Distressed borrowers scan news reports for false hopes of a cure for their financial illness. For this news cycle, the savior is an irregularity on the Notice of Default.

Irvine Home Address … 2100 TIMBERWOOD Irvine, CA 92620

Resale Home Price …… $339,900

Breaking the law, breaking the law

Breaking the law, breaking the law

So much for the golden future, I can't even start

I've had every promise broken, there's anger in my heart

you don't know what it's like, you don't have a clue

if you did you'd find yourselves doing the same thing too

Breaking the law, breaking the law

Breaking the law, breaking the law

Judas Priest — Breaking The Law

Last month I wrote about How attorneys enable squatters to game the system. The American Banker has picked up on the issue because it directly impacts banks.

New Point of Foreclosure Contention: Default Notice

American Banker — Friday, January 21, 2011 — By Kate Berry

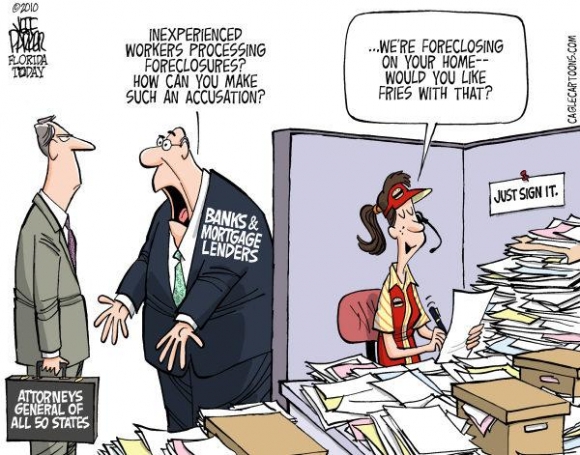

Last year's robo-signing scandals delayed tens of thousands of foreclosures in the 23 states where the process is handled in court. A new controversy could complicate foreclosures in the other 27 states.

At issue is the notice of default, the first letter that a mortgage lender or servicer sends to a homeowner who has fallen behind on payments. The notice typically starts the formal foreclosure process in nonjudicial states such as California, Arizona and Nevada.

Every notice of default has a signature on it. But just like the infamously rubber-stamped affidavits in the robo-signing cases, default notices, in at least some instances, have been signed by employees who did not verify the information in them, court papers show. In several lawsuits filed in nonjudicial states, borrower attorneys are arguing that this is grounds to stop a foreclosure.

In the case I documented last month, the former owners got an attorney to threaten a lawsuit because the Notice of Default in the county records did not have the address printed on it. Part of the process is that the house must be physically served papers, usually they are taped conspicuously to the door. The person serving the house certainly knew the address. And so did the person who served the Notice of Trustee Sale.

If the copy entered into the public record didn't have the address written on it, should we give the former owner a free house?

Anyone who claims they didn't know the house was in foreclosure is not being truthful — and many holdover occupants, both renters and former owners, feign ignorance if it's to their advantage.

“Whoever signs the NOD needs to have knowledge that there is in fact a default,” said Christopher Peterson, an associate dean and law professor at the University of Utah.

The suits also argue that the default notices are invalid because the employees who signed them worked for companies that did not have standing to foreclose.

In a lawsuit against Wells Fargo & Co. in Nevada, an employee for a title company who signed default notices admitted in a deposition this month that he did not review any documents or know who had the right to foreclose.

“They are starting foreclosures on behalf of companies with no authority to foreclose,” said Robert Hager, an attorney with the Reno, Nev., law firm Hager & Hearne, representing the borrower in the case. “The policy of these companies is to just have a signer execute a notice of default starting foreclosure without any documentation to determine whether they are starting an illegal foreclosure.”

Although not a part of a recent Recon Trust and Bank of America lawsuit (Nevada court blocks Bank of America trust foreclosure), these suits occasionally find a legal wrinkle where a few plaintiffs gain some benefit, and a few law firms make a fortune.

The Recon Trust lawsuit in Nevada did cause a huge number of last-minute auction postponements yesterday. The list in Las Vegas was nearly 1,000 properties. Even with over 900 of those being postponed or cancelled each day, it usually takes four or five hours to call the whole list. Yesterday it was finished in about an hour. Or course, the other trustees are expected to pick up Recon Trust's slack just as they did during the brief moratorium last fall during robo-signer.

The Nevada nonjudicial foreclosure statute requires that the company signing a notice of default have the authority to foreclose, Hager said.

In a deposition on Jan. 4, Stanley Silva, a title officer at Ticor Title of Nevada Inc., said he “technically signed” default notices for clients, which were often acting as agents of other parties, which in turn worked for others.

