The bear rally has ended. The next leg down will likely lead us to the true bottom of real estate prices.

Irvine Home Address … 2100 TIMBERWOOD Irvine, CA 92620

Resale Home Price …… $359,900

The Spirit of the Woods is like an old good friend.

Makes me feel warm and good in-side.

I knew his name and it was good to see him again.

Cause in the wind he's still a-live.

Oh Fred Bear

Walk with me down the trails again.

Take me back, back where I be-long.

Fred Bear

Ted Nugent — Fred Bear

As I noted in a previous post, House prices resume their downward trend, the false bottom of 2009 is being tested by a languishing real estate market.

Housing Recovery Stalls

Fresh Fall in Home Prices Is Headwind for Economy; Other Signs Still Strong

By S. MITRA KALITA And SUDEEP REDDY — DECEMBER 29, 2010

A new bout of declining home prices is threatening to hamper the U.S. recovery, just as consumers and the overall economy have been showing signs of healing.

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. Many economists expect the declines to continue into at least next spring, erasing most of the gains made since prices bottomed out in early 2009.

The housing market, which appeared poised for a recovery earlier in the year, now could be heading for a second downward drift.

“This looks like a double-dip [in housing] is pretty much on the way, if not already here,” said David Blitzer, chairman of the Standard & Poor's index committee. “Somebody who thought last year that it's going to be straight up from here was wrong.“

That's right. The bears were right, and the bulls were wrong.

Enough gloating. Back to the serious business of documenting the ongoing collapse of real estate prices.

Other news in recent weeks, however, has offered hope the economy is on the cusp of strong, sustainable growth. Retail sales returned to levels seen just before the recession started in 2007. Manufacturing continues to expand. U.S. exports are back to where they were just before the financial crisis.

Optimism among heads of small businesses and large corporations is also near pre-recession levels. And tax legislation that includes a one-year payroll-tax cut for most workers has boosted prospects.

Yet the twin forces of jobs and housing remain trouble spots. The labor market has added a million jobs in the past year, but that pace is far too slow to offset an unemployment rate that climbed to 9.8% last month.

Job worries are hampering consumer confidence despite strength in holiday sales and a rising stock market. The Conference Board, a business research group, said Tuesday that its confidence index fell to 52.5 from 54.3 in November, as consumers' views about job availability worsened.

The index, after rising through May as the economy showed early signs of improvement, now has retreated to its level of a year ago. The percentage of people planning to buy a home is also back to where it was a year ago, erasing improvement seen in early 2010.

U.S. Consumer-Confidence Index Slips

In the Case-Shiller data, all 20 cities in the index posted month-over-month declines in October.

As for year-over-year data, only four areas—Los Angeles, San Diego, San Francisco and Washington, D.C.—showed prices higher than in October 2009. Six markets hit their lowest since prices started falling four years ago, dropping below their spring 2009 levels, when most regions saw prices bottom out. The six were Atlanta, Miami, Seattle, Tampa, Charlotte, N.C., and Portland, Ore.

Prices in several markets, including Las Vegas and Cleveland, are nearly down to 2000 levels.

The low end in Las Vegas is trading at the early 90s levels. The good stuff still hangs on at 2004 prices. The good stuff will continue to decline, but investors and new owner-occupants will keep low-end prices stable.

The housing index was driven down by factors including the expiration of a federal tax credit for buyers who signed contracts by April 30, which caused demand to fall off.

Prices also were weighed down by a huge inventory of foreclosed homes, which tend to sell at sharply discounted prices.

In recent months, according to the National Association of Realtors, foreclosure and other distressed sales have represented more than 30% of home sales—and more than half in some states, such as Nevada.

Wells Fargo & Co. projects prices will drop 8% more by mid-2011, given high supply. “Demand is still dead in the water,” said Wells economist Sam Bullard.

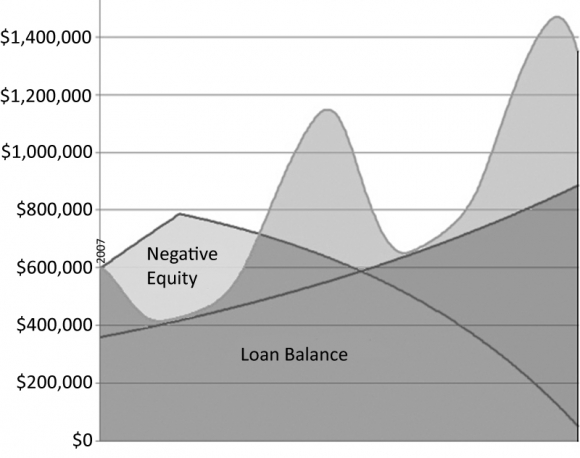

Prices also face other hurdles: slightly rising mortgage rates, and homeowners who owe more on their houses than they're worth, and thus may walk away as values dip further.

