Assaulted by bad news, a home debtor has launched a public relations campaign to keep the kool aid flowing.

Irvine Home Address … 13 WINDJAMMER 2 Irvine, CA 92614

Resale Home Price …… $299,000

Some things in life are bad,

They can really make you mad.

Other things just make you swear and curse.

When you're chewing on life's gristle,

Don't grumble, give a wistle!

And this'll help things turn out for the best…

And… always look on the bright side of life!

Monty Python — Always Look on the Bright Side of Life

Defending Home Ownership

By Barry Ritholtz – August 28th, 2010, 10:42AM

Jonathan Miller and I have been kicking around an idea for a “Home ownership is a good thing” OpEd.

Apparently, we aren’t the only ones:

• Five Reasons to Stop Worrying About Your Home’s Value (Moneywatch)

• In Defense of Home Ownership (NYT)

None of these hit the issues and topics that we want to cover — but it is interesting that other folks are thinking along the same lines.

Now, if only I could figure out whether these articles are 1) Contrarian pushback against the dominant RE meme; or b) proof that the bottom is not yet here, as people cling to the hope of a RE recovery.

I'll answer that one for you Barry: it is a sign that people are clinging to the hope of a real estate recovery. We are not yet at the bottom.

Why is sentiment so important?

Why are market collapses signified by changes in consumer sentiment? First, we need to distinguish between deflating market bubbles and market swings causing temporarily low prices. The housing bubble was a bubble; prices became elevated from fundamental values, and they are in the process of correcting back to true value. Prices were not temporarily depressed, they were temporarily elevated. In a bubble scenario, prices do not recover.

When market sentiment is still in denial — like most of California's coastal markets are — people cling to the hope of a recovery that is not going to happen. Stories about the double dip may push the market into fear, but it is nowhere near capitulation and despair like the subprime markets are today. As long as there is the delusion that prime markets are somehow going to avoid the deflation of the bubble, there will be an overhanging supply of sellers waiting for a slight improvement to sell their properties, and the distressed debt in the market remains. As long as there is overhead supply and people holding distressed debt, the market will not recover because each attempt simply brings out more sellers and prices get pushed downward.

An understanding of this market dynamic is the primary concept separating traders from academics. Traders understand this. Academics don't. Since the banks get most of their advice from academics, they will consistently make the wrong decisions, the market will not clear, and prices will grind lower until they capitulate and the inventory is finally gone. As we are witnessing today in Las Vegas, everyone must sell, abandon hope, and feel widespread despair before the market bottoms.

In Defense of Home Ownership

By RON LIEBER

Published: August 27, 2010

It’s hard to read the headlines and not conclude that becoming a homeowner is a terrible idea.

This week, the National Association of Realtors announced that existing-home sales in July had fallen an astounding 25.5 percent from the previous year. Sure, there was a federal tax credit in place last summer. But with single-family home sales at their lowest level since 1995 and unemployment still stubbornly high, home prices may fall further.

In the meantime, millions of homeowners are still far underwater, and government programs to help them have fallen well short of their goals. More foreclosures are coming, casting a deeper shadow over home prices. So it’s hardly surprising that the conventional wisdom says that home values will never again rise faster than inflation.

The truth is that home prices cannot rise faster than inflation unless we are inflating a bubble. The only thing surprising is that reasonable people who understand this are being heard right now. Usually, the bullshit from the NAr and the general level of kool aid intoxication in the media makes more noise.

But as with stocks and the weather, it is dangerous to assume any certainty in the housing market. And by wallowing too much in the misery of others, people looking for a new place to live run the risk of thinking every home purchase will end in regret, at least financially.

Many still could, if they buy in hard-hit areas where prices could fall further.

The problem is that people don't know where prices could fall further. The markets commonly labeled as safe havens are the most at risk whereas the markets labeled as hopeless are at or near the bottom.

But a mortgage is still a form of long-term forced savings, after all. This is more important than ever, since fewer people have access to generous pensions than they did during the last big housing slump. A 401(k) or similar plan is no bargain, either, with its erratic returns and employer matches that come and go as the economic winds shift. Social Security is also likely to be less generous, and Medicare will probably cost more.

Besides, owning a home isn’t just about what shows up on a net worth statement — something that bears repeating after all the “investing” that people thought they were doing when buying homes over the last 10 or 15 years. Many of these more qualitative factors, from living free of a landlord’s whim to having access to a good school district or retirement community, haven’t changed and probably never will.

It is possible, as a homeowner, to make very little money but still buy plenty of happiness. So before you swear off real estate, reconsider a few of the basics.

WORST CASES Some buyers may rue the day in 2010 they bought their homes. They may end up like those who bought in 2006 and have lost their jobs. Now those people face the difficulty of moving to pursue employment elsewhere because they owe much more than their homes are worth.

