number even though he denies that the shadow inventory exists. Oh wait, he has not explicitly denied shadow inventory, he just mocks all references to it (don’t want to confuse Irvine HO).

Yes …

… but his type never thought we were in a bubble in the first place. Now that the govt has completely thrown everything at this problem, and Irvine was spared a complete collapse, these idiots stand back and say “I told you so”.

I know this ponzi scheme is not done unwinding. I know the govt can’t backstop and subsidize every aspect of real estate forever. I know the banks are sitting on trillions in losses, and in a sense … they’re insolvent.

@lee:

“… but his type never thought we were in a bubble in the first place.”

Just to be clear, are you saying that PR did not recognize the bubble? I’m not sure if I ever read him post that but I could be wrong.

I thought everyone recognized the bubble, just the opinions of how it was going to shake out is what differed.

Looking at prices today, I still think Irvine is in a bubble.

I am a realtor (hate being one, but I need the Supra key) I just signed docs on a short sale yesterday (@ ~ -15% to comps) and have 2 more in front of the banks.

I advise my clients that the combination of a short sale and today’s interest rates allows them to buy and have payments less then renting. In a worst case scenario (they need to move, etc), they should be able to rent it out instead of being forced to sell if rates go up and prices fall.

They can be a miserable transaction, but I must admit that there is a bit of a rush when you finally get a difficult deal closed.

Just to be specific…

They are cheaper than renting AFTER putting 20% down, right? That’s a lot of money to have parked in a house right now.

As long as this goes on, I see renters (on average, all other things being equal) accruing greater wealth than homeowners.

Chuck

I was just going to say the same thing re: the 20% down. The monthlys are getting to be similar, however you must make the commitment.

.Gov will gladly loan 96.5% of the value. why would a 1st timer put anymore skin in the game? prices continue to fall

FHA terms are not as good as they used to be + all things being equal, the FHA offer will get “lost”. In my experience, the high quality, well priced short sales are on the market for days and only strong offers that can close are considered.

YMMV.

Actually 10% down gets it done sometimes. If someone thinks they are better off renting, I tell them they very well may be right–there are pros and cons to buying and I am not sure that buying will be the best for them and they should only consider it if they prefer to own for non-monetary reasons.

That said, I am also hear many complaints of rising rents. And with all the money printing going on, inflation may become an issue. In that case, owners with 4 handle fixed rate mortgages should do well.

For me, I plan on buying one rental a year over the next few years. Basically dollar cost average during the bottoming process. I know I am not smart enough to pick the bottom and I don’t mind being a bit early as long as I can come out well in the end.

I have been telling everyone not to buy since 2004 (world’s worst real estate agent), but now with the new post bubble lows + short sale discount + a 4 handle mortgage it may be an OK time to buy. Not a great time (high interest rates and lower prices would be better), but an OK time if it fits their life plans.

Someone trying to buy an SFR in Irvine now with an FHA loan is shadow demand. Wasting time.

The one thing that stands out to me in today’s post is this:

“…foreclosures do not hurt resale market value unless and until they are resold on the MLS for less than current comps. Since most flippers are trying to maximize profits, they are trying to sell for the highest price they can get, so reductions from current comps are minimal.”

I thought foreclosures were supposed to help bring down the prices. Isn’t that why there are numerous articles here that lambast the banks for slowing the foreclosure process down, creating more shadow inventory and thus not allowing prices to adjust naturally?

And if the second part is true, then aren’t flippers just as guilty as the government for keeping prices aloft?

Does that mean the IrvineRenter is the Las Vegas Chupacabra who is keeping prices there from dropping even further? OMG… IR is an FCB! 😉

I think what IR was saying there is that when the house is auctioned off, that in itself is not counted on comps. It is when (or if) that goes back out into the MLS market that the comps will kick in. So, if a foreclosure is auctioned off at $100K for a $200K MV home, it is not counted into comps. But when the person (i.e. flipper) that bought it for $100K resells it on MLS for $150K, then the comp will now slip to $150K.

