Workers in the real estate industrial complex are succumbing to the difficult market environment. Those who aren't squatting are often left homeless with their renting brethren.

Irvine Home Address … 162 PINEVIEW Irvine, CA 92620

Resale Home Price …… $189,900

Yes, how many times can a man turn his head

Pretending he just doesn't see?

The answer my friend is blowin' in the wind

The answer is blowin' in the wind.

Bob Dylan — Blowin' In The Wind

Have you thought about what you would do if you became unemployed? Has that nagging question been draining your energy throughout the recession? Sometimes the consequences are as a bad as you imagine.

Homeless ex-mortgage broker Susan Schneider shows housing bust hit agents hard

Annie Gowen, Washington Post Staff Writer, Saturday, February 19, 2011; 9:15 PM

Before the real estate bust, Rob Paxton and Susan Schneider might have met at a networking event or through their home-buyer clients. Instead, they first crossed paths at a day shelter for the homeless in Falls Church.

Schneider, once a mortgage broker with plenty of disposable income, arrived one cold winter morning with her possessions in tow, looking for a hot meal.

In the kitchen, Paxton stirred a bubbling pot on the stove. He once pulled in more than $200,000 a year in Northern Virginia, but he had taken the part-time job as the shelter's director when his commissions dwindled to almost nothing.

Paxton, 55, noticed Schneider right away. Wearing a knit cap and a slightly dazed expression, hers was one of the few female faces in a sea of mostly Latino men awaiting the noon meal. He said hello, and soon they'd swapped stories.

“We have a lot of common ground,” Paxton says. “Same business: trying to get people into homes.”

The carnage among people who try to make a living from real estate related professions has been remarkable. As I noted yesterday, OC homebuilding is 62% off its historic norms. With demand for new homes is less than half of what it normally is, less than half the money that normally flows into real estate is available to support the industry.

Now it is Schneider who needs a home. And over the past six weeks, Paxton has tried to help her – shepherding her to different shelters to find an open bed, giving her food and calmly taking her calls when her perilous situation frays her emotions past the breaking point.

Although Schneider, 43, is grateful for the help, their alliance is shaky at times. She doesn't hide her bitterness that the man trying to help her – a colleague, really – still has his charming gray-and-white colonial in Fairfax Station, while she lost it all.

“Don't get me wrong – Rob is a nice guy,” she says. “But you really have to live it to know what it's like.”

I wonder if the colleague is making his mortgage payment or if he is struggling with little or no income and squatting in his McMansion?

… She used to love to cook, back when she had an apartment in Alexandria, a new Honda Accord and her own mortgage business. She wasn't rich, but she was comfortable, able to afford dinners out – grilled salmon and a nice pinot grigio – and $100 salon treatments for her hair. In her spare time, she organized community bike rides along the George Washington Parkway.

She'd worked in the mortgage business in Northern Virginia since 1998. Then, in 2005, searching for a change of scenery, she moved to Texas and took a job as a loan officer at Countrywide Financial, the home-loan behemoth now owned by Bank of America, whose lax lending practices made it the poster child of boom excess.

She was named a top rookie – and has the little plastic paperweight to prove it – but began to feel claustrophobic in her cubicle as she and her fellow loan officers were driven to make more and ever riskier loans.

“It was a sweatshop,” she says. “People were refinancing just to save one monthly payment – or $10 a month.”

She left Countrywide in 2006 and ended up back in Northern Virginia, launching her own mortgage business, Mortgage Made Simple, just as the real estate market here began to tank.

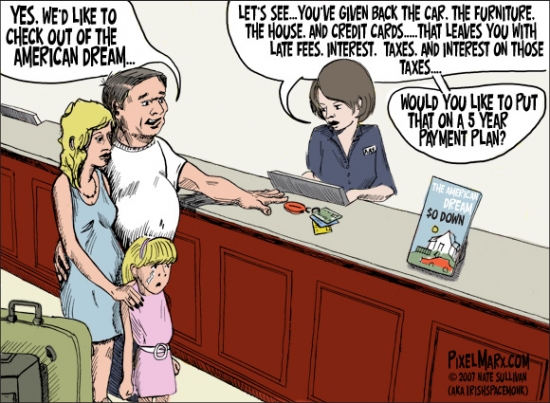

She recognized borrowers were not benefitting from the sweatshop work, but she participated eagerly for the financial rewards. Apparently the morality of what she was facilitating was not an issue. In her mind, she was living the American dream until 2006. Too bad it was an illusion projected by a Ponzi scheme.