Marke Hallowell and Allison Firmat, who are getting married next month, are well aware of the history. Yet they plan to put 5 percent or less down, using a fixed-rate mortgage backed by the Federal Housing Administration, once they find a condominium in southern Orange County, Calif. (They’ve already been outbid a few times.)

Ms. Firmat is not working, and Mr. Hallowell is a Web developer. Does he worry about mobility problems or making the payments in the event of a job loss, given that he’s the sole breadwinner? “We’re getting such a good deal on interest rates that we could rent our place out,” he said.

Mr. Hallowell and Ms. Firmat say they believe their approach is conservative, at least compared to what they might have done five years ago.

“Nothing is going to change the rate we will have,” Mr. Hallowell said. “Condos like the ones we’re looking at now were unobtainable in the past, unless we went into something with a total balloon payment. There were times I was tempted, but never seriously.”

Indeed, many people who are buying at the moment are locking in mortgage rates of about 4.5 percent. A year ago, they might have paid 5.25 percent on a $300,000 loan for a monthly payment of about $1,657. Today, you could lock in a lower monthly payment of around $1,520 on a mortgage that size, or you might not need to borrow that much, given that prices have fallen in many areas.

FORCED SAVINGS You may make nothing at all beyond inflation over time on a home, but the part of your mortgage payment that goes toward principal is a form of forced savings.

Sure, you might do better by renting and investing the difference between the rent and the total costs of ownership. But at least three things need to go right.

First, you need to actually save the money. Americans have trouble with that sort of plan. Then, you need an after-tax return that’s better than whatever a home would deliver. That’s a task that might not have gone so well over the last 10 or 12 years, and it involves its own future risk, given how little safer investments are returning now. Finally, you must not raid the savings along the way.

LOL! No HELOC abuse? The problem with the whole forced-savings argument is that it is not forced anymore. Unless you live in Texas where they restrict HELOC use — which is why Texas avoided the bubble — then forced savings requires self discipline. In our Ponzi culture here in Southern California, self-discipline is in short supply.

DIFFICULT LANDLORDS A bank can kick you out only if you don’t pay your mortgage. But landlords can drive you away in any number of ways.

Laura Mapp and her husband, Carl Berg, rented from a relative, but it didn’t go particularly well. They found another landlord they liked, but came back from a holiday trip one year to a note saying he wanted to move in himself. They had a month to scram. (The note came with a bottle of wine, at least.)

In yet another rental, they let their landlord know they were looking to buy and inquired about a month-to-month lease. No problem, their landlord said, as long as they used his boyfriend as their real estate agent.

Earlier this year, the couple gave up on landlords and bought a house in the Highland Park neighborhood in Seattle.

This is another specious argument. Landlords rarely if ever throw out a good tenant. In fact, landlords often won't raise rents for fear of losing a good tenant. This article makes it sound like landlords are a capricious lot that likes to exercise their power to make people move. That idea is rather silly.

Look at it another way: how many people have been evicted by their lendinglords over the last 3 years as compared to the number of capricious landlord evictions? Avoiding a landlord is a great idea, but substituting a landlord for a lendinglord isn't much of an improvement. What people should strive for is to pay off a mortgage so they don't need to worry about a landlord or a lendinglord. Of course, that requires sacrifice, so most people opt to service debt, abuse their HELOCs, and take their chances.

THE NICE PART OF TOWN No matter how pretty the neighborhood, prices may still fall further in places like greater Detroit, Cleveland and Las Vegas; outlying areas of Los Angeles, San Francisco and Phoenix; and much of Florida.

This writer is a safe-haven fool. Detroit and Cleveland won't come back because their economies are a shambles. However, Las Vegas, Phoenix, Riverside County, most of Florida, and the San Francisco suburbs are going to recover, and the low prices there represent buying opportunities. The "nice part of town" hasn't endured its price correction yet, so those markets are in danger.

If you’re looking elsewhere, consult The Times’s rent-versus-buy calculator, halfway down the page at nytimes.com/yourmoney.

Their rent-versus-buy calculator is crap compared to the IHB calculator. Theirs was likely produced by the NAr.

But if you want to live in the Fox Hill Farm development in Glen Mills, Pa., you’ll have to buy because renters are not allowed, said Bob Kuhn, who lives there. The same may be true of other communities for older people.

And there may not be many family-size rentals — or at least any financial edge to be gained by renting — in suburbs or urban neighborhoods with excellent public schools.

This is nonsense and scare tactics. You can rent beautiful properties in the best neighborhoods in Irvine, and right now, those rents are below the cost of ownership. (High-end rental deal of the day: 31 Plumeria)

After many years of building their down-payment fund and a couple of years of watching the listings in the Eagle Rock and Mount Washington areas of Los Angeles, Garret and Alison Williams realized that prices simply were not falling much there.

