Strategic default has become common and accepted in Las Vegas.

Irvine Home Address … 260 DEWDROP Irvine, CA 92603

Resale Home Price …… $249,000

It's not right, but it's okay

I'm gonna make it anyway

Close the door behind you

Leave your key

Whitney Houston — It's Not Right, But It's Okay

I am emotionally conflicted about strategic default. It's not right, but it's okay. Do you know what I mean?

I understand the argument that says borrowers should be responsible to keep their word and pay their debts. They should. However, I also believe that families should not be burdened for decades by one poor financial decision.

There are times when our values and beliefs are in conflict, and to avoid hypocrisy, each person must evaluate which of their conflicting values they hold in higher regard. I side with the family. I can't condemn a family for relieving themselves of a financial burden they cannot handle, particularly when lenders abdicated their responsibility of making sure the family could handle the debt.

Strategic default the norm in Las Vegas

Unless you have spent time talking with Las Vegas residents, you can't fully appreciate how common and accepted strategic default is in that town.

First, there is no class distinction when it comes to walking away. I know a business owner who walked away from his $1.1M mortgage. He said when he saw a few comps in his neighborhood go for less than $500,000, he said continuing to pay seemed pointless, so he walked.

I know a mortgage broker who walked away from three properties. She had a condo she bought in the mid 90s and two properties she bought when the market “corrected” in 2007. In early 2009, she saw a comp for her condo go for less than its 1996 purchase price. She calculated that she had almost $400,000 in mortgages on about $175,000 in real estate, and prices were still headed straight down.

Basically, anyone who bought in the 00s is underwater or nearly so, and there is little hope of price recover while the rest of the city strategically defaults because they too are underwater. The excess debt will be purged in Las Vegas, and the excessive debt service payments will not serve as a drag on the local economy as it will here. That being said, the purging process is not pretty.

In Nevada, 23 percent who lost homes to foreclosure could afford payments

Officials say trend shows no signs of slowing

Nearly one in four people in Nevada who lost their homes to foreclosure have admitting to walking away even though they could afford their monthly payments, according to a study released today by the Nevada Association of Realtors.

The study said 23 percent of those surveyed described their own situation as a strategic default, meaning they decided to stop making payments on their debt despite having the financial ability to pay. Many of those who walked away from their homes said trusted confidants advised them that a strategic default was their best option, the study said.

Keep in mind that many of these borrowers probably could not really afford the payment long term. Those borrowers are merely accelerating the inevitable rather than truly walking away from an obligation they could comfortably cover.

The authors of the study said strategic defaults are a much greater problem in Nevada than the rest of the nation. It has less of a stigma here that it’s a shameful decision, and it’s becoming more popular as part of a snowball effect, they said.

“I believe the current trend upward. It could get worse,” said Joel Searby, SGS’s director of marketing and business development. “The cultural stigma is dropping, and it’s becoming more acceptable.”

The survey was conducted by SGS, a national research firm that has done similar studies in Florida and Pennsylvania. It held two focus groups in Las Vegas and interviewed more than 1,000 Nevadans by phone.

“It was striking to see that nearly one in four Nevadans who lost their homes to foreclosure admitted they simply walked away from their mortgage,” said outgoing Nevada Association of Realtors President Linda Rheinberger.

Nevada has ranked No. 1 in the nation in terms of its rate of foreclosure filings since January 2007.

A report released today by California-based CoreLogic said foreclosure rates in Nevada increased in November to 9.49 percent of mortgage loans, up 1.71 percentage points from November 2009. The national rate was 3.48 percent in November.

In November, 19.65 percent of Las Vegas mortgages were 90 days or more delinquent, down from 19.70 percent in October. The statewide delinquency rate is 17.35 percent, CoreLogic reported.

It's difficult to imagine nearly 10% of mortgages in foreclosure and another 10% delinquent. It is difficult to keep a rate that high because after enough time goes by with a 20% delinquency rate, every mortgage in the area will turn over. The 20% in the pool from last year is a different 20% that is in the foreclosure queue now.

University studies in the past two years have suggested that between 17 and 25 percent of Las Vegas residents have considered or would consider walking away from their mortgage even though they could afford their payments.

Nevada had nearly 8,000 homes foreclosed upon in the fourth quarter of 2010, according to California-based RealtyTrac. If the survey is correct, that means more than 1,800 of those are people who did so strategically.

Searby said he was surprised with the findings of so many people walking away in Nevada. Anecdotal evidence in surveys in other states suggests the problem is “significantly worse” in Nevada, he said.

Nevada homes have taken one of the biggest price drops in the nation, and in Las Vegas prices have fallen about 60 percent from their peak in June 2006.

Cause and effect. Low prices are creating the circumstances leading to more strategic default. It is a classic downward spiral. The Las Vegas experience inspired the amend-extend-pretend dance to avoid a repeat in every housing market in the country.

Searby said a culture is developing in Las Vegas and the rest of Nevada that strategic defaults are OK, and there isn’t the stigma once associated with it. That’s creating a snowball effect that increases its popularity, he said.