So foreclosures DO bring prices down IF it is listed and bought on MLS. But if auctioned, only when it is brought BACK into MLS. So if anything, IR is dragging prices further down, at least until demand market value equals supply market value.

“OMG… IR is an FCB!”

Yes, in Las Vegas I am an FCB supporting prices.

Foreclosures do bring down prices. Auction resales generally sell for a discount to current comps, but not a very large discount. The discounts on short sales or GSE REOs are much deeper than any flipper would give. If it were up to the flippers to dispose of all the properties, the decline would be long and slow without air pockets. When the banks start releasing short sales and REO, they drop the market in 10% to 15% increments.

In the contex of banks holding up foreclosures I think the thought process is that opening the flood gates will cause prices to naturally adjust lower just from a supply and demand effect. Significant more inventory on the same demand equals lower prices. Not because each individual foreclosure is reselling for large discounts under comps, like what may be happening with short sales. More of a gradual effect because of increased supply.

Regarding short sales in Irvine:

Here’s a short sale in my neighborhood that sold last month: http://www.redfin.com/CA/Irvine/9-Spring-Buck-92614/home/4691524

IR profiled it here back in February: https://www.irvinehousingblog.com/blog/comments/panel-finds-greenspan-and-bernanke-responsible-and-negligent/

IR also mentioned it in this post on March 17th, pointing out how it was a comp-killer to the nearby property profiled in that post: https://www.irvinehousingblog.com/blog/comments/irelands-housing-bubble-like-ours-only-worse/

He’s absolutely right! It HAS been a comp-killer. One property that was listed for sale when this property sold has since been de-listed. The 3 other properties for sale on this block have been sitting untouched, and 2 of them have had price reductions since 9 Spring Buck sold on March 9th. The listing agents haven’t even had the balls to lie about any of these 3 properties being in backup offer status in order to stoke interest. They know they’re screwed, and at least 2 of them have convinced their sellers to reduce their list price.

-Darth

P.S. 13 Spring Buck (http://www.redfin.com/CA/Irvine/13-Spring-Buck-92614/home/4692474) is one of the supposedly-extinct 4/3 SFR’s. In fact, it’s a 4/3.5, and it was highly upgraded throughout in 1995. Despite all the upgrades, FIVE price reductions since it was first listed in Sept. 2010, AND currently being listed at a mere $279/sf, it’s still untouched after 219 days.

P.P.S. Think I should bother contacting the agent for 3 Silkleaf and see if he’ll accept $440K? It’s $5K more than his sellers paid for it in 2003. They can either cut their losses now or take an even lower offer next year this time if rates rise. With current comps this year at $488K, does anyone really think that prices for these cottages won’t be lower this time next year if rates rise?

13 Spring Buck might other problems, according to the Redfin agent comments:

“Water stains on ceiling in many rooms.”

And if I’m not mistaken, the 2nd floor is an addition so there might be some issues there too. And since these are cottage style-homes, these don’t really fall into what I define as a traditional 4/3 SFR (need that driveway too!).

Shevy just recently posted about some other more traditional WBridge homes going for more than comps so there a both sides to this coin.

Why would these not fall into a 4/3? I see that an attached 2-car garage is in the back (which is a popular design these days to hide the ugly facade), and it’s 2400 sf, which makes it a legit 4/3, no? Even if an addition, the pictures show a seamless integration of the elements between the original and the additions (e.g. stairs look built-in, not tacked on) so I don’t know that it means much. I suppose we can nitpick about what a “traditional” 4/3 should consist of, but I don’t know that a 2400 sf SFR in Irvine should be cherry-picked with additional definitions. If it looks like a duck, sounds like a duck…

No driveway? And proximity to neighbors?

Hey… I don’t make the rules, that’s just what it seems like buyers are looking for.

For all intents and purposes, these are just as good as all the 2-story detached condos with no driveways that are going up by Irvine Pacific that range from $500k+.