The owners under pressure include Tasha McLaughlin, a 33-year-old mother of two in Sacramento's South Natomas neighborhood. She and her husband, Steve, bought their two-bedroom house in 2004 for $256,000, intending to stay about five years. After 11 months of trying to sell it between 2006 and 2007, the family took it off the market.

“Everyone is saying we should foreclose or claim bankruptcy, but I have a moral issue with that,” said Mrs. McLaughlin. “The more we try to pay the mortgage and pinch pennies, the more we get punished.”

Now, with a similar home down the block listed for $80,000, the McLaughlins are accepting that they won't recoup their losses anytime soon. Their interest-only loan is set to increase their current $1,600 monthly payment to $2,200 in seven years. If they were to default on their mortgage and walk away, they calculate that in about the same time, seven years, their credit scores would be stable enough to allow them to buy again elsewhere.

“I am just going to swallow my pride and walk out. I have to,” said Mrs. McLaughlin. “The market for homes is not going up.“

Housing analysts agree that markets such as Sacramento, Las Vegas and parts of Arizona and Florida are at risk of more declines. “These places relied so heavily on mortgages and real estate for their economy that we're going to see a two-tiered recovery,” said Chris Mayer, a professor of real estate at Columbia Business School. “Luxury spending is not going on across the country—it's happening among highly skilled consumers who live in the places that have seen some recovery.”

Homes remain a key part of Americans' wealth. Households held $6.4 trillion of home equity at the end of the third quarter, alongside $12.2 trillion in stocks and mutual-fund shares, according to Federal Reserve data.

For every dollar decline in housing wealth, consumers reduce spending by about a nickel in the subsequent 18 months, Moody's Economy.com chief economist Mark Zandi estimates. He cautioned that other factors, such as the stock market's strength and tax credits, could offset this effect.

“People feel poorer when their houses are going down in value,” said Jack Fitzgerald, chief executive of Fitzgerald Auto Malls, which has a dozen locations along the East Coast. He is seeing many customers who could buy new cars choosing used cars instead, “spending as little as they can.” While sales are improving, he expects them to grow only slowly, given all the consumer uncertainty.

Still, the overall economy's dependence on housing diminished greatly since the financial crisis, said Ivy Zelman, chief executive of Zelman & Associates, a housing-research firm. “Consumers have shown us they can still spend even if home prices go down,” she said. But falling home values “put a lid on the recovery and the magnitude of it.”

I don't believe house prices will fall a large amount from here. They will go down, particularly at the high end, but with an improving economic picture, demand for housing will improve. Considering it has been hovering near historic lows for years, it is bound to pick up some in 2011. Much will depend on the course of interest rates and unemployment. If interest rates move higher and unemployment stays high, house prices may fall significantly, but if interest rates remain low, and if unemployment drops, we won't see a significant uptick in prices because hte overhead supply, but we could see a big increase in sales volumes. That would be great for clearing the market.

100% financing deal emerges from 2.5 years of shadow inventory

Today's featured property was purchased on 9/16/2005 for $509,000. The owners used a $356,300 first mortgage, a $152,700 stand-alone second, and a $0 down payment. The defaulted about three years ago.

Foreclosure Record

Recording Date: 05/12/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 02/09/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 11/02/2009

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 06/04/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 04/21/2008

Document Type: Notice of Default

Since this was a purchase money, non-recourse mortgage, the bank was in no hurry to foreclose and take the loss. There is no prospect of recovery on this loan. The finally got around to foreclosing on 7/19/2010 for $431,484, then they spent several months preparing it for sale — which looks like they did nothing.

Are the shadow inventory deniers still making fools of themselves, or has everyone accepted that shadow inventory is real and not that hard to find?

