Sales volumes are way down, and home prices are about to follow.

Irvine Home Address … 17501 TEACHERS Ave Irvine, CA 92614

Resale Home Price …… $583,731

This is my life

And people try to shut me down

Put my music on

And those people don't make a sound

Down down down down down

Everybody falling down down down down down

And they falling

Space Cowboy — Falling Down

Prices are falling, and they are about to go negative year-over-year. If interest rates go up, the price decline may gain momentum and lead to a significant leg down in local prices.

Housing prices flat, sales sinking

JEFF COLLINS — Nov. 16, 2010

The housing market continued to struggle against fierce headwinds last month, losing ground in the face of tightfisted lenders and edgy buyers.

The median price of an Orange County home – or price at the midpoint of all sales – fell to $438,000 last month, housing tracker MDA DataQuick reported Tuesday.

That's the lowest since April and up just 0.3 of a percentage point (or $1,500) from the October 2009 median.

Next month, we will likely see a year-over-year decrease in the median home price. The double dip will be official. The next milestone will be breaking below the false bottom put in during 2009.

Meanwhile, sagging sales stretched into their fourth month, with 2,298 Orange County homes trading hands in October.

That's 9 percent fewer than in September and 17.9 percent below the October 2009 tally.

While sales typically drop from September to October, last month was the second-slowest for an October since DataQuick began tracking home sales in 1988. It also was nearly 36 percent below the average of around 3,600 housing deals in a typical October.

I keep repeating it because the bulls do not get it: sales volumes are way, way down. The only people who believe sales are strong are those getting their information from the Irvine Company marketing team. For every 3 sales that ordinarily occurs in October, only 2 happened last month.

The market appeared to be on fire during the first half of the year. But industry insiders now fret that state and federal tax breaks failed to ignite a stronger, longer-lasting recovery after ending in the second half.

"A lot of us were disappointed that the wind that would be in our sails just faded," observed Jeff Culbertson, executive vice president for Coldwell Banker's Southwestern U.S. region, which includes Orange County.

"We're not in a bad market," Culbertson added. "But we're not in a good market."

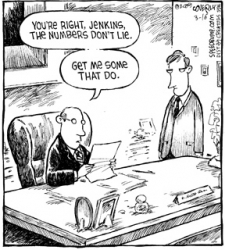

Used house salesmen never give up. They won't admit the obvious: the market is very weak and prices are too high. The reason realtors are not trusted is obvious. They lie. They ignore the obvious. The candy coat a turd and expect buyers to eat it.

Although October was the 14th consecutive month of year-over-year price increases, the gain was the smallest of a streak dating to September 2009.

Last month's median price also fell $12,000 from the 2010 high of $450,000 reached in May and July. That means that all the price gains of the past year have virtually evaporated.

At $280,000, the median price of an O.C. condo fell 11.7 percent from last year's levels;

How do you get a move-up market while condos continue to implode? You don't.

the median price of a newly built home decreased 1.1 percent.

I thought the Irvine Company was increasing prices and building even more homes. That isn't what the statistics are saying.

"Things have slowed down and agents are starting to get worried," said Irvine top-producer Mac Mackenzie. "I think buyer confidence has been reduced, and people are having trouble getting (their loans) approved."

"We're not seeing any move-up buyers," added Harry Solomon, managing owner of Nova Real Estate Services in Laguna Hills. "If you can't sell the little condo because you're upside-down, you're certainly not going to buy something else. … If you don't have the equity to move up, people are going to renting."

Agents noted also that home sales at the high end of the housing market, which appeared on the verge of taking off, stalled recently.

In whose fantasy was the high end on the verge of taking off? The high end awaits its comeuppance. Prices will fall very hard at the high end when they get around to booting out the squatters.

For example, sales of $650,000 or more accounted for 30.4 percent of all home sales in July. Last month, they accounted for 27.6 percent of all deals.

"Once we get over (an asking price of) $1.5 million, it seems like it's quiet in the marketplace," said Newport Beach luxury home sales agent Steve High.