In the ensuing months, she tried everything she could to keep the business afloat, even delving into the murky subprime mortgage market and doling out loans to customers with bad credit and insufficient incomes. She thinks many of those customers have likely lost those homes by now. Then, in 2008, she was evicted.

“I lost everything, and I [didn't] have anywhere to go,” she says. “I was depressed, angry – all these emotions. . . . Who wouldn't be?”

At first, she slept on the office floor of another mortgage broker who eventually kicked her out. Then – like the homeless character Will Smith played in “The Pursuit of Happyness” – she spent a week holed up in a bathroom of a hotel in Alexandria. She lived on a friend's boat, then at a campsite in Lake Fairfax Park, surviving on a string of low-wage jobs. She waitressed, washed towels at a gym and now waves signs outside a Liberty Tax office in a Statue of Liberty costume.

By December, though, she hit what she calls “rock bottom.” The cold weather drove her inside to hypothermia shelters in local churches at night – and to Safe Haven.

In their shoes

Paxton became the shelter's director in July, the latest in a string of part-time jobs – including a county position teaching financial education to low-income residents – to supplement his Realtor's income, which took a big hit in the down market.

“It's not a matter of working harder – the business just wasn't there,” says Paxton, who grew up in Arlington County. He and his wife, Mary, an IT manager for Fairfax County, have three daughters and face mounting college tuition expenses. One daughter is a student at Clemson, another is applying to some private institutions.

Although Paxton took the job as a way to pay his bills, he has thrown himself into the work with increasing zeal. He went dumpster diving with one Safe Haven regular to observe how it was done. He posed as a homeless man to check out the food at a nearby church.

Now that the real estate market is recovering, Paxton sometimes goes from a million-dollar listing for Long & Foster to tying an apron around his pressed chinos and Ralph Lauren sweater to serve in the chow line.

Colleagues and family members say he has always had a humanitarian streak, but he's developed a much greater sense of empathy for people in Schneider's situation.

One frigid evening, he took her to three shelters to find a place where she could sleep that night, waiting with her in a long line in the cold.

“That was my first taste of, 'Wow, that's what it's really like,' ” he says.

But his efforts to help Schneider have not always gone smoothly.

Although she admits to being depressed and angry since she lost her home, she does not want to seek counseling or other support. One volunteer's efforts to get her a spare room with an older woman went nowhere. She says she has a strained relationship with her relatives, who live overseas and are unaware of her plight.

“Everybody loves happy endings,” Paxton says. “With Susan, it may be a happy ending. I don't know at this point. I'm having my doubts, but I'm hopeful.”

A former life

Schneider says her game plan is simple: “Get a better job and get out of this mess.” She knows it won't be easy.

After lunch, she goes over to a storage facility in Alexandria where she has been keeping her remaining possessions. She tries to swipe her access card, but it fails. A clerk behind the counter delivers the bad news: She needs to pay $360 by March 11 or the contents of the locker will be sold.

Eventually, she is allowed upstairs to retrieve personal papers from the locker. Inside is the detritus of her formerly middle-class life – kitchenware, a black Wilsons leather jacket, the gold dancing shoes she used to wear to Glen Echo Park, outdoor gear and her beloved bike – a pricey Roubaix that she bought when she was flush.

“Somebody is going to get some really good stuff,” she said, her voice cracking.

She barely blinks when she replaces the lock on door, but once outside, she sighs heavily.

“I miss my bike,” she says, like it's already gone.

It's easy to make fun of some of the losers who where flushed out of the system in the crash of the Great Housing Bubble, particularly the Ponizis who carried on foolishly as if the good times were going to last forever. However, there comes a point when the crisis has dragged on long enough that good people get punished — people who did not participate in the excesses of the bubble. It's hard to say if the people in today's story are good or bad or worthy of compassion or ridicule. This woman's story was sympathetic. Though some may consider her response degrading, I think her spirit of self-reliance is noble. I would dress up in a ridiculous costume to support myself and my family. I'm thankful I don't have to.

I still giggle about some of the other characters in real estate who are getting what they deserve…

Total loss on a 2004 investment

The owner of today's featured property paid $290,000 on 11/22/2004. He used a $203,000 first mortgage, a $58,000 second mortgage, and a $29,000 down payment.