Some websites are dedicated to encouraging people to walk away from their homes. The Las Vegas Sun and its sister publication, In Business Las Vegas, has written on the subject, and one prominent home builder, Richard Plaster, president of Signature Homes, has encouraged people to do a strategic default to spare their finances.

“It is about how they’re perceived by their peers,” Searby said. “One man in a focus group said growing up this would have been an act of shame. It’s not seen as something that brings shame on him now. There’s a subculture arising who don’t believe walking away from a mortgage is necessarily bad. This has become a financial decision for most of the families first and foremost.”

This is the argument I have been making for months. The needs and interests of the family outweigh paying the mortgage on an underwater property when it's cheaper to rent.

This dilemma is not new. If your family were starving to death, would you steal food? Most would. Anyone who valued survival more than personal property law would. In fact, many wars have been fought because one group lacked resources to survive, so they go to war to take those resources from another.

Searby said what surprised him in the survey is that those who are walking away tend to be older, mostly 40 and over, rather than younger generations that might be perceived to be less financially responsible.

“They are looking at the last 30 to 40 years of their life and feel it doesn’t make sense to have that kind of debt hanging over their heads,” Searby said. “It’s about their quality of life and that all they are going to pass on to their kids is debt.”

That scenario describes one Las Vegas resident who took part in the survey.

Lee, who didn’t want to use her last name, said she plans to walk away from her $1,700 a month mortgage even though she can afford the payment. Lee said the value of her home that she refinanced about six years ago for $235,000 plummeted from $270,000 to $80,000 today. Since then, she has retired from her federal job and had her husband leave her.

Interesting sob story, but at least she admitted to the HELOC abuse.

Lee said the Federal Deposit Insurance Corp. has taken over the bank that once held her loan and the lender now servicing the loan has been unwilling to work with her to reduce her payments. She said it’s prudent to keep the money for taking care of herself during her retirement.

“Why should I pay on something when it’s like losing $150,000 in the stock market,” Lee said. “The way I look at it is I’m 73 and never going to see this market come back. I don’t feel bad at all. They had a chance to work with me.”

Lee said she plans to rent a home from her girlfriend and isn’t worried that the lender will come after her for the first mortgage six months after foreclosing or for the second and third mortgages on the homes over the next six year as allowed under state law.

If that happens, she said, she will file bankruptcy.

In all likelihood, either the lender or a zombie debt collector will come after her, and she will have to declare bankruptcy to make the problem go away.

.jpg)

Most borrowers who walk away should declare bankruptcy. It's the only way to be sure the debt will never be a problem again. I can foresee many borrowers who walked away getting blind-sided by lenders several years from now when the borrowers have assets again.

Searby said those who walk away aren’t concerned that it would take them three to seven years to get another mortgage or that their credit might make it difficult to buy a car for a while.

That's because people don't have much reason to worry. The powers-that-be are determined to give everyone a pass.

The survey said most Nevada homeowners facing foreclosure weren’t aware of the federal and nonprofit programs designed to help them. Some 61 percent said they weren’t aware of foreclosure aid programs and only 3 percent said they used the state’s foreclosure mediation program or were helped by it in any way.

Many Nevadans experiencing foreclosure faced two or more life-altering events that increased their risk of defaulting on their mortgage, the study said. The report said the loss of a job and unexpected medical bills were the most common events triggering a foreclosure.

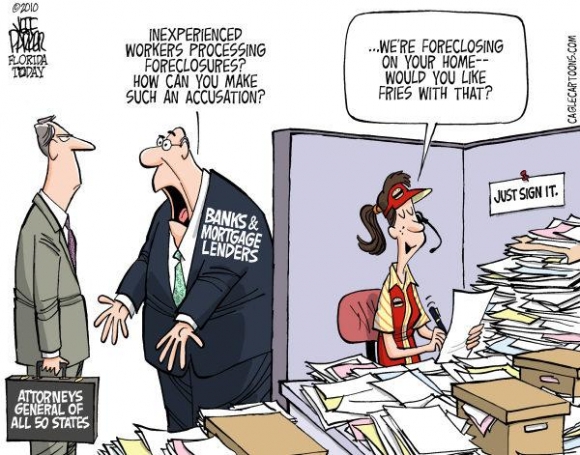

Homeowners statewide were far more likely to blame banks and lenders, at 46 percent, than the government, which polled 20 percent, for the foreclosure problem. Homebuyers got 13 percent of the blame, the study said.

Interesting. Lenders are getting their oversized share of the blame.

Short sales proved to be moderately helpful in avoiding foreclosures with the report saying 10 percent of those surveyed said it helped them.

NVAR President Mike Young said the study would be used as a basis with the state’s lawmakers to help address the problems with foreclosures. Besides advocacy and counseling, streamlining short sales could help stabilize the housing market, he said.

Short sales are those in which lenders allow the homes to be sold for less than is owed on the mortgage. Homeowners have faced hurdles in getting banks to approve that option.