“The person at the bottom of the chain, by executing the document, has taken an action on behalf of all of them through their various agency agreements,” Silva said. In one case, for example, he said he had signed “on behalf of Ticor Title of Nevada, who is agent for LPS Title, who is agent for National Default Servicing.”

“Who is agent for Fidelity National?” Hager asked. “Apparently, yes,” Silva replied.

“Which is a servicer for Wilshire?”

“Apparently.”

The attorney has exposed the inner workings of MERS, and it's ugly, but does it violate some standard of law? How much knowledge of events does a signer need to have? What is the signer attesting to? Could a trained monkey sign the papers? Could a barely legally responsible adult with minimal education and experience be given the responsibility of signing foreclosure documents? Why not?

Silva said under oath that he never reviewed any documents or knew what company was the holder of the original note at the time he signed the notice of default. He said he signed about 200 default notices over a four-year period.

When asked by Hager if he signed notices of default “without verifying the accuracy of the information,” Silva replied: “Correct.”

What level of verification is required of the signer? How are they to verify? What are the penalties for failure to verify properly? Does the response imply that the signers were doing things knowingly inaccurate? Wouldn't whoever was signing look to others to properly prepare the paperwork? Shouldn't they be able to rely on the bank's internal system of checks and balances to know the paperwork they are signing is correct?

For as much as I malign banks, they do know how to accurately keep track of who they loaned money to and how much they are owed. If a loan holder is not paying them, they know it, and they know where that borrower lives. The idea that somewhere in that system banks get lost and start randomly foreclosing on people for no reason is silly.

Representatives for Wells Fargo did not return calls seeking comment. The intermediaries that Silva mentioned in his testimony either did not return calls or declined to comment.

Walter Hackett, a lawyer with Inland Counties Legal Services, in San Bernardino, Calif., and a former banker with Bank of America Corp. and Union Bank, has filed several cases contesting notices of default, on the grounds that the employees signing such notices were working for companies that are not the noteholders — or even their appointed agents.

“A huge percentage of notices of default and notices of trustee sales are legally questionable and probably void,” Hackett said. “Nobody with the authority to trigger the nonjudicial foreclosure process is triggering it — only third parties who claim they have the right to do so are triggering it.”

This is the MERS defense. The third party claim to ownership of the note is being called into question. Its wrong.

After a notice of default is sent to the borrower and filed at the county recorder's office, a notice of sale is typically published in the local newspaper and the sale of the property often takes place without the borrower even knowing the home has been sold to another party.

That is ridiculous. Most of the homes I have purchased at action still had the notices taped to the front door. The colorful masking tape and bright white paper stand out at street level. Someone living in a neighborhood where one of these is posted will notice the next time they drive buy. These notices are that conspicuous.

O. Max Gardner 3rd, a consumer bankruptcy attorney at Gardner & Gardner PLLC in Shelby, N.C., said the default notice is “the key legal document that is sent to the borrower” before a notice of sale.

Thousands of judicial-state foreclosures were halted last year after several banks including Ally Financial Inc.'s GMAC Mortgage and Bank of America Corp. admitted that employees had signed affidavits without reviewing the documents. In several judicial states, including New York and Florida, sloppy paperwork by servicers has led courts to require that companies verify they have all the proper documents, including proof they own the mortgage before foreclosing.

This month, in a closely watched case, the Supreme Judicial Court of Massachusetts (a nonjudicial state) rejected claims made by U.S. Bancorp and Wells Fargo that the banks, as securitization trustees, did not have to prove their authority to foreclose on two separate homes.

Peterson, the law professor, said one difference between the notice of default cases and the widely publicized robo-signing incidents is that in the latter, affidavits are given to judges whereas the notice of default is not strictly a legal document.

But consumer lawyers said homeowners face a bigger legal burden in nonjudicial sates because they have to file a lawsuit against the holder of the note to bring any action in court.

“Because there's no court reviewing anything in nonjudicial states,” abuses are “probably even more rampant,” Gardner said. “This is just another example of robo-signing in a different context.”

Those poor abused loan owners. They were victims of rampant mortgage process abuse in nonjudicial states like California. Not.

Two and a half years in the foreclosure process

Amend-extend-pretend is used by banks to buy time. They are hoping if they drag out the process long enough prices will rebound and they will get out without taking a loss on their oversized loans. Today's featured property was served a Notice of Default on 4/21/2008 which means they missed payments in April, March, February, and probably January of that year.

Prior to the housing bubble, lenders would customarily wait until customers were 90 days late with a payment before issuing a NOD. It's also likely that this borrower was delinqent long before then and the bank let them slide 180 days or more before issuing the NOD. Shadow inventory is stuck in the limbo between delinqency on the mortgage and the Notice of Default.