That is the worst reason to buy.

By the time they were ready to pounce this year, they had a big enough down payment and interest rates had fallen so far that renting didn’t make much financial sense, even if they could have found a rental big enough for them and their two small children.

“Had we rented, we would be paying more than we’re paying for a mortgage,” said Ms. Williams, who had lived in the same two-bedroom rental for 12 years before she and her family moved into their new house in Eagle Rock earlier this month. “I don’t see how we could really regret having made the move when it’s so much better for us on so many levels.”

I question whether or not this family was getting a house equivilent to a rental if prices had not corrected yet. Perhaps their new mortgage payment is lower than rent, but they are moving into an inferior property.

I am bullish on ownership under certain conditions, and first among those is acquiring the property for a price below rental parity. In fact, I can flip from bearish to bullish quickly if prices fall below rental parity. We should start seeing more properties like that soon. I would prefer to purchase at the top of the interest rate cycle and refi on the way down, but that may be years from now, and if prices are below rental parity, I probably will not wait until 2015 for interest rates to hit 7%.

The bottom line is this: absent appreciation in excess of inflation, home ownership is a financial burden. There are emotional benefits to owning, but obtaining these benefits comes at a price. If the price is right, home ownership is wonderful, and if the price is wrong, home ownership can be a crushing weight or ball and chain.

It's worth noting that not everyone thinks our obsession with home ownership is a good thing:

Promoting Homeownership Is Not Only Un-American: It Contributed to the Housing Bubble

Posted on 08/29/10 at 2:53pm by Professor Mark J. Perry

From the Forbes.com article "The Un-American Dream":

"For nearly a century it has been the policy of the U.S. government to increase American homeownership. Its efforts include (but aren't limited to) bouts of easy money from the Fed, the mortgage-interest deduction, the exclusion of capital gains on primary residence sales, direct and indirect subsidies from the Department of Housing and Urban Development, and artificial liquidity pumped into the mortgage market via government sponsored entities Fannie and Freddie.

Policymakers assure us that the next generation of government housing programs will be "carefully designed" (bring on the next five-year plan, Comrade!). But the real question is why the government should be doing anything to promote homeownership.

"I do believe in the American Dream," said President Bush in 2002. "Owning a home is a part of that dream, it just is. Right here in America, if you own your own home, you're realizing the American dream." Bush was echoing a theme that reaches back at least to Herbert Hoover: When the government encourages homeownership, the story goes, it strengthens individuals and communities and thereby fosters the American Dream. They're wrong. A government crusade to promote homeownership is un-American.

America's distinction is that it was the first nation founded on the principle that you have a right to pursue your own happiness without government interference. But the government's homeownership crusade means it gets to decide how you should live, and stick-and-carrot you into living that way.

Here's the real lesson: The American Dream is not some government-subsidized house foisted on you by George W. Bush or Barney Frank. It's the undiluted freedom to decide how you want to live–and, if you want to own a home, it's the freedom to work, save, establish credit, and earn one. In America, the government's job is to protect our freedom to pursue our values, not to dictate what our values are. Its homeownership policy should be the same as its toaster oven policy: laissez-faire.

Government intervention in housing runs deep, and it can't be eliminated overnight. But the government should make its long-term goal to fully extricate itself from the housing market. It can then start gradually dismantling Fannie, Freddie, tax preferences for homeowners, and every other government housing program."

MP: You can add the government's role in promoting fixed-rate 30-year mortgages, and subsidizing FHA mortgages that only require a 3.5% down payment to the list of policies that the government has used to increase homeownership.