Irvine Home Address … 2100 TIMBERWOOD Irvine, CA 92620 ![]()

Resale Home Price … $359,900

Home Purchase Price … $509,000

Home Purchase Date …. 9/16/2005

Net Gain (Loss) ………. $(170,694)

Percent Change ………. -33.5%

Annual Appreciation … -6.3%

Cost of Ownership

————————————————-

$359,900 ………. Asking Price

$12,597 ………. 3.5% Down FHA Financing

5.07% …………… Mortgage Interest Rate

$347,304 ………. 30-Year Mortgage

$75,116 ………. Income Requirement

$1,879 ………. Monthly Mortgage Payment

$312 ………. Property Tax

$100 ………. Special Taxes and Levies (Mello Roos)

$60 ………. Homeowners Insurance

$242 ………. Homeowners Association Fees

============================================

$2,593 ………. Monthly Cash Outlays

-$311 ………. Tax Savings (% of Interest and Property Tax)

-$412 ………. Equity Hidden in Payment

$25 ………. Lost Income to Down Payment (net of taxes)

$45 ………. Maintenance and Replacement Reserves

============================================

$1,940 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,599 ………. Furnishing and Move In @1%

$3,599 ………. Closing Costs @1%

$3,473 ………… Interest Points @1% of Loan

$12,597 ………. Down Payment

============================================

$23,268 ………. Total Cash Costs

$29,700 ………… Emergency Cash Reserves

============================================

$52,968 ………. Total Savings Needed

Property Details for 2100 TIMBERWOOD Irvine, CA 92620

——————————————————————————

Beds: 2

Baths: 1 bath

Home size: 1,270 sq ft

($283 / sq ft)

Lot Size: n/a

Year Built: 2005

Days on Market: 73

Listing Updated: 40526

MLS Number: P755549

Property Type: Condominium, Residential

Community: Northwood

Tract: Cust

———————————————————

According to the listing agent, this listing is a bank owned (foreclosed) property.

Like new! Immaculate one bedroom + loft (used at a bedroom) townhouse built in 2005 located in the desirable Collage complex. Unit features include brand new paint and carpet throughout, fireplace, one car garage, patio with pool views, walk-in closet and storage room. Complex is equipped with beautifully manicured landscaping, pool, spa and secure gate access. Property will be sold with washer, dryer, stove/range and dishwasher.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend and a happy new year,

Irvine Renter

Banks need a moral stigma to be associated with loan repayment. If the transaction were viewed by borrowers as a simple business transaction — which it is — then issues of morality are not effective at cajoling debtors into repayment, particularly when default is in the best interest of the debtor. Banks have long relied on borrower morality to get repaid.

Banks need a moral stigma to be associated with loan repayment. If the transaction were viewed by borrowers as a simple business transaction — which it is — then issues of morality are not effective at cajoling debtors into repayment, particularly when default is in the best interest of the debtor. Banks have long relied on borrower morality to get repaid.

Given these circumstances, only during brief periods of upward volatility (sucker rallies) is it possible to reap major appreciation benefits from owning residential real estate. It has always been about utility of ownership, but people are only now detoxifying from the kool aid enough to see it.

Given these circumstances, only during brief periods of upward volatility (sucker rallies) is it possible to reap major appreciation benefits from owning residential real estate. It has always been about utility of ownership, but people are only now detoxifying from the kool aid enough to see it.

This Luxury Built Pardee Home is situated at the end of the cul-de-sac Nestled alongside Nature. Step thru the Gated entryway to two sitting areas, Built-in BBQ features Granite top seating gather around the firepit or just enjoy the nearly 10,000 sq. ft. lot and upgraded hardscaping. 5 bedrooms & Bonus Room allow room for any family needs. Designer Mahogany cabinetry, Viking Professional Stainless Steel appliances, Blt-in desk, Baltic Brown Granite Counters Center island w/bar seating. Living/Family Room Fireplaces. Spacious Family Room with cozy breakfast nook. Laura Ashley Plantation Shutters throughout. Recessed Lighting, Wired for surrond sound or security. 3 car garage features Remoteless entry & Epoxy flooring. Master suite features elegant Master Bath with jacuzzi tub and dual shower fixtures. Upstairs laundry room. Upgraded carpeting and neutral decor makes it easy for this to be your new home, VERY CLEAN and hardly lived it.

This Luxury Built Pardee Home is situated at the end of the cul-de-sac Nestled alongside Nature. Step thru the Gated entryway to two sitting areas, Built-in BBQ features Granite top seating gather around the firepit or just enjoy the nearly 10,000 sq. ft. lot and upgraded hardscaping. 5 bedrooms & Bonus Room allow room for any family needs. Designer Mahogany cabinetry, Viking Professional Stainless Steel appliances, Blt-in desk, Baltic Brown Granite Counters Center island w/bar seating. Living/Family Room Fireplaces. Spacious Family Room with cozy breakfast nook. Laura Ashley Plantation Shutters throughout. Recessed Lighting, Wired for surrond sound or security. 3 car garage features Remoteless entry & Epoxy flooring. Master suite features elegant Master Bath with jacuzzi tub and dual shower fixtures. Upstairs laundry room. Upgraded carpeting and neutral decor makes it easy for this to be your new home, VERY CLEAN and hardly lived it.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)