.jpg)

The previous owner of today's featured property was a peak buyer. He paid $509,000 on 9/16/2005. He used a $356,300 first mortgage, a $152,700 second mortgage, and a $0 down payment. By late 2007 he had already given up.

The bank bought the property at auction last July for $431,484. Apparently, with more than three years seasoning, this foreclosure is fully baked and ready for consumption on the Irvine MLS.

Irvine Home Address … 2100 TIMBERWOOD Irvine, CA 92620 ![]()

Resale Home Price … $339,900

Home Purchase Price … $431,484

Home Purchase Date …. 7/19/10

Net Gain (Loss) ………. $(111,978)

Percent Change ………. -26.0%

Annual Appreciation … -40.2%

Cost of Ownership

————————————————-

$339,900 ………. Asking Price

$11,897 ………. 3.5% Down FHA Financing

4.78% …………… Mortgage Interest Rate

$328,004 ………. 30-Year Mortgage

$68,627 ………. Income Requirement

$1,717 ………. Monthly Mortgage Payment

$295 ………. Property Tax

$111 ………. Special Taxes and Levies (Mello Roos)

$57 ………. Homeowners Insurance

$241 ………. Homeowners Association Fees

============================================

$2,420 ………. Monthly Cash Outlays

-$280 ………. Tax Savings (% of Interest and Property Tax)

-$410 ………. Equity Hidden in Payment

$22 ………. Lost Income to Down Payment (net of taxes)

$42 ………. Maintenance and Replacement Reserves

============================================

$1,794 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,399 ………. Furnishing and Move In @1%

$3,399 ………. Closing Costs @1%

$3,280 ………… Interest Points @1% of Loan

$11,897 ………. Down Payment

============================================

$21,975 ………. Total Cash Costs

$27,500 ………… Emergency Cash Reserves

============================================

$49,475 ………. Total Savings Needed

Property Details for 2100 TIMBERWOOD Irvine, CA 92620

——————————————————————————

Beds:: 2

Baths:: 1

Sq. Ft.:: 1270

$0,268

Lot Size:: –

Property Type:: Residential, Condominium

Style:: Two Level, Contemporary

Year Built:: 2000

Community:: Northwood

County:: Orange

MLS#:: P765390

Source:: CARETS

——————————————————————————

Like new! Immaculate two bedroom + loft townhouse built in 2005 located in the desirable Collage complex. Unit features include brand new paint and carpet throughout, fireplace, one car garage, patio with pool views, walk-in closet and storage room. Complex is equipped with beautifully manicured landscaping, pool, spa and secure gate access. Property will be sold with washer, dryer, stove/range and dishwasher.

Hi, Irvine renter,

I am confused that I found all the houses for sale in Westpark II have been listed at price the same level reached in 2006 (peak)

48 festivo 2100 sqt 949K

1 santa eugenia 2100sqt 920k

28 vienne 2900 sqt 1090k

18 trieste <3100 sqt 1249k

27 arbusto 2535 sqt 1099k

Some neighborhoods have fallen more than others, and there isn’t much of a pattern in the collapse. Some neighborhoods like Westpark or Oak Creek have held up better than other neighborhoods, even some of those considered more desirable. Perhaps Westpark and Oak Creek will survive the crash unscathed. I doubt it.

The simple fact that it’s 2011 and there are parts of Irvine selling for 2006 price is impressive when other markets have crashed 50%. 5 long years, the recession better devastate the Irvine economy soon before it’s too late. It’s seems like the week before Christmas every night at the Irvine Spectrum. The reality that is the Irvine economy is note worthy.

What is the current count of homes in these areas (Oak Creek/Westpark) that are in some stage of the foreclosure process? Don’t they have to make their way to the market at some point?

Good point, if there weren’t a steady stream of foreclosures hitting those neighborhoods would prices be even higher?

I actually laughed out load when I read that. Thank you.

If you meant me, no problem. My post are meant to entertain and create laughs. It’s hard for the emotionally attached to see through it sometimes. It’s always the case.

Right again PR

The reality in Irvine is quite different

How’s the high end holding up you ask?

Let’s see 24 Pismo Beach just sold for $1.358M on 1/25

IR profiled it when a flipper purchased it at auction on 6/11/10

Everyone here, with the exception of a few of us, thought that the guy was crazy for pulling the trigger and buying it for $1.147M cash

Not a bad return for a 7 month hold.

The popular opinion here has this home valued at $750K

The return is less than 10% after backing out 6% commission, and assuming a 4% carrying cost for cost of capital. Please note that 4% is an extremely generous cost, and does not accurately reflect the idiosyncratic risk associated with single property ownership.