And that’s different than any house now being built in SoCal how? From an aesthetics standpoint, the trend is towards having garages in the back rather than those ugly things with a drive up front. So it may actually be (despite the home’s age) a preference for many.

But the basic premise that these large homes, smack dab in middle of Irvine, should be “undesirable” to many Irvine buyers points to the notion that maybe these are overpriced? Fact of the matter is that there are 125+ homes in Irvine 2000sf+, with 4bd/3bas, of all kinds (how long would it take to move those?). So yeah, there are homes to be had in Irvine for larger families. By selectively excluding a portion of them as “undesirable” for Irvine home seekers would only support the arguments here that these homes should be cheaper. You said it, not me.

I agree that it is a proven comp killer, but we should note that 9 Spring Buck was paid for in cash, which can explain the lower pricing. I can imagine agents telling their buyers “but it was paid for in cash…. yadda yadda”

And 13 Spring Buck… wow… big drops there.

This post is just a test to figure out this site’s HTML tag for embedding links in posts. Disregard otherwise.

<link>https://www.irvinehousingblog.com/blog/comments/panel-finds-greenspan-and-bernanke-responsible-and-negligent/</link>

Hmm, apparently that’s not it. Does anyone know the HTML tag for embedding links in posts on this site?

-Darth

Darth,

Replace the ‘[‘ ‘]’ with ‘<' '>‘ in my example below:

[a href=”http://whatever.com”]Description[/a]

Testing…

https://www.irvinehousingblog.com/blog/comments/panel-finds-greenspan-and-bernanke-responsible-and-negligent

Info that causes Planet Realty to stick his head in the sand

-Darth

Hmm, I appear to still be doing something wrong…

Oh, I think I forgot the quotation marks. Oops.

Trying again…

https://www.irvinehousingblog.com/blog/comments/panel-finds-greenspan-and-bernanke-responsible-and-negligent

Info that causes Planet Realty to stick his head in the sand

-Darth

Ahh, that’s better! Thanks, IHO!

-Darth

You forgot the href= part and the link is in the tag itself while the description is what is between the tags.

testing

[img]http://geo.rgio.us/testgallery/images/plogger_test_collection/plogger_test_album/testpattern.jpg[/img]

Construction in Columbus Square has begun in full-force. There are three lots that have sat vacant for a couple years. All three have multiple foundations poured and framing going-up for models. It will be interesting to see the pricing…

There’s a really great park, Sweet Shade Park, near those new units. Had my son’s birthday party there last weekend. Convenient to shopping and cheap gas and cheap hot dogs (Costco) as well as good freeway access (261 & 405) without being too close to the 261 or the RR crossing like some of the parts of Columbus Grove down past Edinger. I don’t buy into the scaremongering about toxic waste on the old base, so all-in-all, I like this part of Columbus Grove. I wouldn’t touch them for another 10 years because of the Mello-Roos, but nice location.

-Darth

In one of those projects, Augusta (I think it was called Astoria in a former life), the Plan 3 has a 3CWG, but unlike Astoria, there is no utilization of the space above the garage so it’s smaller. Plan 1 is even weirder, detached 2-car garage… why? That will be great when it rains… but I guess since that only happens 3 days a year in SoCal, they weren’t worried about it.

And these are alley-access homes, so no driveways.

I think unless they price these really low, they are going to be slow to move just like before.

I don’t mind the alley garage access. It does make for a tiny side yard though. I’m hoping these detached SFRs have poor layouts and are priced high. My wife will want to tour the models, and I don’t want anything peaking her interest…

these are great if you dont mind the smell of garbage lofting in the air!! Oh ant the views of the high tension lines and of course Jamboree HWY!

Um, you’re thinking of Columbus Grove, I believe…

Speaking of inventory… What is the deal with the spike in inventory numbers as of April 2nd?

Is that a real spike or bogus, it seems to have persisted.

It is not accurate. I’m not certain but it seems to include those that are Pending. I don’t have a way to filter those out so we may stop updating it until we find another source.