That's because nobody can afford those prices with their real incomes. Prices only got over $1.5M because we underwrote stupid loans at those price levels. Now nothing but air supports those prices. (see How to Lose $2,650,000 in Irvine Real Estate)

High noted that despite some of the lowest interest rates in history, buyers still are having a hard time qualifying – especially those seeking to get so-called "jumbo" loans of around $730,000 or more.

"You keep hearing about these low interest rates, but we still have a huge challenge in people qualifying for loans," High said.

Without liar loans, people have to qualify based on their income. And contrary to the popular fantasy of OC posers, there are not enough high wage earners in Orange County to support all the houses at those price points.

In Orange County's lower-cost central core, well-priced homes are getting offers within two weeks, said Santa Ana real estate agent Hector Ramirez of Citivest Realty Services.

Investors continue to buy three-bedroom houses selling for as low as $300,000, Ramirez said. With rent averaging $1,900 a month or more for such houses, the income will easily cover monthly loan payments. But such deals are hard to find.

Only a fool would pay $300,000 for a property grossing $1,900 a month rent. It may cover the loan payment, but it won't likely cover the other costs of ownership and have positive cashflow. I put an investor in a Las Vegas house for about $105,000 that grosses $1,300 a month in rent. That is a cashflow investment.

"There's not much to choose from," he said.

And even at the low end, the pace of sales also subsided since homebuyer tax credits dried up in June.

Lenders seized 604 homes from defaulting owners last month, 16.1 percent fewer than in October 2009, DataQuick reported.

Lenders also filed 1,501 default notices – the first stage in the foreclosure process – on borrowers who missed three or more payments. That's nearly a third fewer than the year-earlier level.

And since the rate of notices and foreclosures is a small fraction of the number of loan delinquencies, we continue to build an enormous shadow inventory. (see There are 36,000+ Distressed Properties in Orange County)

High, the Newport Beach agent, noted that prices will hold so long as the foreclosure rate holds steady.

But, he warned, "If we see an abundance of bank-owned properties coming on the market, we will see some volatility in prices."

Yes, downward volatility.

Culbertson, Coldwell Banker's regional chief, noted that the market needs to get over an "emotional drag," a sense among buyers that it's safe again to make a move. That won't occur until people start to hear more positive news about the economy and the job market, he said.

In other words, we need to give potential buyers a healthy dose of bullshit in order to dupe them into buying. This guy is shameless.

"The market that we're in right now," Culbertson said, "may be the market we're going to have to live with."

Register staff writer Jonathan Lansner contributed to this report.

Contact the writer: 714-796-7734 or jcollins@ocregister.com

Foreclosure after 20 years loan ownership

Many loan owners started out in the late 90s and the 00s, so a housing bubble and irresponsible lending is all they know. However, many others survived the previous housing bubble and should have known better than to borrow themselves into oblivion. Today's featured owner borrowed all he could as soon as he could. He didn't leave much equity in the house before the market collapsed.

Many loan owners started out in the late 90s and the 00s, so a housing bubble and irresponsible lending is all they know. However, many others survived the previous housing bubble and should have known better than to borrow themselves into oblivion. Today's featured owner borrowed all he could as soon as he could. He didn't leave much equity in the house before the market collapsed.

- This house was purchased on 3/30/1990 for $260,000. The original mortgage information is not available, but it was likely a $208,000 first mortgage and a $52,000 down payment. That purchase date was the peak of the previous bubble. This owner spent most of the 90s underwater.

- On 12/9/1997 he refinanced with a $243,000 first mortgage. As soon as the market bottomed, this borrower went Ponzi.

- On 2/5/1998 he obtained a $50,000 stand-alone second.

- On 12/14/2001 he refinanced with a $289,000 first mortgage.

- On 5/23/2002 he obtained a $72,000 HELOC.

- On 7/15/2003 he got a $322,000 first mortgage.

- On 1/26/2005 he opened a $150,000 HELOC.

- On 1/27/2006 he obtained a $592,000 Option ARM with a 2.2% teaser rate.