I would argue that on a risk adjusted basis, this trade was a loser.

I would also expect that most flips would involve some reconditioning cost (not factored in above), that would further lower the rate of return.

Deals are cut with the listing agent.

Besides cleaning, there’s very minimal reconditioning involved like simply hanging out the For Sale sign.

It’s a 6 month CD returning 12%

Yeah but his cost of capital for his cash was 4%, LOL.

12% for a 6 month CD. With losing trades like that, who needs winners.

Off to the next 100% cash property flipped to another $300K cash down payment buyer.

Welcome to Irvine.

Hmmm, I am guessing bybyour response that you have no financial skills whatsoever. For those of us who actually invest money, we use a discount rate to represent the opportunity cost and risk premium associated with any Investment regardless if the source of funds is cash or borrowing.

Do you have any concept of idiosyncratic risk? My guess is no.

Buying an uninspected property at the courthouse steps is perilous. But you know that of already. It’s the part about factoring in those extra risk that you obviously are ignorant.

Those are list prices, not sale prices. 1 Santa Eugenia might be an interesting profile, as it has a sale listed at 760k just a month ago. Was that an auction purchase?

Yeah… that looks like a flip.

There are probably one or two more outliers in that area less than $800k but most of the sales for those Montage/Vintage models in Westpark II have been $900k or higher.

Newer 3-car garage homes in Irvine are hawt!

I had several cases against Walter Hackett, one of the lawyers mentioned in the article. His clients were not successful in any of those lawsuits and the lawsuits were quickly dismissed by the courts.

What he still doesn’t seem to understand is that 3rd parties (i.e., not the note holder) are authorized to initiate non-judicial foreclosures here in California.

I think that you are erroneously blaming the attorneys. I doubt that banks can keep all of the information correct 100% of the time. There is some human error in all systems. Perhaps, the law is there to protect the innocent when there is a mistake. I’m sure that they are thankful that we are a country where no man or bank is above the law.

I think the question is: what level of wrongful foreclosure are we willing to accept?

Its rather like the criminal justice system, do we require “preponderance of evidence” (which appears to be where we are now), or “beyond a reasonable doubt” (which is what it used to be prior to securitization/mers).

The examples of true F-ups by banks have been few, but not zero (like the BofA florida FC on a paid-off house this fall, or the story of the soldier in Iraq who was illegally FC’d in Michigan that ran in yesterday’s NYT).

What level of proof do we require to take someone’s house?

Why doesn’t at least one of these banks try and get in front of this whole issue and release something like the following:

“When a homeowner is delinquent in their payments, sometime we at HonestBank have to resort to foreclosure. Rarely, mistakes are made, but from this point on, here’s what will happen if any non-delinquent homeowner is foreclosed on through HonestBank’s error: After correcting the error at our expense, I, John Mucketymuck, CEO of HonestBank, will personally fly to your house, look you in the eye, apologize, take you out to dinner, and give you a check for $50,000 for your trouble.”

Of course, the CEO will have to go out and apologize in the extreme cases, but if it happens more than a couple times a year, you can bet the approval process for foreclosures will change a bit. It also lets the bank put some of the focus back on the fact that the people complaining loudest about foreclosure proceedings are delinquent anyway. Why go crying to the media and the courts if you’re paid up when you can just get a nice dinner and a $50K check?

The law is the law.. Sloppy in is Sloppy out. Only a judge can say if this is right or wrong but ultimately the right thing is keeping people in their houses. Thoughts?

Did you get that Cappy? Minimal reconditioning. I wonder if any of these wonder boys have ever tried flipping a residential property, or maybe even had a conversation with a professional flipper and found out what their margin is.

Minimal reconditioning.

Yeah, you just head on down to the courthouse, buy a foreclosure, put out a sign, and baam! 12% in 6 months. Anybody can do it.

‘This is the MERS defense. The third party claim to ownership of the note is being called into question. Its wrong.’

LOL!!! You have obviously been misled.

The actual process of money creation takes place primarily in banks … bankers discovered that they could make loans merely by giving their promise to pay, or bank notes, to borrowers. In this way banks began to create money. Transaction deposits are the modern counterpart of bank notes. It was a small step from printing notes to making book entries crediting deposits of borrowers, which the borrowers in turn could ‘spend’ by writing checks, thereby ‘printing’ their own money.