Short sales are not the answer, and neither are loan modifications. More foreclosures are on the way.

What the foreclosed leave behind

I have found all manner of personal possessions left behind in properties. One of my competitors jokes about how he finds vacuum cleaners left in each property. I have only found 4 or 5 of them.

Some of the items left behind likely were beloved by their former owners. Mostly this is stuff like dolls or photographs, but on some occasions, it is much more.

Aren't these two cute?

They were a few days from starvation when we found them trapped in the back yard of a house the former owners. I understand owners abandoning their house. It's property. It's not alive. These owners abandoned their family pets. Disgraceful.

What goes through the mind of the former owners? Did they think someone like me would come along and save their dogs? What if we had waited another few days before taking possession?

We couldn't find any evidence of food left behind, although judging from these dogs appearances, they long since scavenged anything edible. After eating any remaining garbage and plant matter, they likely gnawed on that rubber tire.

Are these former owners such assholes that they left their dogs to die?

You'll be happy to know that we saved these two dogs from this fate and took them to a local shelter.

Should it really take two or more years to resolve a bad loan?

Today's featured property was originally posted April 26, 2007: More Jasmine Dew Drops in Quail Hill.

This was a flip gone bad. The owner put the property for sale about a year after paying $450,000 for a one bedroom apartment. He tried off and on selling the property for the next couple of years. He tired of the payments and quit paying sometime before mid 2008.

Foreclosure Record

Recording Date: 11/29/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 02/18/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 10/08/2008

Document Type: Notice of Default

They may have convinced him to pretend with a loan modification, but one bedroom apartments are still not selling for more than $450,000 six years later, so the owner doesn't see much point in remaining current.

When he bought the property, he used a $356,000 first mortgage, a $66,700 second mortgage, and a $27,300 down payment, so he does have some skin in the game.

I speculate he has other assets too. I further speculate this sale is being held up while the owner and the second mortgage holder agree to a settlement. I know none of these people, but it does explain why one property can be for sale for years while an underwater delinquent borrower continues to be on title.

Today's featured property should have been foreclosed on years ago and washed through the system. Here we are in 2011, and we haven't resolved bad loans from 2008.

Irvine Home Address … 260 DEWDROP Irvine, CA 92603 ![]()

Resale Home Price … $249,000

Home Purchase Price … $445,000

Home Purchase Date …. 11/21/05

Net Gain (Loss) ………. $(210,940)

Percent Change ………. -47.4%

Annual Appreciation … -10.9%

Cost of Ownership

————————————————-

$249,000 ………. Asking Price

$8,715 ………. 3.5% Down FHA Financing

4.78% …………… Mortgage Interest Rate

$240,285 ………. 30-Year Mortgage

$50,274 ………. Income Requirement

$1,258 ………. Monthly Mortgage Payment

$216 ………. Property Tax

$153 ………. Special Taxes and Levies (Mello Roos)

$42 ………. Homeowners Insurance

$297 ………. Homeowners Association Fees

============================================

$1,965 ………. Monthly Cash Outlays

-$117 ………. Tax Savings (% of Interest and Property Tax)

-$301 ………. Equity Hidden in Payment

$16 ………. Lost Income to Down Payment (net of taxes)

$31 ………. Maintenance and Replacement Reserves

============================================

$1,594 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,490 ………. Furnishing and Move In @1%

$2,490 ………. Closing Costs @1%

$2,403 ………… Interest Points @1% of Loan

$8,715 ………. Down Payment

============================================

$16,098 ………. Total Cash Costs

$24,400 ………… Emergency Cash Reserves

============================================

$40,498 ………. Total Savings Needed

Property Details for 260 DEWDROP Irvine, CA 92603

——————————————————————————

Beds:: 1

Baths:: 1

Sq. Ft.:: 0830

$0,300

Lot Size:: –

Property Type:: Residential, Condominium

Style:: One Level, Contemporary

View:: Peek-A-Boo

Year Built:: 2003

Community:: Quail Hill

County:: Orange

MLS#:: L27347

—————————————————————————–

IMMACULATE LARGE SINGLE STORY 1 BEDROOM CONDO, BRIGHT KITCHEN WITH CORIAN COUNTERS AND BREAKFAST BAR OPEN TO A SPACIOUS LIVING ROOM WITH A FIREPLACE AND BUILT IN OFFICE/ MEDIA. SEPARATE DINING AREA, MASTER SUITE WITH HUGE CLOSETS. FLOORS ARE HARDWOOD THROUGHOUT LIVING AND DINING, CARPET IN THE BEDROOM AND CERAMIC TILE IN THE BATHROOM. PLANTATION SHUTTERS, A/C AND LAUNDRY INSIDE. THE COMPLEX HAS A POOL, SPA, GYM, BBQ AREA AND A CLUBHOUSE.

The realtor describes this place as LARGE and SPACIOUS. It's a one-bedroom one-bath condo of 830 square feet. The right word in realtorspeak is COZY.

.jpg)