- On 2/16/2006 he got a $65,000 HELOC.

- On 6/26/2006 he enlarged his HELOC to $85,000.

- Total property debt is $677,000.

- Total mortgage equity withdrawal is $469,000.

If he hadn't borrowed the $469,000 as it appeared, he would only have netted about $300,000 on the transaction. Mortgage equity withdrawal is certainly the most efficient method for obtaining real estate equity. Of course, it is theft, and it requires sacrificing your credit score, but the potential gains are enormous. No wonder so many did it.

Irvine Home Address … 17501 TEACHERS Ave Irvine, CA 92614 ![]()

Resale Home Price … $583,731

Home Purchase Price … $260,000

Home Purchase Date …. 3/30/1990

Net Gain (Loss) ………. $288,707

Percent Change ………. 111.0%

Annual Appreciation … 3.9%

Cost of Ownership

————————————————-

$583,731 ………. Asking Price

$116,746 ………. 20% Down Conventional

4.55% …………… Mortgage Interest Rate

$466,985 ………. 30-Year Mortgage

$114,752 ………. Income Requirement

$2,380 ………. Monthly Mortgage Payment

$506 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$97 ………. Homeowners Insurance

$224 ………. Homeowners Association Fees

============================================.jpg)

$3,207 ………. Monthly Cash Outlays

-$398 ………. Tax Savings (% of Interest and Property Tax)

-$609 ………. Equity Hidden in Payment

$198 ………. Lost Income to Down Payment (net of taxes)

$73 ………. Maintenance and Replacement Reserves

============================================

$2,470 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,837 ………. Furnishing and Move In @1%

$5,837 ………. Closing Costs @1%

$4,670 ………… Interest Points @1% of Loan

$116,746 ………. Down Payment

============================================

$133,091 ………. Total Cash Costs

$37,800 ………… Emergency Cash Reserves

============================================

$170,891 ………. Total Savings Needed

Property Details for 17501 TEACHERS Ave Irvine, CA 92614

——————————————————————————

Beds: : 5

Baths: : 3

Sq. Ft.: : 2067

$0,282

Lot Size: : 5,509 Sq. Ft.

Property Type:: Residential, Single Family

Style:: Two Level, A-Frame

Year Built: : 1971

Community: : Westpark

County: : Orange

MLS#: : S639286

On Redfin: : 2 days

——————————————————————————

BEST VALUE IN IRVINE AND MAY BE IN SOCAL. !!! PRICED FOR QUICK SALE!!!! THIS is it, don't miss this one. 5 Bed room 2.5 bath in great neighbour. Association pool, spa, basket ball court, Tennis court available. Great freeway access and very convinient location. Show and Sell.

neighbour? convinient?

After the flurry of ALL CAPS, the realtor ended the sentence fragment with a period, then she added three exclamation points. Half way through this description, there is no information, but plenty of extraneous realtorspeak. Awful.

This video is long, but it is worth a listen.

The photos are a bit confusing. Are they trying to sell this home or …?

What on Earth did these people spend approximately $400K on?

They sure as hell didn’t spend it on the house. The kitchen is a horror and dates back to the 70s, at least. Everything in this house is ugly, outdated, and shabby.

What a shame- these people could probably have safely borrowed about $30K against the house to reno the kitchen, and left it there, and then made small extra payments against their mortgage principal to offset the small HELOC. They’d be beautifully situated now with a house nearly paid off.

They spent it on food, cars, bills, vacations, and house payments.

I think they re-did the outside. That’s an old neighborhood and I’m pretty sure that’s not the original outside. Did you notice there’s a picture with a man in it? I see you Mr. Heloc Abuse F.

Sue in Irvine, you’re hilarious! 🙂

I’m about 1/2 way through “Monster”…the book about the subprime players. Things look incredibly bleak from that angle, and I just can’t understand why so many of these players aren’t in prison.

What on Earth did these people spend approximately $400K on?

Oh medical bills I’m sure.