You have to imagine when he bought the place he figured that California real estate went up 7% to 10% per year every year, so if he held this property for 6 years, he should be selling it for between $420,000 and $520,000 depending on the appreciation rate. He probably figured the $420,000 was conservative.

The reality is he is now selling this property for $190,000. He has lost his down payment, the second mortgage holder is looking for money, and the first mortgage holder is wondering how they will be made whole.

This is one Irvine investor who didn't acheive his financial projections.

Irvine Home Address … 162 PINEVIEW Irvine, CA 92620 ![]()

Resale Home Price … $189,900

Home Purchase Price … $290,000

Home Purchase Date …. 11/22/2004

Net Gain (Loss) ………. $(111,494)

Percent Change ………. -38.4%

Annual Appreciation … -6.7%

Cost of Ownership

————————————————-

$189,900 ………. Asking Price

$6,647 ………. 3.5% Down FHA Financing

5.02% …………… Mortgage Interest Rate

$183,254 ………. 30-Year Mortgage

$39,410 ………. Income Requirement

$0,986 ………. Monthly Mortgage Payment

$165 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$32 ………. Homeowners Insurance

$295 ………. Homeowners Association Fees

============================================

$1,477 ………. Monthly Cash Outlays

-$93 ………. Tax Savings (% of Interest and Property Tax)

-$219 ………. Equity Hidden in Payment

$13 ………. Lost Income to Down Payment (net of taxes)

$24 ………. Maintenance and Replacement Reserves

============================================

$1,201 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,899 ………. Furnishing and Move In @1%

$1,899 ………. Closing Costs @1%

$1,833 ………… Interest Points @1% of Loan

$6,647 ………. Down Payment

============================================

$12,277 ………. Total Cash Costs

$18,400 ………… Emergency Cash Reserves

============================================

$30,677 ………. Total Savings Needed

Property Details for 162 PINEVIEW Irvine, CA 92620

——————————————————————————

Beds: 1

Baths: 1

Sq. Ft.: 932

$204/SF

Lot Size: 763 Sq. Ft.

Property Type: Residential, Condominium

Style: Two Level, Other

Year Built: 1977

Community: Northwood

County: Orange

MLS#: P764582Source: SoCalMLS

Status: Active This listing is for sale and the sellers are accepting offers.

On Redfin: 41 days

——————————————————————————

Cozy townhouse features 1BD+Loft & 1BR. Large livingroom, comfortable dining area, roomy bedroom with walk in closet. Great location in complex, back to the lake, beautiful view, a short walk to pool area. Short Sale done by experienced Realtor.

People need to learn how to save and be quick to keep their income going. When the recession hit, did this lady run and get the first job she could to keep money coming and completely shrink down her expenses to bare minimal? Chances are she only looked for jobs that she didn’t think were below her and kept her cable tv. Now she is doing whatever it takes to earn money but still doesn’t get it. Sell all your crap and don’t pay anyone for storage.

People need to learn how to save and be quick to keep their income going.

No kidding. These folks should be doing whatever it takes to keep their income going even if it means dressing up in statue of liberty costumes and whoring themselves rather than sitting around complaining.

When the recession hit, did this lady run and get the first job she could to keep money coming and completely shrink down her expenses to bare minimal?

Obviously this lady continued to live the high life.

Chances are she only looked for jobs that she didn’t think were below her and kept her cable tv.

Yes! Yes!

If only she would have donned her lady liberty sooner rather than hold out for that Major League Baseball contract.

If only these people would quit with the $50.00 cable bills then they could pay their obscene mortgages. Makes perfect sense to me!

Sell all your crap and don’t pay anyone for storage.

Exactly! I noticed from the photos that she does still appear to have a shirt on her back. Come on lady, sell it and quit whining.

IrvineRenter, in the future please do not waste my time with these stories unless the subject is lying dead, naked, in a gutter.

Thank you.

“there comes a point when the crisis has dragged on long enough that good people get punished — people who did not participate in the excesses of the bubble.”

For all those that want to mock this woman, think about the hundreds of thousands of unemployed, underemployed and displaced RE industry workers. Mortgage excess was bad, bad mortgages in and of themselves are not inherently bad. People need mortgages and there were lots of good people (notaries, agents, back room administrative staff) that didn’t lead the ponzi scheme left in the wake.

Yes, it’s too bad they didn’t save every penny for a rainy day, but do you? No, feeling secure and successful you enjoy meals out, a nice car, and even HBO.