– Modern Money Mechanics, Federal Reserve Bank of Chicago

I first became aware that all my suspicions about the banking system were accurate when I read Thoren’s book, Truth In Money. I learned that all money is ‘borrowed into existence’. It doesn’t exist until someone borrows it. It is ‘debt-based money’, hence it is not really money since real money is based upon substance – gold, silver, etc. If ‘money’ is borrowed into existence, then this is all that exists. So, where is the ‘interest’? It doesn’t exist. How can it possibly be paid? It can’t be paid because it is not part of what is created. It simply does not exist. The currency we use is based upon our future labour which the Feds have promised to the banksters. It also does not yet exist. Future generations are already enslaved to pay a debt which does not exist.

We can’t pay debt with something of no substance. We also need to take a look at how the account statements were created. Goods and services are assigned a value; everything is only true because someone says so and someone else agrees to it. Do you ever question your bills, which are not true bills in commerce but rather ‘statements of account’? … not the ‘amount due’, but the concept . What if you found out that

everything you ever needed or wanted was already paid for? – that you didn’t owe anyone anything? When you go into a store to buy a book and you pay in whatever manner you choose, what do you get for the payment? No, not the book; you get a receipt. The evidence for this is that the dollar amount on the receipt matches precisely the dollar amount on your payment. It is an exact exchange. The book is not even part of the equation. It was pre-paid; all you did was go to the store to claim and retrieve it. In order to understand the concept of ‘pre-paid’, imagine this: Suppose you want to open a restaurant and you just need another $10,000 and so you ask a friend to lend it to you. Knowing that there is no money and the currency your friend has is essentially worthless compared to what he truly wants in his life, he sure wouldn’t mind lending it to you. So after a couple of months you ashamedly go to him and say that there is no way you can ever pay him back, what with interest and all, yet you are so ingratiated to him you tell him that he can eat in your restaurant any time he wants – for free. Not only that but also you would be so grateful if he would because, alas, it would assuage your guilt. All he is required to do when the waiter presents him with an itemization of his meal is to sign it; he is not required to pay for his meal – its ‘prepaid’.

In the same way, our bills are already paid and, in fact, the corporate entity which is billing us would be only too grateful if we would take advantage of our having prepaid them because then they wouldn’t have to pay the tax on the $ we send them. So all that is required of us is to sign the invoice and return it to them. The telephone company is funded by the government; you and I, and everyone who has a birth certificate or socialist number (ss#) have funded the government. So, we have an ‘exemption’ the same way your friend is exempted from paying for his meals at your restaurant. Why is the telephone company sending us a statement (not an invoice) with a ‘amount owing’ on it? We paid up front. All goods and services are now lawfully ours just for the asking.

Our mind is of 3 categories: what we know, what we don’t know, and what we don’t know we don’t

know. Not knowing is unfortunate; not knowing that we don’t know is tragic. – W. Erhart.

The guy at 24 Pismo Beach kicked butt. I was at the auction the day he bought that one. I didn’t think he would get the $1.5M he was asking, but I knew he had plenty of room to lower the price to make a sale.

I actually thought the property would sell between $1.4M and $1.45M, but after 6 months of holding it, the flipper was probably quite motivated.

how ’bout this overseas baby

Dalkey (Dublin, Ireland) house valued in 2007 at €6.2m sells for €1.4m

that’s a sweet 78% drop

wonder who holds the paper on this beauty ?

oh yeah , that’s right ; irish taxpayers

it’s a beautiful thing ain’t it?

http://www.irishtimes.com/newspaper/frontpage/2011/0129/1224288528521.html

$340,000 for one bath ?! that’s funny . i like that .

Delaying foreclosure actually helps the banks. As moronic as this sounds it all has to do with banks being able to avoid having to use mark to market accounting. Mark-to-whatever-you-want-to-mark-it-to accounting was the same type of anti free market accounting that the Government allowed in the Enron case. The financial institutions changed their accounting away from MTM in March of 2009, with the help of BS Government laws and regs. That’s why financials reported record earnings in April of 2009 as they could mark their bad book values up to above market rates. I posted about this on my blog, you can click on my name to read about the “Non-Foreclosure Crisis”

Nobody can seriously think that the banks would make and allow trustees to make such novice mistakes if they wouldn’t benefit from such delays.

Some specialists state that home loans aid people to live their own way, just because they are able to feel free to buy necessary things. Moreover, banks present term loan for all people.

> If the copy entered into the public record didn’t have the address written on it, should we give the former owner a free house?

Actually, yes. Until the complainant has the right paperwork to go to court, that’s how our law, and common sense, work.

IrvineRenter: I don’t understand why you’re so obtuse about this. How can a lawsuit be filed when the complainant cannot prove anything? Why should the defendant be expected to do anything in that case?

Just because you want your auctions to be tidy in Vegas doesn’t mean the world rolls that way.