1 s-serie Mercedes : 125k

1 lexus something : 75k

=> 200k$ in cars !

vacations in high-end resort (500 to more/d) + trip

20-35k /year * 5y = 100k$+

left 100k$ … well, yeah, daily stuff and dinners out for 5years

400k$ for < 50 IQ people goes fast. While I still wonder if these people have actually a >200 IQ !

Wouldn’t a couple of new Lambos do the trick?

That list looks long 🙂

Interesting article from Time.com titled:

No Reason to Pay Realtor Commissions When Selling a House

http://money.blogs.time.com/2010/11/02/study-no-reason-to-pay-realtor-commissions-when-selling-a-house/#ixzz161vpi5OJ

So I drove around Woodbury East yesterday. They are thisclose together, packed in like sardines. Even the detached “houses” are close with no yard, maybe a small patio in back right up to the neighbor. It’s nice to look at models, but once they actually build your place you are in for a big letdown.

Did you “MOOOOO” at the residents?

IrvineRenter:

Wow… I’m surprised you tried to pull this.

Not only is that statistic not directly relevant (lower median price could just mean more homes were built at below the median) but you are trying to tie overall statistics to what is factually happening in Irvine. Take almost any tract in the 2010 New Home Collection, look at Phase 1 pricing and then look at the last phase (I say “last” because almost every tract has SOLD THROUGH). If you don’t think they raised prices… check the batteries on your abacus.

As for increasing building… Stonegate East is selling, Portola Springs is expanding, Cypress Village, Laguna Altera, Stonegate and Orchard Hills are on deck.

Maybe if you drove around and looked at the projects, you could see all the activity. Why don’t you write an article on how well the New Home Collection did despite all the doom and gloom going on every where else. Your blog could benefit from some different perspective once in a while.

And by the way… this doesn’t mean Irvine is totally immune. I do notice lots of softening in the resale market, especially the older homes and the inflated ones sold during the boom… but the declines just aren’t as bad as other places.

Excellent post,

Completely agree with all the points IHO made.

New construction in those areas of Irvine is happening at a frenzied pace.

It’s demand driven.

Where else do you see this momentum in new construction taking place?

In other areas, they can’t give away homes fast enough.

I’m confused I thought this post was talking about Las Vegas, wait Orange County? How about Irvine?

Who’s on first, what’s on second, I don’t know who’s on third.

IHO, you are too thorough in your discussion of the Irvine housing market. I don’t see much desire here to discect and understand why building is occuring at a feverish pace and large cash down payments are flocking to Irvine.

The approach here is more talk about general housing conditions, a dash of Las Vegas, and a mockery of a HELOC abusers financial history.

Irvine is still a bubbly cauldron of koolaid thanks to dismal savings account returns, hedging against inflation, shadow inventory choking supply, and foreign cash.

The govt and fed are forcing people to speculate. RE has less perceived downside risk than cash, savings, etc.

Dissection is futile if you dont see/understand the bigger picture.

Why Irvine? Is it special?

Irvine may have a clientele with more sound financials and thus, a greater ability to foolishly overpay.

The overleveraged exist in all cities as does downward pressure on prices, in varying degrees of course.

To say that Irvine is the exempt from market forces is laughable.

The overleveraged exist in all cities as does downward pressure on prices, in varying degrees of course.

Either way – large down payments or not, it’s obvious that these Irvine house debtors are not going to pay off the loans.

I’d say the declines in Irvine are bad IHO. Condos where I live..highest price sold in 2005 was $535,000. Latest sales in 2010 are around $400,000 for the same model.

@Sue:

I didn’t say they weren’t bad… just not AS bad as other places.

If that same condo sold elsewhere for $535k, it would probably be $250-300k now.

Maybe worse in the IE or Vegas.

Regardless, new homes pace and pricing in Irvine is phenomenal considering the economic climate. For IR to state the contrary makes me wonder because he is usually straightforward and even he should recognize it.