I actually feel sorry for the lady here. Probably the first person in any of these articles. She is at least trying to help herself and I admire that.

talk about the blind leading the blind.

as a mortgage broker, she was only playing the hand dealt to her by ultra low interest rates and government subsidization. This also is true of wall st.

Yet another example of earn $1 -> spend $1.50

How many realtors were/are telling people that the bottom was/is in while they were squatting themselves?

My sister was working with a realtor in Bend, OR. When I found out that her realtor had been squatting, I told her to get another realtor.

Anyone notice that article yesterday stating that by the end of 2011, the average time of non-payment in foreclosure status homes will rise to almost 24 months? You read that correctly … 24 MONTHS WITHOUT PAYING A NICKEL toward a mortgage!!!

THAT is the real injustice of this whole mess. The former high and mighty pulled thousands outta their homes to buy Harleys (Heloc-Davidsons I call them), 24′ ski boats, loaded diesel pickups to pull the boats and ATV’s and $10K vacations in Vegas. Suddenly the banks (who are far from blameless in their collusion) had the temerity to demand these wanna-be’s pay back the loans. What nerve! So Joe Heloc-Davidson decides (conveniently) the bank somehow duped him into borrowing all that cash and he’s morally outraged and the bank isn’t going to get a nickel of his hard earned contractor income! In an aberrant quirk of fate this dirt bag gets to stay in his home, rent free for 2 WHOLE FLIPPING YEARS because the aforementioned banks are dragging their heels on foreclosure. So Joe Heloc-Davidson keeps spending cash like he won the lottery before (and if) the bank finally boots him out?! Where is the moral outrage against these people?

Meanwhile us renters don’t get anywhere near that kind of deal. 30-60 days without making a payment and the sheriffs at your door. I was one of the millions who lost their job thru no fault of their own. I was in telecom, making a good living, paying my bills on time, paid off nearly all debt, saving every month toward a downpayment on a home purchase. The economy tanks, the business cycle turns down and my company sent 30,000 people out the door. 18 months later I nearly exhausted the savings I had built toward my future, my measly unemployment comp was about to run out and I was facing the prospect of having to move my family to a smaller apartment to ensure we could make ends meet. I’m one of the lucky ones. I had savings to fall back on and I found a job. I make nearly $30K less a year than I did before but I consider myself very fortunate.

So I ask again, how is this fair? I did everything right … or at least like I had been taught by my parents. You work hard, you save money, you buy a home and build your future. HAH! The jokes on me! Instead, what I should’ve done is buy an overpriced home I had no earthly hope of paying off, used the bank’s (taxpayer’s) money to finance vacations and $80K cars for my wife and I and when the bill came due … declare myself a victim and dare the bank to kick me out … after all it’s MY house, I’m entitled dammit!

I could’ve saved two years worth of housing payments, paid off everything else and stashed the cash. Then rented for 2-3 years after the bank kicked me out and set myself up for another home “purchase”. That’s the new American Dream kids.

Here’s a link to the article I mentioned:

http://www.usatoday.com/money/economy/housing/2011-02-21-unpaidmortgages21_ST_N.htm

Simply astounding. You can about bet your bottom dollar this will never again occur in history. I guess I’m just rueful about the fact I have a conscience and couldn’t live with myself if I tried this stunt.

Just imagine it though … nearly two years without having to pay rent or a mortgage? Must be nice.

Well nobody said the unemployment losses would be pain free. The economy is going through a major adjustment shift in investment right now toward other economies and markets that, you know, aren’t completely damaged goods like housing.

Some housing markets are recovering already in the US, but they’ll never get back to 2004-2005 prices and 0% unemployment again.

The claims by the NAR president here are interesting to say the least:

http://link.brightcove.com/services/player/bcpid640545894001?bckey=AQ~~,AAAAAFdYoqM~,hGPKFRRe3LrHWo8pgapUgyJZhmjS59mq&bctid=793237734001

He is saying that each mortgage debt payment made “affects 82 different occupations” and potentially “2.5 million jobs”. I have my doubts, and are these sustainable jobs at market equilibrium or based on the diabetic highs of 2005, Mr. NAR President? Some recovery in housing jobs is going to happen naturally anyway. Be patient.

Is it really wise to install policies that are hell bent on pumping up the housing market once again? We already lost billions on that bet.

I just wish the NAR and it’s members would stop vilifying renting and glorifying housing. Just be the industry leaders and educate people on the right choice for their financial situation and future. The renters may be buyers someday eventually. Why not cultivate that potential?