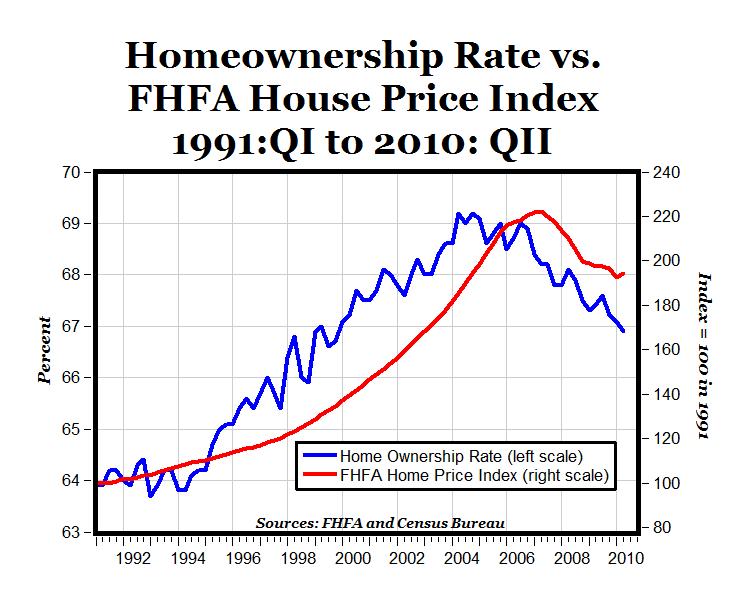

The chart above shows how the political promotion of homeownership in the U.S. may have contributed to the housing bubble. The blue line is the quarterly homeownership rate from the Census Bureau (data here) going back to 1991, which went from 64% in the early 1990s to a record high of more than 69% in 2004. During that same time period, the Federal Housing Finance Agency's (FHFA) Home Price Index (data here) doubled from 100 in 1991 to 200 in 2005, before reaching a peak of more than 222 at the height of the real estate bubble in 2007.

In the aftermath of the real estate bubble's crash, the homeownership rate has fallen to a 10-year low of 66.9% (QII 2010) and the FHFA home price has fallen back to 2004 levels. Promoting homeownerhip is not only un-American, but it helped create an unsustainable real estates bubble, which turned the "American dream" into an "American nightmare" for millions of Americans by turning "good renters into terrible homeowners."

Another hard-working condo

Day after day when I look at how much money people took out of their properties, I am astounded. I get the sense these houses worked harder than the people did. It certainly provided many with a substantial side income.

- Today's featured property was purchased on 10/26/1998 for $169,500. The owner used a $161,025 first mortgage and a $8,475 down payment.

- On 8/8/2000 he obtained a stand-alone second for $21,800.

-

On 11/13/2001 he refinanced the first mortgage for $210,937, and he got a $33,750 HELOC.

- On 1/14/2003 he refinanced with a $191,250 first mortgage.

- On 9/24/2003 he obtained a $279,000 first mortgage.

- On 11/15/2004 he got a HELOC for $83,000.

- On 1/12/2006 he refinanced the first mortgage for $372,000.

- On 3/8/2006 he obtained a $53,000 HELOC.

- On 6/20/2006 he got a Option ARM for $425,000.

- On 4/2/2007 he refinanced with another Option ARM for $412,000 and obtained a $35,000 HELOC.

- Total property debt is $447,000.

- Total mortgage equity withdrawal is $285,975.

- Total squatting time is 8 months so far, but the NOT has not been filed yet. He has more time coming.

Foreclosure Record

Recording Date: 04/26/2010

Document Type: Notice of Default

Interesting fact: The resale price of this house may end up being less than the previous owner's mortgage equity withdrawal.

Irvine Home Address … 13 WINDJAMMER 2 Irvine, CA 92614 ![]()

Resale Home Price … $299,000

Home Purchase Price … $169,500

Home Purchase Date …. 10/26/1998

Net Gain (Loss) ………. $111,560

Percent Change ………. 65.8%

Annual Appreciation … 4.8%

Cost of Ownership

————————————————-

$299,000 ………. Asking Price

$10,465 ………. 3.5% Down FHA Financing

4.50% …………… Mortgage Interest Rate

$288,535 ………. 30-Year Mortgage

$58,435 ………. Income Requirement

$1,462 ………. Monthly Mortgage Payment

$259 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$25 ………. Homeowners Insurance

$316 ………. Homeowners Association Fees

============================================.jpg)

$2,062 ………. Monthly Cash Outlays

-$134 ………. Tax Savings (% of Interest and Property Tax)

-$380 ………. Equity Hidden in Payment

$17 ………. Lost Income to Down Payment (net of taxes)

$37 ………. Maintenance and Replacement Reserves

============================================

$1,603 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,990 ………. Furnishing and Move In @1%

$2,990 ………. Closing Costs @1%

$2,885 ………… Interest Points @1% of Loan

$10,465 ………. Down Payment

============================================

$19,330 ………. Total Cash Costs

$24,500 ………… Emergency Cash Reserves

============================================

$43,830 ………. Total Savings Needed

Property Details for 13 WINDJAMMER 2 Irvine, CA 92614

——————————————————————————

Beds: 2

Baths: 1 full 1 part baths

Home size: 1,125 sq ft

($266 / sq ft)

Lot Size: n/a

Year Built: 1980

Days on Market: 114

Listing Updated: 40417

MLS Number: S617532

Property Type: Condominium, Townhouse, Residential

Community: Woodbridge

Tract: St

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

APPROVED SHORT SALE! Charming 2 bed, 1.5 bathroom home in Irvine Somerset tract. Ideal quiet location adjacent to greenbelt and amenities. Tremendous value!