All I can see right now in the MLS are dropping prices (when looking at potential purchases). Here is a typical example for an Irvine 3 BR: Original price: $620k, Previous price: $590k, Current price: $555k. And that’s asking price, not sales price…So the price drops a real and make people sit on the sidelines. No wonder sales are down.

@Marc:

Yes… I said a portion of resales have been dropping. But new homes in Irvine sold fast and even when The Irvine Company increased prices during that time… they still sold.

Whatever the explanation is for that — it happened… despite the statistics that IR mentions.

Portola and Orchard? I always wonder who is crazy enough for pay $600k plus for a showbox in a location that is almost Riverside!

O.C. unemployment drops to 9.1%

http://economy.ocregister.com/2010/11/19/o-c-unemployment-drops-to-9-1/44408/

“Orange County saw particular strength in professional and business services, which added 3,000 jobs in October. This sector, which includes accountants, lawyers, engineers and temp workers, increased by 9,600 in the past year.”

any bullish news stands on the shoulders of unsustainable stimulus and artificially low interest rates, UNSUSTAINABLE being the key word.

You’re anonymous for a reason.

Ha ha ha ha

Did you see any opinion there? I didn’t

Just linking statistics.

radio guy has good points.

i cringe when people bitch about the banksters and GS.

the source of the problem is cheap money and govt subsidy.

Yup!

If you visit this community at 11:00 pm, the car parking all over both sides of the street, just like traffic jam in the pick hour of freeway 5.

This problem is hidden when you see the model home but after the community is built up, you will feel just live in the middle of freeway 5.

OC Homes are 4th most costly in the nation.

http://lansner.ocregister.com/2010/11/22/o-c-homes-nations-4th-most-costly/88900/

Why is that article using the median SFR price for OC as opposed to median house price? I guess I can’t expect that much from the OC Register.

If one city is overweight in condo’s compared to another, does it really make sense to use median price for all housing types? Using median SFR price compares apples to apples (well, as long as you’re willing to ignore the FAR smaller lots in The OC.)

Would you prefer that they used median price/sf? The OC would look even more ridiculously-overpriced in that light. But that stat wouldn’t fit very well with the view of the world that your broker has told you to believe, now would it?

-Darth

Do you think they used median SFR in NY, SF, and Honolulu ? No they didn’t, they used median price, same with LA. Please for once try to accept the reality that I’m right.

The knife catchers are getting a bit shrill.

Pathetic, I can’t understand why your blog is so popular and you can’t understand the truth.

In a strange way I like this house because the outside is as ugly as the inside. There is no false advertising here…no effort made to disguise a lousy interior with at least a half-way attractive paint job. No sirree, Bob, someone said, “We have to be sure the outside looks just as bad as the inside” or vice versa.

What always gets me is that here is a house selling for over 1/2 a million dollars and it’s got furnature from your local goodwill store. This really brings home the consequences of being “house poor”. There isn’t one decent item of furnature in any of the pictures.

Well put, but I gotta wonder whether the exterior is really that pink color or whether that’s due to poor photography. Seems like a color an Irvine HOA wouldn’t approve.

Year Built: : 1971

Asking Price $583,731

LOL!!!!! Get real!

PMI thinks both OC and Las Vegas are ‘high risk’

http://lansner.ocregister.com/2010/11/19/o-c-called-high-risk-housing-market/89084/

How much would any of you guess it cost to re-clad the exterior of the house? Did it really cost $400K? Or 300K? I’m asking because I really have no idea how much a job like this would cost for a house this size.

Notice a second refrigerator parked right in front of the sliding glass doors in the dining room- dead giveaway of house overcrowding. I’m going to guess that two families were living in this place.

Still scratching my head wondering where all the HELOC money went, because it did not go into improving or furnishing this house.

Who would buy houses in Irvine if there were tunnels and high-speed trains to Riverside with $150,000 4-bedroom houses?

It’ll happen eventually in 15-25 years, but the Irvine Company will do everything to oppose these plans.

I’m not sure that “candy coating turds” really requires more of a visual than the imagination already conjures up, IR.