Interesting that Realtors are apparently going to be spending a lot of 2011 money on lobbyists to create more investment in housing market for adjacent jobs. The problem is that ship has not only sailed, it has been blown up on the high seas and rest in tiny splintered pieces on the ocean floor.

I think the housing market gets enough help already in subsidies and income tax breaks that no other countries receive.

How about pursuing policies to bring back value-add manufacturing and production and even service jobs back to the US?

Don’t tell me. I know. My alarm clock says WakeTFU.

“Just be the industry leaders and educate people on the right choice for their financial situation and future. The renters may be buyers someday eventually. Why not cultivate that potential?”

Sounds like the Ideal Home Brokers business plan.

“Some recovery in housing jobs is going to happen naturally anyway. Be patient.”

The NAr isn’t going to be happy until half the workforce is taking 6% from selling homes to each other at ever-increasing prices.

A drug dealer profits help support lots of other groups too! Direct employments of the distrubutors, the producers, the transports, the police department, the restraunts, clubs, car dealers and all the auto related industries. In fact the drug dealers are likely to spend put back a greater precentage of the profits back inot the economy.

Does not mean that we need more drug dealers on every corner? The needs of a society are not determined by how much money a trade injects into the economy.

Lower housing prices are needed for a healthy economy, not higher prices.

Tue Feb 22, 6:21 am ET

WASHINGTON (Reuters) – A housing trade association is examining the possibility that the data it releases underestimated the collapse of the housing industry, the Wall Street Journal reported on Monday.

surprise, surprise, surprise.

Time for the US to be producers and just not consumers and money suffliers. With the near possibility of removing the dollar as the international trade currency, the US banks and Fed can be bypassed and money sufflying fees reduced. That’s why the US needed to invade Iraq — to much talk and moves to trade and price oil directely for Euros. To keep the trading in dollars, instability need to be incouraged.

Actual link:

http://online.wsj.com/article/SB10001424052748704476604576158452087956150.html

And yes, the “housing trade association” is the NAR.

“The group reported that there were 4.9 million sales of previously owned homes in 2010, down 5.7% from 5.2 million in 2009. But CoreLogic, a real-estate analytics firm based in Santa Ana, Calif., counted just 3.3 million homes sales last year, a drop of 10.8% from 3.7 million in 2009. CoreLogic says NAR could have overstated home sales by as much as 20%.”

“If they are off by this much, this consistently, it would be sending the wrong signal to the market,” said Mr. Brinkmann, MBA’s chief economist.

Realtors and financiers are leeches sucking people’s money.

Somehow, people are able to put nice ads with good photos on craigslist when they want to rent a room or a house. They are able to show these rooms and houses to prospective renters without any external help.

But the housing mafia wants its profits and makes it difficult to sell and buy houses.

It’s like the auto mafia that doesn’t want direct sales of new cars through the Internet.

Wow, NAR overstating house sales? How surprising. NAR has robbed itself of all credibility, and the current chief economist gots to go, just like the previous one. Common, a miscalculation in inventory? Where’s your QA group? Oh right, your QA is asleep unless your model outputs negative housing data.

http://www.calculatedriskblog.com/2011/02/real-house-prices-fall-to-2000-levels.html

that was a pretty good story until the part where she moved to texas

“Have you thought about what you would do if you became unemployed?”

It’s ironic that is the first sentence I read today. I’ve thought about that a lot lately.

I’m not in the mortgage industry at all and have no ties to it.

I’ve worked at my job for almost 30 years yet have been placed on administrative leave. I’m fighting some accusations. Even if the pending results are positive the state is in such bad fiscal health that I may ironically get laid off. (I don’t get unemployment benefits either)

I was always taught to save for a rainy day. That day may be here and I’m not panicking. I have rental properties as a result of saving and being able to buy w/cash for one and paying off the other back when others were borrowing for excessive lifestyles. I’ve never paid for a cable bill. I use two over the air antennas for two separate tv’s and we get lots of channels.

Immediately when I was placed on administrative leave I took my child out of daycare. I save a few hundred a week right there. My wife and I have fixed up an extra room we have and are contemplating renting it out now.

My wife is from overseas where the unemployment in eastern Europe makes the US look like they are on a holiday vacation. I’ve witnessed hyperinflation first hand over there and watched what people do to survive. In many ways we are still spoiled over here and not thankful for what we have. There are ways to survive if you are disciplined enough.